ASE Technology Holding Co (ASE, 日月光投控), the world’s biggest chip assembly and testing manufacturing (ATM) service provider, expects to double its leading-edge advanced technology services revenue next year to more than US$1 billion, benefiting from strong demand for artificial intelligence (AI) chips, a company executive said on Thursday.

That would be the second year that ASE has doubled its advanced chip packaging and testing technology revenue, following an estimate of more than US$500 million for this year.

ASE is one of the major beneficiaries from the AI boom as Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) is outsourcing production of advanced chip packaging technology, or chip-on-wafer-on-substrate (CoWoS), to local outsourced semiconductor assembly and test service providers such as ASE in efforts to solve prolonged capacity constraints.

Photo: CNA

“TSMC’s aggressive expansion of their back-end leading technology capacity is really a statement of a very, very strong demand coming in the next few years. Being a chosen customer of our customers as well as a foundry partner, we’ll definitely share that nudge potential in front of us,” ASE chief financial officer Joseph Tung (董宏思) told a virtual investors’ conference on Thursday.

The strong growth momentum would elevate the revenue contribution from ASE’s advanced packaging and testing technology segment to 12 percent or 13 percent of the company’s total ATM revenue next year, Tung said.

AI chip supplier Nvidia Corp has been the main adopter of TSMC’s CoWoS technology. That demand is to increase further next year with the introduction of Nvidia’s new Blackwell AI chips, market researcher TrendForce Corp (集邦科技) said last month, Tung said.

In addition to TSMC, ASE is engaging with multiple customers to provide its advanced chip packaging and testing services, Tung said.

ASE is making necessary investments in a variety of advanced technologies for wafer sort, final test, and burn-in tests, he said, adding that the company is also aggressively expanding its turnkey business for existing and future customers.

“We are engaging with all the direct customers, with system houses, fabless houses and foundry houses. The demand is coming from different directions. The real issue is how efficiently we will catch up our capacity with the demand,” Tung said.

As a result, the capital expenditures this year are to surpass its annual depreciation and amortization levels of US$1.9 billion. ASE said 2021 was the last year it spent more on machinery and equipment than its depreciation and amortization.

ASE considers these leading-edge technology businesses to be “margin accretive.” The growth of these businesses would help bring the company’s gross margin of its ATM business back to its structural margin range from 24 percent to 30 percent next year, Tung said.

During the current quarter, ASE expects gross margin of its ATM business to be little changed compared with 23.1 percent in the third quarter, the best since the final quarter last year.

ATM revenue is expected to have grown slightly from NT$85.79 billion (US$2.68 billion) last quarter, ASE said, adding that revenue from the electronics manufacturing service (EMS) business is predicted to decline about 5 percent sequentially from NT$74.87 billion last quarter.

ASE reported its strongest quarterly net profit in about seven quarters for last quarter, totaling NT$9.67 billion. That represented a 10 percent annual expansion or 24 percent quarterly growth from NT$8.78 billion and NT$7.78 billion. Earnings per share rose to NT$2.24 from NT$2.04 a year ago and NT$1.8 a quarter earlier.

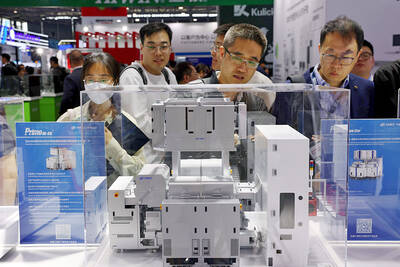

With this year’s Semicon Taiwan trade show set to kick off on Wednesday, market attention has turned to the mass production of advanced packaging technologies and capacity expansion in Taiwan and the US. With traditional scaling reaching physical limits, heterogeneous integration and packaging technologies have emerged as key solutions. Surging demand for artificial intelligence (AI), high-performance computing (HPC) and high-bandwidth memory (HBM) chips has put technologies such as chip-on-wafer-on-substrate (CoWoS), integrated fan-out (InFO), system on integrated chips (SoIC), 3D IC and fan-out panel-level packaging (FOPLP) at the center of semiconductor innovation, making them a major focus at this year’s trade show, according

DEBUT: The trade show is to feature 17 national pavilions, a new high for the event, including from Canada, Costa Rica, Lithuania, Sweden and Vietnam for the first time The Semicon Taiwan trade show, which opens on Wednesday, is expected to see a new high in the number of exhibitors and visitors from around the world, said its organizer, SEMI, which has described the annual event as the “Olympics of the semiconductor industry.” SEMI, which represents companies in the electronics manufacturing and design supply chain, and touts the annual exhibition as the most influential semiconductor trade show in the world, said more than 1,200 enterprises from 56 countries are to showcase their innovations across more than 4,100 booths, and that the event could attract 100,000 visitors. This year’s event features 17

Germany is to establish its first-ever national pavilion at Semicon Taiwan, which starts tomorrow in Taipei, as the country looks to raise its profile and deepen semiconductor ties with Taiwan as global chip demand accelerates. Martin Mayer, a semiconductor investment expert at Germany Trade & Invest (GTAI), Germany’s international economic promotion agency, said before leaving for Taiwan that the nation is a crucial partner in developing Germany’s semiconductor ecosystem. Germany’s debut at the international semiconductor exhibition in Taipei aims to “show presence” and signal its commitment to semiconductors, while building trust with Taiwanese companies, government and industry associations, he said. “The best outcome

Semiconductor equipment billings in Taiwan are expected to double this year, as manufacturers in the industry are keen to expand production to meet strong global demand for artificial intelligence applications, according to SEMI, which represents companies in the electronics manufacturing and design supply chain. Speaking at a news conference before the opening of Semicon Taiwan trade show tomorrow, SEMI director of industry research and statistics Clark Tseng (曾瑞榆) said semiconductor equipment billings in Taiwan are expected to grow by an annual 100 percent this year, beating an earlier estimate of 70 percent growth. He said that Taiwan received a boost from a