Tokyo Electron Ltd reaffirmed its annual outlook and outlined plans to build a ¥104 billion (US$683 million) plant, suggesting it expects sustained spending on artificial intelligence (AI).

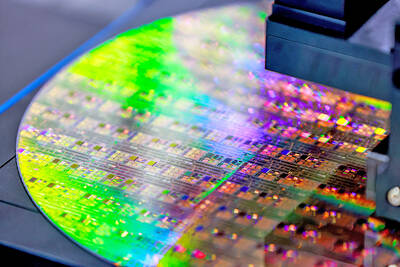

The company, one of a handful of key chip gear makers globally, revealed the expansion plans after posting better-than-expected earnings. The Japanese supplier to Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) and Samsung Electronics Co brought in operating profit of ¥199.6 billion in the fourth quarter last year from sales of machines used to prepare, etch and clean silicon wafers that are ultimately cut into memory or logic chips. That was up 51 percent from the previous year and compares with the average of analyst estimates of ¥174 billion.

Closely watched as an indicator of spending on chips used for AI development, Tokyo Electron did not hike its outlook, as compatriot Advantest Corp did a week earlier. Indications from supply chain players have been mixed, as Dutch lithography supplier ASML Holding NV reported a surprisingly high number of orders, while Arm Holdings PLC and Advanced Micro Devices Inc gave cautious forecasts that added to doubts about the sustainability of the free-spending trend in the market.

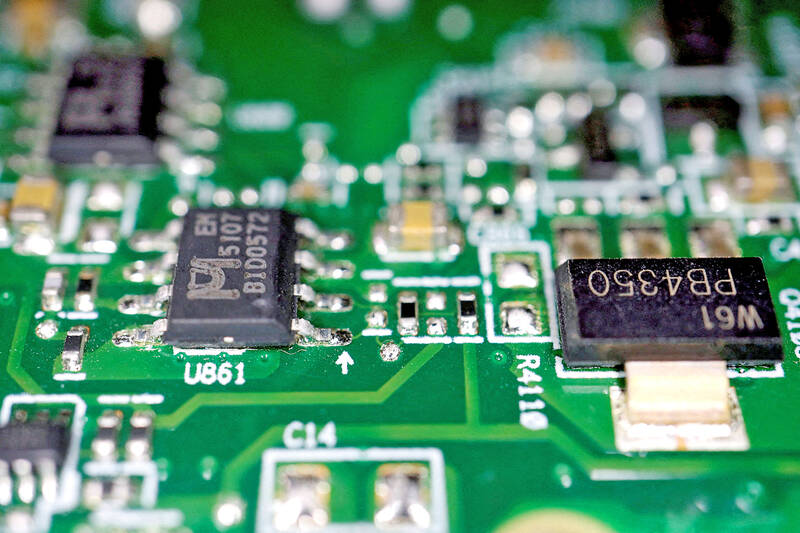

Photo: Reuters

Tokyo Electron’s move to expand capacity with a plant in Miyagi Prefecture reflects demand from customers such as TSMC, Samsung and SK Hynix Inc, which have indicated they would continue elevated spending on tools used to process wafers into semiconductors.

Much of the investment this year would come from cutting-edge logic makers and high-bandwidth memory makers hurrying to meet AI server demand, Tokyo Electron chief executive officer Toshiki Kawai said on an earnings call.

That is while the company expects a lull in chip gear purchases by Chinese customers, especially among new entrants to chipmaking, Kawai said.

China is expected to comprise a percentage in the mid-30s of Tokyo Electron’s sales in the business year starting in April, down from more than 40 percent in the current fiscal year, he said.

“We can’t deny that we’ve been affected” by US restrictions on exports of chip-related technologies and other geopolitical factors, Kawai said.

Chinese start-up DeepSeek’s low-cost and open-source AI model is raising concern that the tech sector faces far more price competition and less revenue than previously predicted. Still, AI industry leaders have argued that cheaper AI models would mean more new entrants that would further support demand for AI infrastructure over the long term.

Tokyo Electron is still evaluating DeepSeek and its impact, finance division officer Hiroshi Kawamoto said.

If lower-cost AI leads to an expansion of the market, it is a positive, Kawamoto said.

Taiwan’s rapidly aging population is fueling a sharp increase in homes occupied solely by elderly people, a trend that is reshaping the nation’s housing market and social fabric, real-estate brokers said yesterday. About 850,000 residences were occupied by elderly people in the first quarter, including 655,000 that housed only one resident, the Ministry of the Interior said. The figures have nearly doubled from a decade earlier, Great Home Realty Co (大家房屋) said, as people aged 65 and older now make up 20.8 percent of the population. “The so-called silver tsunami represents more than just a demographic shift — it could fundamentally redefine the

The US government on Wednesday sanctioned more than two dozen companies in China, Turkey and the United Arab Emirates, including offshoots of a US chip firm, accusing the businesses of providing illicit support to Iran’s military or proxies. The US Department of Commerce included two subsidiaries of US-based chip distributor Arrow Electronics Inc (艾睿電子) on its so-called entity list published on the federal register for facilitating purchases by Iran’s proxies of US tech. Arrow spokesman John Hourigan said that the subsidiaries have been operating in full compliance with US export control regulations and his company is discussing with the US Bureau of

Businesses across the global semiconductor supply chain are bracing themselves for disruptions from an escalating trade war, after China imposed curbs on rare earth mineral exports and the US responded with additional tariffs and restrictions on software sales to the Asian nation. China’s restrictions, the most targeted move yet to limit supplies of rare earth materials, represent the first major attempt by Beijing to exercise long-arm jurisdiction over foreign companies to target the semiconductor industry, threatening to stall the chips powering the artificial intelligence (AI) boom. They prompted US President Donald Trump on Friday to announce that he would impose an additional

China Airlines Ltd (CAL, 中華航空) said it expects peak season effects in the fourth quarter to continue to boost demand for passenger flights and cargo services, after reporting its second-highest-ever September sales on Monday. The carrier said it posted NT$15.88 billion (US$517 million) in consolidated sales last month, trailing only September last year’s NT$16.01 billion. Last month, CAL generated NT$8.77 billion from its passenger flights and NT$5.37 billion from cargo services, it said. In the first nine months of this year, the carrier posted NT$154.93 billion in cumulative sales, up 2.62 percent from a year earlier, marking the second-highest level for the January-September