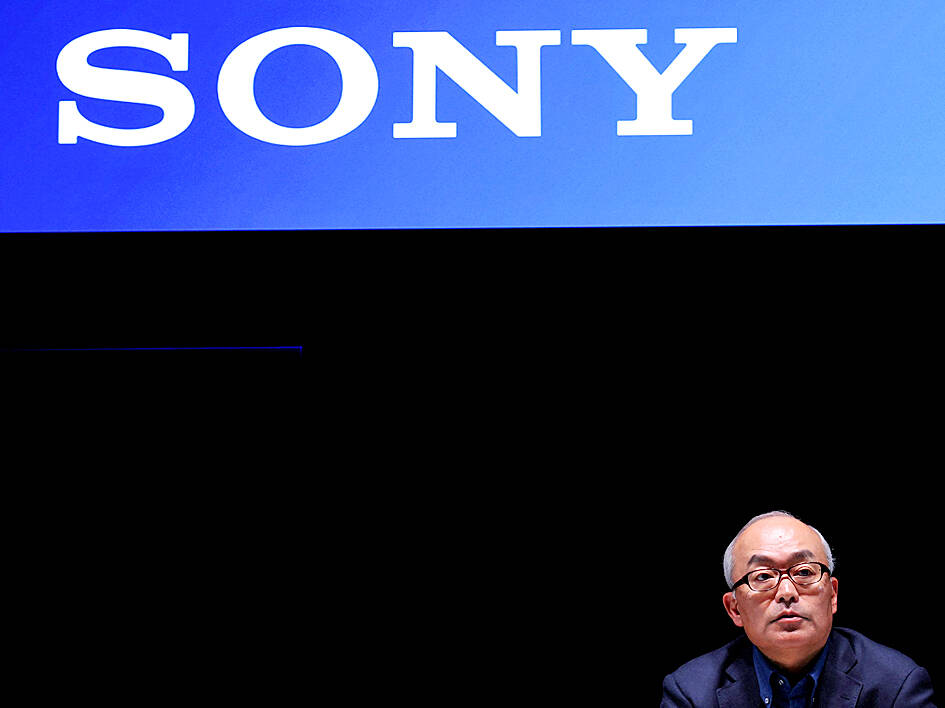

Sony Group Corp is appointing Hiroki Totoki. 60, as chief executive officer, a stamp of approval for the longtime finance chief’s push to expand the Japanese company’s entertainment reach.

Along with outgoing CEO Kenichiro Yoshida, Totoki helped steer the Tokyo-based technology conglomerate to focus on growing its entertainment offerings. Last year alone, the company expressed interest in potential acquisitions ranging from Paramount Global to domestic publishing house Kadokawa Corp.

That focus on content — which spans PlayStation games, anime, music and movies — is bolstering revenue and profit at Sony. In the September quarter, operating profit grew 76 percent year-on-year amid sluggish demand for its smartphone components and image sensors, used by the likes of Apple Inc and Xiaomi Corp (小米).

Photo: Reuters

Yoshida is to remain as chairman of the board, Sony said in a statement yesterday.

Hideaki Nishino is to take charge of the company’s pivotal game and network services business, while Hermen Hulst is newly appointed as CEO of the game studio business. The moves, all effective April 1, are part of a new management structure intended to secure Sony’s long-term growth, the company said.

Totoki had taken up more of the leadership burden at Tokyo-based Sony two years prior, when he added the titles of president and chief operating officer to his role as chief financial officer. He provides Sony’s commentary on conference calls after earnings each quarter and has steered the company through a difficult time with prolonged supply shortages of its flagship PlayStation 5 console.

On Ireland’s blustery western seaboard, researchers are gleefully flying giant kites — not for fun, but in the hope of generating renewable electricity and sparking a “revolution” in wind energy. “We use a kite to capture the wind and a generator at the bottom of it that captures the power,” said Padraic Doherty of Kitepower, the Dutch firm behind the venture. At its test site in operation since September 2023 near the small town of Bangor Erris, the team transports the vast 60-square-meter kite from a hangar across the lunar-like bogland to a generator. The kite is then attached by a

Foxconn Technology Co (鴻準精密), a metal casing supplier owned by Hon Hai Precision Industry Co (鴻海精密), yesterday announced plans to invest US$1 billion in the US over the next decade as part of its business transformation strategy. The Apple Inc supplier said in a statement that its board approved the investment on Thursday, as part of a transformation strategy focused on precision mold development, smart manufacturing, robotics and advanced automation. The strategy would have a strong emphasis on artificial intelligence (AI), the company added. The company said it aims to build a flexible, intelligent production ecosystem to boost competitiveness and sustainability. Foxconn

Leading Taiwanese bicycle brands Giant Manufacturing Co (巨大機械) and Merida Industry Co (美利達工業) on Sunday said that they have adopted measures to mitigate the impact of the tariff policies of US President Donald Trump’s administration. The US announced at the beginning of this month that it would impose a 20 percent tariff on imported goods made in Taiwan, effective on Thursday last week. The tariff would be added to other pre-existing most-favored-nation duties and industry-specific trade remedy levy, which would bring the overall tariff on Taiwan-made bicycles to between 25.5 percent and 31 percent. However, Giant did not seem too perturbed by the

TARIFF CONCERNS: Semiconductor suppliers are tempering expectations for the traditionally strong third quarter, citing US tariff uncertainty and a stronger NT dollar Several Taiwanese semiconductor suppliers are taking a cautious view of the third quarter — typically a peak season for the industry — citing uncertainty over US tariffs and the stronger New Taiwan dollar. Smartphone chip designer MediaTek Inc (聯發科技) said that customers accelerated orders in the first half of the year to avoid potential tariffs threatened by US President Donald Trump’s administration. As a result, it anticipates weaker-than-usual peak-season demand in the third quarter. The US tariff plan, announced on April 2, initially proposed a 32 percent duty on Taiwanese goods. Its implementation was postponed by 90 days to July 9, then