Taiwan’s official manufacturing purchasing managers’ index (PMI) last month gained 5.3 points to 54, the best performance in six months, as local firms benefitted from a sustained artificial intelligence boom and China’s stimulus measures for consumption, the Chung-Hua Institution for Economic Research (CIER, 中華經濟研究院) said yesterday.

However, the non-manufacturing index slipped into contraction mode for the first time in 27 months, signaling a slowdown in domestic demand and consumer spending, the institute said.

“Improving new orders and production activity accounted for the pickup in the latest PMI data,” CIER president Lien Hsien-ming (連賢明) told a media briefing in Taipei.

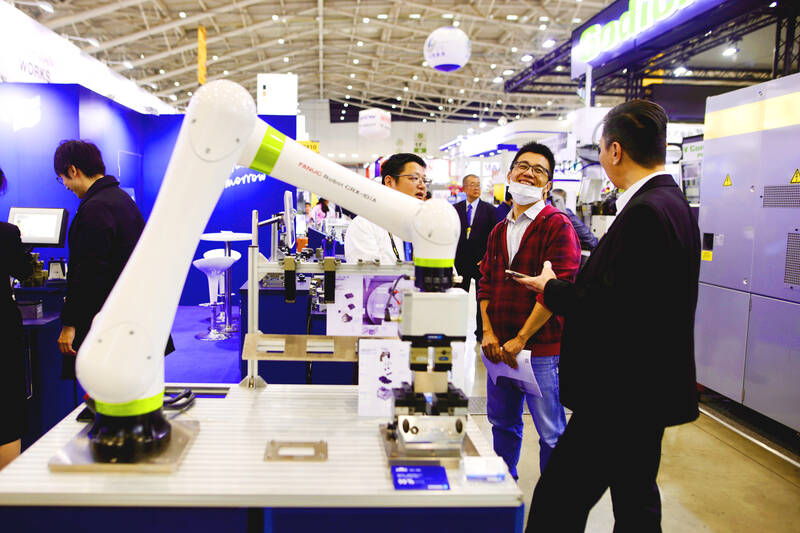

Photo: Ritchie B. Tongo, EPA-EFE

PMI seeks to capture the health of the manufacturing industry, with values of more than 50 indicating expansion and points below the threshold suggesting contraction.

Taiwanese firms reported rush orders intended to cope with potential tariff hikes under US President Donald Trump, and China’s subsidy for replacing consumer electronic gadgets including smartphones and notebook computers lent further support, Lien said.

The gauge for new orders picked up 4.7 points to 54.4, while industrial output rose 14.9 points to 59.9, both emerging from the woods seen one month earlier, the institute said.

The readings on employment rose 1.2 points to 52 and suppliers’ delivery times lengthened to 50.8, while the measure on inventories climbed 6.2 points to 52.7, the first time it moved into positive territory since September 2022, it added.

Academia Sinica fellow Kamhon Kan (簡錦漢) warned against being overly optimistic about the results, saying that uncertainty is heightening over global trade after the US’ new tariffs on Canada, Mexico and China went into effect.

In response, Canada and China raised tariffs on US imports, with Mexico also pledging retaliatory measures, making the flow of goods more expensive and curtailing demand, Kan said.

Furthermore, more local firms could take cues from Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) and move their production to the US to dodge tariffs, and weaken Taiwan’s technology advantages and its export-focused economy, Kan said.

Lien said there is little else TSMC can do to appease Trump and its US investment plans could put pressure on major rival Samsung Electronics Co in negotiating trade terms with the White House.

On the services side, the non-manufacturing index shed 5.8 pints to 49.2, the first contraction since July 2022, the institute said.

Local restaurants and hotels fared weaker-than-expected over the Lunar New Year holiday, as Taiwanese opted to vacation abroad, Lien said.

That explained why the nation’s tourism deficit exceeded NT$600 billion (US$18.28 billion), Lien said.

Policymakers and service providers should work to keep consumer spending in Taiwan, he added.

PERSISTENT RUMORS: Nvidia’s CEO said the firm is not in talks to sell AI chips to China, but he would welcome a change in US policy barring the activity Nvidia Corp CEO Jensen Huang (黃仁勳) said his company is not in discussions to sell its Blackwell artificial intelligence (AI) chips to Chinese firms, waving off speculation it is trying to engineer a return to the world’s largest semiconductor market. Huang, who arrived in Taiwan yesterday ahead of meetings with longtime partner Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), took the opportunity to clarify recent comments about the US-China AI race. The Nvidia head caused a stir in an interview this week with the Financial Times, in which he was quoted as saying “China will win” the AI race. Huang yesterday said

Nissan Motor Co has agreed to sell its global headquarters in Yokohama for ¥97 billion (US$630 million) to a group sponsored by Taiwanese autoparts maker Minth Group (敏實集團), as the struggling automaker seeks to shore up its financial position. The acquisition is led by a special purchase company managed by KJR Management Ltd, a Japanese real-estate unit of private equity giant KKR & Co, people familiar with the matter said. KJR said it would act as asset manager together with Mizuho Real Estate Management Co. Nissan is undergoing a broad cost-cutting campaign by eliminating jobs and shuttering plants as it grapples

The Chinese government has issued guidance requiring new data center projects that have received any state funds to only use domestically made artificial intelligence (AI) chips, two sources familiar with the matter told Reuters. In recent weeks, Chinese regulatory authorities have ordered such data centers that are less than 30 percent complete to remove all installed foreign chips, or cancel plans to purchase them, while projects in a more advanced stage would be decided on a case-by-case basis, the sources said. The move could represent one of China’s most aggressive steps yet to eliminate foreign technology from its critical infrastructure amid a

MORE WEIGHT: The national weighting was raised in one index while holding steady in two others, while several companies rose or fell in prominence MSCI Inc, a global index provider, has raised Taiwan’s weighting in one of its major indices and left the country’s weighting unchanged in two other indices after a regular index review. In a statement released on Thursday, MSCI said it has upgraded Taiwan’s weighting in the MSCI All-Country World Index by 0.02 percentage points to 2.25 percent, while maintaining the weighting in the MSCI Emerging Markets Index, the most closely watched by foreign institutional investors, at 20.46 percent. Additionally, the index provider has left Taiwan’s weighting in the MSCI All-Country Asia ex-Japan Index unchanged at 23.15 percent. The latest index adjustments are to