Merchants and consumers alike found the Singles’ Day shopping festival Monday less shiny than in years past as e-commerce firms look abroad for growth.

The annual event, named after the numeric form of its Nov. 11 date, was started in 2009 by e-commerce platform Alibaba Group Holding Ltd (阿里巴巴), which offered attractive discounts to entice shoppers to spend big. The extravaganza has since expanded to other platforms, such as JD.com Inc (京東) and Pinduoduo Inc (拼多多), as well as abroad.

While Singles’ Day was previously a one-day event, shopping platforms in China now begin the festival weeks ahead to drum up sales volume. It has also traditionally been regarded as a barometer of consumer sentiment.

Photo: Qilai Shen, Bloomberg

However, consumers no longer go all out on purchases during the shopping extravaganza amid China’s lagging domestic economy, dragged down by a real-estate crisis and deflationary pressures.

“I only spent a few hundred yuan on daily necessities,” said Wang Haihua, who owns a fitness center in Beijing.

The prices on e-commerce platforms during Singles’ Day are not necessarily cheaper than usual, Wang said.

“They are all tricks and we have seen through it over the years,” she said.

Zhang Jiewei, a 34-year-old who runs a barber shop in Xi’an, said that he no longer trusted Singles’ Day promotions, as some merchants tend to raise the usual price of a product before offering a discount, giving consumers the illusion they are getting a deal.

“I am not going to buy anything this year,” he said.

Some experts say that Beijing’s recent stimulus measures have had little impact to boost consumer confidence.

“People are not interested in spending and are cutting back on big-ticket items,” China Market Research Group founder and managing director Shaun Rein said. “Since October 2022, the weak economy means that everything has been on discount year-round, 11.11 is not going to bring in more discounts than the month before.”

Rein said he expects low growth for the Singles’ Day shopping festival, as consumers tighten their spending in anticipation of difficult economic times ahead.

However, categories such as sportswear and fitness have been doing well as customers “trade down a Gucci bag for Lululemon sportswear,” he said.

Platforms such as JD.com and Alibaba, which operates e-commerce platforms Taobao (淘寶) and Tmall (天貓), used to publish the value of transactions made during the festival, but have stopped revealing the total figure. While yearly growth used to be in the double digits, estimates of recent figures have dwindled to low, single-digit growth.

Data provider Syntun (星圖數據) estimated that last year’s gross merchandising volume sales across major e-commerce platforms grew just 2 percent to 1.14 trillion yuan (US$158.46 billion), a far cry from double-digit growth before the COVID-19 pandemic.

Merchants who typically take part in the Singles’ Day shopping festival say the costs of participation no longer pay off, amid high advertising fees and unsatisfactory sales.

Meanwhile, e-commerce platforms grappling with a slowing domestic market have also turned to overseas markets to seek new growth, offering promotions such as global free shipping and allowing merchants to sell globally with ease.

For example, Alibaba in a blog post on its Alizila site said that about 70,000 merchants saw sales double with global free shipping.

In markets such as Singapore and Hong Kong, new customers also doubled, it added.

Taiwan’s exports soared 56 percent year-on-year to an all-time high of US$64.05 billion last month, propelled by surging global demand for artificial intelligence (AI), high-performance computing and cloud service infrastructure, the Ministry of Finance said yesterday. Department of Statistics Director-General Beatrice Tsai (蔡美娜) called the figure an unexpected upside surprise, citing a wave of technology orders from overseas customers alongside the usual year-end shopping season for technology products. Growth is likely to remain strong this month, she said, projecting a 40 percent to 45 percent expansion on an annual basis. The outperformance could prompt the Directorate-General of Budget, Accounting and

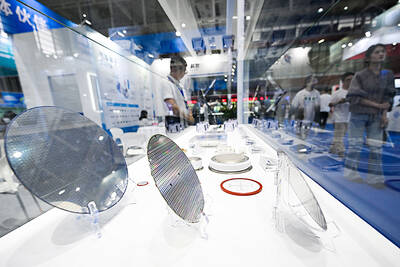

Two Chinese chipmakers are attracting strong retail investor demand, buoyed by industry peer Moore Threads Technology Co’s (摩爾線程) stellar debut. The retail portion of MetaX Integrated Circuits (Shanghai) Co’s (上海沐曦) upcoming initial public offering (IPO) was 2,986 times oversubscribed on Friday, according to a filing. Meanwhile, Beijing Onmicro Electronics Co (北京昂瑞微), which makes radio frequency chips, was 2,899 times oversubscribed on Friday, its filing showed. The bids coincided with Moore Threads’ trading debut, which surged 425 percent on Friday after raising 8 billion yuan (US$1.13 billion) on bets that the company could emerge as a viable local competitor to Nvidia

BARRIERS: Gudeng’s chairman said it was unlikely that the US could replicate Taiwan’s science parks in Arizona, given its strict immigration policies and cultural differences Gudeng Precision Industrial Co (家登), which supplies wafer pods to the world’s major semiconductor firms, yesterday said it is in no rush to set up production in the US due to high costs. The company supplies its customers through a warehouse in Arizona jointly operated by TSS Holdings Ltd (德鑫控股), a joint holding of Gudeng and 17 Taiwanese firms in the semiconductor supply chain, including specialty plastic compounds producer Nytex Composites Co (耐特) and automated material handling system supplier Symtek Automation Asia Co (迅得). While the company has long been exploring the feasibility of setting up production in the US to address

OPTION: Uber said it could provide higher pay for batch trips, if incentives for batching is not removed entirely, as the latter would force it to pass on the costs to consumers Uber Technologies Inc yesterday warned that proposed restrictions on batching orders and minimum wages could prompt a NT$20 delivery fee increase in Taiwan, as lower efficiency would drive up costs. Uber CEO Dara Khosrowshahi made the remarks yesterday during his visit to Taiwan. He is on a multileg trip to the region, which includes stops in South Korea and Japan. His visit coincided the release last month of the Ministry of Labor’s draft bill on the delivery sector, which aims to safeguard delivery workers’ rights and improve their welfare. The ministry set the minimum pay for local food delivery drivers at