MediaTek Inc (聯發科), the world’s largest supplier of mobile phone chips, yesterday said that revenue this quarter could grow by up to 10 percent, bolstered by China’s economic stimulus program and customers pulling in orders amid concern over US tariffs.

The first quarter tends to be a slack season, but MediaTek expects moderate revenue growth from its two major business segments — smartphone chips and smart edge platforms such as Wi-Fi chips.

Revenue is expected to increase sequentially by 2 to 10 percent to NT$140.8 billion to NT$151.8 billion (US$4.3 billion and US$4.6 billion) during the quarter ending March 31, the chip designer said.

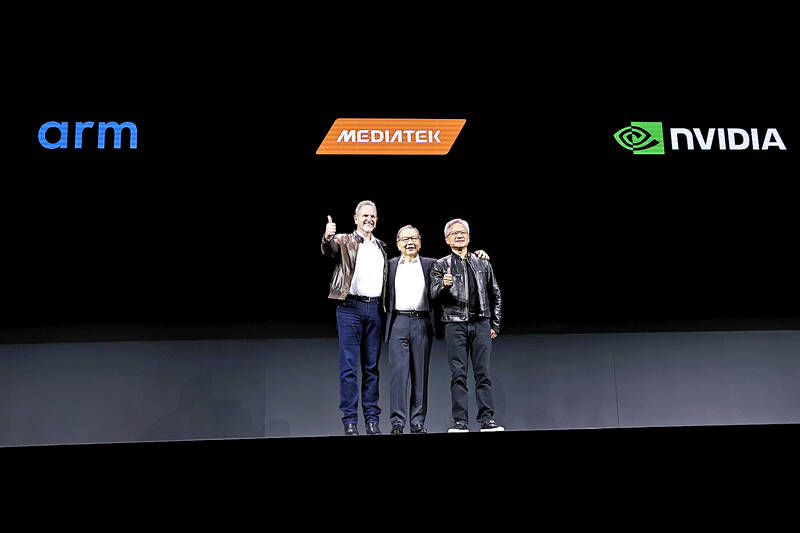

Photo: CNA

“Overall, for the first quarter of 2025, we see healthy smartphone demand thanks to China’s stimulus program, as well as some pull-in demand for products such as televisions, Wi-Fi, tablets and Chromebooks due to global tariff uncertainties,” MediaTek CEO Rick Tsai (蔡力行) told investors during a quarterly conference yesterday.

“Therefore, we expect first-quarter revenue to grow sequentially at a better-than-normal seasonal pace. Corporate gross margin is expected to be stable,” he said.

The company expects gross margin to come in at 47 percent give or take 1.5 percentage points, he said.

MediaTek is highly concentrated on the Chinese smartphone market. Strong uptake of Oppo’s (歐珀) and Vivo’s (維沃) artificial intelligence (AI)-enabled phones has helped the company more than double its flagship smartphone chip revenue last year, significantly exceeding its goal of 70 percent annually.

However, the mobile phone chip designer said that the visibility for the next quarter is low, mostly due to the global tariff war triggered by the US.

However, the AI megatrend is here to stay, the company said.

With recent launch of DeepSeek’s (深度求索) more cost-efficient AI model, MediaTek is “getting more optimistic” about such a trend, given the democratizing of AI applications among average users, Tsai said.

That bodes well not only for the growth of edge AI devices, but also for cloud-based data centers, he said.

As the world’s major cloud service providers are “doubling down” on their investments in AI data centers, MediaTek is investing heavily in AI application-specific-IC (ASIC) business by adding engineers, mainly in the US, and internal resources reallocations, aiming to enhance and broaden its AI ASIC business scope, Tsai said.

MediaTek expects its new AI ASIC business to bear fruit next year and contribute more than US$1 billion in revenue in the first or second quarter, he said.

The global AI ASIC market is estimated to reach US$45 billion by 2028, according to MediaTek’s previous forecast, which did not factor in the impact of DeepSeek.

The budget-friendly AI model from DeepSeek would accelerate the adoption of AI applications, Tsai said.

MediaTek added that its collaboration with Nvidia Corp to roll out a GB10 chip used for AI desktop applications would hit the shelves in May and be available for more diversified applications later this year.

The company reported that net profit last quarter slid 6.9 percent year on year to NT$23.94 billion from NT$25.71 billion. On a quarterly basis, it declined 6.4 percent from NT$25.59 billion.

Last year as a whole, net profit surged 38.8 percent annually to NT$107.14 billion from NT$77.19 billion in 2023, marking the third-highest level in the company’s history. Earnings per share surged to NT$66.92 from NT$48.51.

Gross margin improved to 49.6 percent last year from 47.8 percent in 2023.

Revenue rose 19 percent year-on-year in US dollar terms, beating the firm’s goal of 15 percent growth.

SEMICONDUCTORS: The German laser and plasma generator company will expand its local services as its specialized offerings support Taiwan’s semiconductor industries Trumpf SE + Co KG, a global leader in supplying laser technology and plasma generators used in chip production, is expanding its investments in Taiwan in an effort to deeply integrate into the global semiconductor supply chain in the pursuit of growth. The company, headquartered in Ditzingen, Germany, has invested significantly in a newly inaugurated regional technical center for plasma generators in Taoyuan, its latest expansion in Taiwan after being engaged in various industries for more than 25 years. The center, the first of its kind Trumpf built outside Germany, aims to serve customers from Taiwan, Japan, Southeast Asia and South Korea,

Gasoline and diesel prices at domestic fuel stations are to fall NT$0.2 per liter this week, down for a second consecutive week, CPC Corp, Taiwan (台灣中油) and Formosa Petrochemical Corp (台塑石化) announced yesterday. Effective today, gasoline prices at CPC and Formosa stations are to drop to NT$26.4, NT$27.9 and NT$29.9 per liter for 92, 95 and 98-octane unleaded gasoline respectively, the companies said in separate statements. The price of premium diesel is to fall to NT$24.8 per liter at CPC stations and NT$24.6 at Formosa pumps, they said. The price adjustments came even as international crude oil prices rose last week, as traders

SIZE MATTERS: TSMC started phasing out 8-inch wafer production last year, while Samsung is more aggressively retiring 8-inch capacity, TrendForce said Chipmakers are expected to raise prices of 8-inch wafers by up to 20 percent this year on concern over supply constraints as major contract chipmakers Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) and Samsung Electronics Co gradually retire less advanced wafer capacity, TrendForce Corp (集邦科技) said yesterday. It is the first significant across-the-board price hike since a global semiconductor correction in 2023, the Taipei-based market researcher said in a report. Global 8-inch wafer capacity slid 0.3 percent year-on-year last year, although 8-inch wafer prices still hovered at relatively stable levels throughout the year, TrendForce said. The downward trend is expected to continue this year,

POWERING UP: PSUs for AI servers made up about 50% of Delta’s total server PSU revenue during the first three quarters of last year, the company said Power supply and electronic components maker Delta Electronics Inc (台達電) reported record-high revenue of NT$161.61 billion (US$5.11 billion) for last quarter and said it remains positive about this quarter. Last quarter’s figure was up 7.6 percent from the previous quarter and 41.51 percent higher than a year earlier, and largely in line with Yuanta Securities Investment Consulting Co’s (元大投顧) forecast of NT$160 billion. Delta’s annual revenue last year rose 31.76 percent year-on-year to NT$554.89 billion, also a record high for the company. Its strong performance reflected continued demand for high-performance power solutions and advanced liquid-cooling products used in artificial intelligence (AI) data centers,