US President Joe Biden’s administration plans one additional round of restrictions on the export of artificial intelligence (AI) chips from firms such as Nvidia Corp just days before leaving office, a final push in his effort to keep advanced technologies out of the hands of China and Russia.

The US wants to curb the sale of AI chips used in data centers on a country and company basis, with the goal of concentrating AI development in friendly nations and getting businesses around the world to align with US standards, people familiar with the matter said.

The result would be an expansion of semiconductor trade restrictions to most of the world — an attempt to control the spread of AI technology at a time of soaring demand. The regulations, which could be issued as soon as Friday, would create three tiers of chip curbs, said the people, who asked not to be identified because the discussions are private.

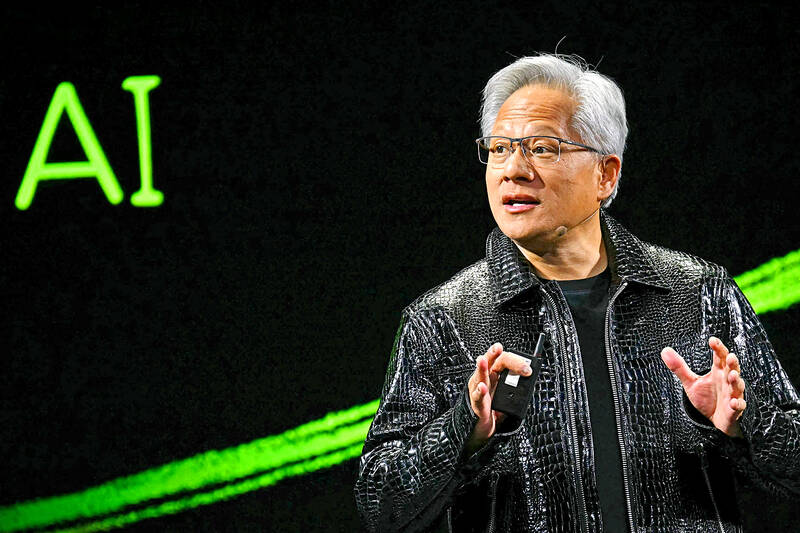

Photo: AFP

At the top level, a small number of US allies would maintain essentially unmitigated access to US chips. A group of adversaries, meanwhile, would be effectively blocked from importing the semiconductors. The vast majority of the world would face limits on the total computing power that can go to one country.

Companies headquartered in nations in that last group would be able to bypass their national limits — and get their own, significantly higher caps — by agreeing to a set of US government security requirements and human rights standards, the people said.

That type of designation — called a validated end user — aims to create a set of trusted entities that develop and deploy AI in secure environments around the world.

Nvidia objected to the proposal in a statement. “A last-minute rule restricting exports to most of the world would be a major shift in policy that would not reduce the risk of misuse but would threaten economic growth and US leadership,” Nvidia said. “The worldwide interest in accelerated computing for everyday applications is a tremendous opportunity for the US to cultivate, promoting the economy and adding US jobs.”

A representative of the White House’s National Security Council declined to comment. The US Department of Commerce’s Bureau of Industry and Security, which is in charge of chip export controls, did not immediately respond to a request for comment.

The measures build on years of curbs that already limit the ability of US chipmakers like Nvidia and Advanced Micro Devices Inc to sell advanced processors in China and Russia. The US also has sought to prevent adversary nations from accessing cutting-edge technology through intermediaries in places such as the Middle East and Southeast Asia.

The rules follow months of debate over how quickly and broadly to deploy US chips to global data centers. US chips far outperform Chinese ones at AI tasks, companies and entire countries have indicated that they are willing to jump through hoops to gain access to US technology. That gives the US potentially significant leverage to shape global AI development.

The US has “a serious once-in-a-generation moment to leverage US AI technology,” the top Democrat and Republican on the House China Select Committee wrote last week in a letter to US Secretary of Commerce Gina Raimondo.

Sweeping policy changes under US Secretary of Health and Human Services Robert F. Kennedy Jr are having a chilling effect on vaccine makers as anti-vaccine rhetoric has turned into concrete changes in inoculation schedules and recommendations, investors and executives said. The administration of US President Donald Trump has in the past year upended vaccine recommendations, with the country last month ending its longstanding guidance that all children receive inoculations against flu, hepatitis A and other diseases. The unprecedented changes have led to diminished vaccine usage, hurt the investment case for some biotechs, and created a drag that would likely dent revenues and

Global semiconductor stocks advanced yesterday, as comments by Nvidia Corp chief executive officer Jensen Huang (黃仁勳) at Davos, Switzerland, helped reinforce investor enthusiasm for artificial intelligence (AI). Samsung Electronics Co gained as much as 5 percent to an all-time high, helping drive South Korea’s benchmark KOSPI above 5,000 for the first time. That came after the Philadelphia Semiconductor Index rose more than 3 percent to a fresh record on Wednesday, with a boost from Nvidia. The gains came amid broad risk-on trade after US President Donald Trump withdrew his threat of tariffs on some European nations over backing for Greenland. Huang further

CULPRITS: Factors that affected the slip included falling global crude oil prices, wait-and-see consumer attitudes due to US tariffs and a different Lunar New Year holiday schedule Taiwan’s retail sales ended a nine-year growth streak last year, slipping 0.2 percent from a year earlier as uncertainty over US tariff policies affected demand for durable goods, data released on Friday by the Ministry of Economic Affairs showed. Last year’s retail sales totaled NT$4.84 trillion (US$153.27 billion), down about NT$9.5 billion, or 0.2 percent, from 2024. Despite the decline, the figure was still the second-highest annual sales total on record. Ministry statistics department deputy head Chen Yu-fang (陳玉芳) said sales of cars, motorcycles and related products, which accounted for 17.4 percent of total retail rales last year, fell NT$68.1 billion, or

HSBC Bank Taiwan Ltd (匯豐台灣商銀) and the Taiwan High Prosecutors Office recently signed a memorandum of understanding (MOU) to enhance cooperation on the suspicious transaction analysis mechanism. This landmark agreement makes HSBC the first foreign bank in Taiwan to establish such a partnership with the High Prosecutors Office, underscoring its commitment to active anti-fraud initiatives, financial inclusion, and the “Treating Customers Fairly” principle. Through this deep public-private collaboration, both parties aim to co-create a secure financial ecosystem via early warning detection and precise fraud prevention technologies. At the signing ceremony, HSBC Taiwan CEO and head of banking Adam Chen (陳志堅)