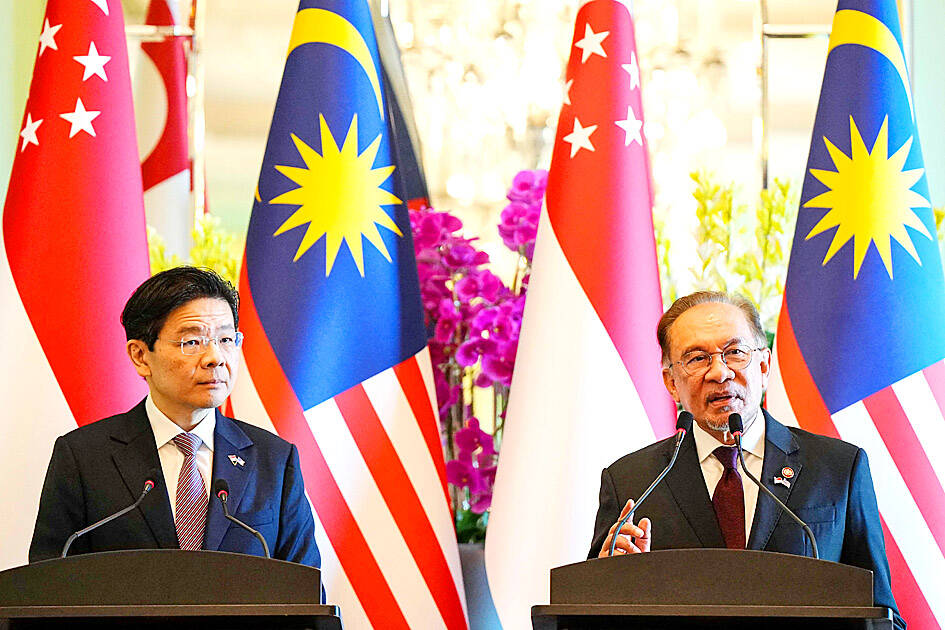

Malaysian and Singaporean leaders yesterday signed an agreement to create a special economic zone to attract global investment, and ease the cross-border flow of goods and people.

Malaysian Prime Minister Anwar Ibrahim called the Johor-Singapore special economic zone a “unique initiative” that harnesses each other’s strengths and deepens linkages in a world that is becoming more polarized.

“Very rarely you find two countries working together as a team,” he told a joint news conference after the signing ceremony. “These two countries have a common strategy, to assist one another, to work and benefit from each other’s strengths... This is the new attitude we must have other than talking always in terms of rivalry and unnecessary conflicts.”

Photo: AFP

The zone, in Malaysia’s southernmost Johor state, is to offer tax breaks and include several flagship areas for various sectors, from manufacturing and aerospace to tourism, energy and healthcare.

Officials are targeting attracting 50 projects within the economic zone in the first five years, creating 20,000 skilled jobs. The move is a boon to Singapore, a global financial hub with scarce natural resources and land.

Singaporean Prime Minister Lawrence Wong (黃循財) said its neighbor’s strong linkages are an important foundation and building block for an integrated region. Malaysia is chair this year of 10-member ASEAN.

“Where ASEAN is concerned, we are talking about not just more trade and investment linkages, but infrastructure linkages, including the ASEAN power grid. These are all good projects that Singapore will support and we hope under Malaysia’s leadership, we can make good progress,” Wong said.

“The greater competition we face is not among ourselves within ASEAN, it’s outside of the region ... so ASEAN has to come together, look at ways in which we can enhance our value proposition and be competitive together,” he said.

Separately, the Indian government is considering fresh subsidies for makers of electronic components and cutting tariffs on imports to help boost local manufacturing, especially of smartphones made by companies such as Apple Inc.

The Indian Ministry of Electronics and Information Technology proposed giving manufacturers of components such as batteries and camera parts at least 230 billion rupees (US$2.7 billion) in support, said people familiar with the matter, who asked not to be identified as the discussions are private.

The ministry also recommended reducing tariffs on some electronic components, an industry demand that would help bring down production costs, one of the people said.

A final decision on the proposals is to be made by the Cabinet, and if approved, details could be announced next month in the government’s upcoming budget, the people said.

Some of the components being targeted by the proposed subsidy include microprocessors, memory, storage, multilayered printed circuit boards, camera components such as lens, and lithium-ion cells, one of the people said.

The subsidies are likely to differ depending on the component, another person said.

India’s current tariffs on electronic components — ranging from zero to 20 percent — is about 5 percent to 6 percent higher than nations such as China and Malaysia, according to research by government think tank Niti Aayog.

Niti Aayog in a report last year said that the government should rationalize its tariffs and provide fiscal incentives to bolster the production of electronic components in India. The South Asian nation faces tough competition from rivals such as Vietnam in luring foreign businesses looking to diversify their supply chains from China.

Additional reporting by Bloomberg

On Tuesday, US President Donald Trump weighed in on a pressing national issue: The rebranding of a restaurant chain. Last week, Cracker Barrel, a Tennessee company whose nationwide locations lean heavily on a cozy, old-timey aesthetic — “rocking chairs on the porch, a warm fire in the hearth, peg games on the table” — announced it was updating its logo. Uncle Herschel, the man who once appeared next to the letters with a barrel, was gone. It sparked ire on the right, with Donald Trump Jr leading a charge against the rebranding: “WTF is wrong with Cracker Barrel?!” Later, Trump Sr weighed

HEADWINDS: Upfront investment is unavoidable in the merger, but cost savings would materialize over time, TS Financial Holding Co president Welch Lin said TS Financial Holding Co (台新新光金控) said it would take about two years before the benefits of its merger with Shin Kong Financial Holding Co (新光金控) become evident, as the group prioritizes the consolidation of its major subsidiaries. “The group’s priority is to complete the consolidation of different subsidiaries,” Welch Lin (林維俊), president of the nation’s fourth-largest financial conglomerate by assets, told reporters during its first earnings briefing since the merger took effect on July 24. The asset management units are scheduled to merge in November, followed by life insurance in January next year and securities operations in April, Lin said. Banking integration,

LOOPHOLES: The move is to end a break that was aiding foreign producers without any similar benefit for US manufacturers, the US Department of Commerce said US President Donald Trump’s administration would make it harder for Samsung Electronics Co and SK Hynix Inc to ship critical equipment to their chipmaking operations in China, dealing a potential blow to the companies’ production in the world’s largest semiconductor market. The US Department of Commerce in a notice published on Friday said that it was revoking waivers for Samsung and SK Hynix to use US technologies in their Chinese operations. The companies had been operating in China under regulations that allow them to import chipmaking equipment without applying for a new license each time. The move would revise what is known

Artificial intelligence (AI) chip designer Cambricon Technologies Corp (寒武紀科技) plunged almost 9 percent after warning investors about a doubling in its share price over just a month, a record gain that helped fuel a US$1 trillion Chinese market rally. Cambricon triggered the selloff with a Thursday filing in which it dispelled talk about nonexistent products in the pipeline, reminded investors it labors under US sanctions, and stressed the difficulties of ascending the technology ladder. The Shanghai-listed company’s stock dived by the most since April in early yesterday trading, while the market stood largely unchanged. The litany of warnings underscores growing scrutiny of