French drugmaker Sanofi’s confirmation yesterday that it plans to sell a controlling stake in its over-the-counter unit to a US investment fund sparked a new political backlash, stoked by fears the deal marks a loss of sovereignty over key medications.

Paris “must block the sale” using powers to protect strategic sectors, said Manuel Bompard, a senior lawmaker in hard-left France Unbowed (LFI), in an interview with broadcaster TF1.

Politicians and unions have for weeks criticized Sanofi’s proposed 16-billion-euro (US$17.4 billion) deal with US-based investment fund Clayton Dubilier & Rice (CD&R) for a controlling stake in Opella.

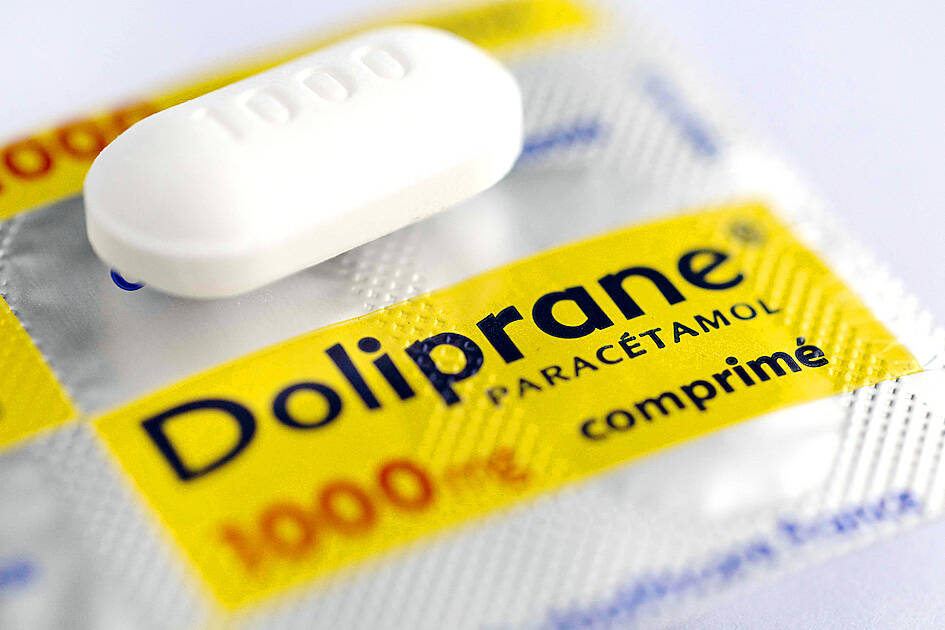

Photo: AFP

The subsidiary makes household-name drugs, including Doliprane branded paracetamol, whose yellow boxes are a mainstay of almost every French medicine cabinet.

Under pressure, French Prime Minister Michel Barnier’s minority government said it has secured a 2 percent stake in Orpella for public investment bank Bpifrance and “extremely strong” guarantees against job cuts and offshoring.

Opella employs more than 11,000 workers and operates in 100 countries.

Sanofi said it is the third-largest business worldwide in the market for over-the-counter medicines, vitamins and supplements.

CD&R — which has a battery of existing investments in France — would help build Orpella into a “French-headquartered, global consumer healthcare champion,” the pharma giant said in a statement.

However, with memories of drug shortages during and since the COVID-19 pandemic still raw for many, critics said the defenses are too weak.

A small stake “won’t give the French state a say in strategic decisions” at Orpella, said Bompard, whose LFI outfit dominates a left alliance that is the largest opposition bloc against Barnier and pro-business French President Emmanuel Macron.

His hard-charging LFI colleague Thomas Portes said on X that the government has offered “no guarantees, just words.”

French Minister of the Economy, Finance and Industry Antoine Armand said that the three-way contract between the CD&R, Sanofi and the government included maintaining production sites, research and development and Orpella’s official headquarters in France, as well as investing at least 70 million euros over five years.

It covers “keeping up a minimum production volume for Opella’s sensitive products in France,” including Doliprane, digestive medication Lanzor and Aspegic branded aspirin, he added.

There would be financial penalties for closing French production sites, laying off workers or failing to keep up purchasing from French suppliers.

That includes Seqens, a company re-establishing production in France of Doliprane’s active ingredient paracetamol.

The layers of protection have failed to completely convince even some in the government camp.

Yesterday’s guarantees “do not at all indicate a commitment for the long term, whether on investment, supply or jobs,” said Charles Rodwell, a lawmaker in Macron’s La Republique En Marche party who has closely followed the case.

He vowed “painstaking” surveillance from parliament of the government’s enforcement of the deal.

Should ministers fall short, lawmakers would “activate all the tools at parliament’s disposition to block” the sale, he added.

Macron attempted to quash fears last week, saying that “the government has the instruments needed to protect France” from any unwanted “capital ownership.”

Emotion over the Opella takeover largely traces back to Doliprane.

Colorful boxes of the non-opioid analgesic against mild to moderate pain and fever often line entire pharmacy walls.

The drug comes in many doses — from 100mg for newborn babies to 1,000mg for adults — and in tablet, capsule, suppository and liquid forms.

It is so ubiquitous that French people call any paracetamol product Doliprane, even when made by a different manufacturer.

Sanofi, France’s biggest healthcare company and among the world’s top 12, said the planned spinoff is part of a strategy to focus less on over-the-counter medication and more on innovative medicines and vaccines, including for polio, influenza and meningitis.

RECYCLE: Taiwan would aid manufacturers in refining rare earths from discarded appliances, which would fit the nation’s circular economy goals, minister Kung said Taiwan would work with the US and Japan on a proposed cooperation initiative in response to Beijing’s newly announced rare earth export curbs, Minister of Economic Affairs Kung Ming-hsin (龔明鑫) said yesterday. China last week announced new restrictions requiring companies to obtain export licenses if their products contain more than 0.1 percent of Chinese-origin rare earths by value. US Secretary of the Treasury Scott Bessent on Wednesday responded by saying that Beijing was “unreliable” in its rare earths exports, adding that the US would “neither be commanded, nor controlled” by China, several media outlets reported. Japanese Minister of Finance Katsunobu Kato yesterday also

China Airlines Ltd (CAL, 中華航空) said it expects peak season effects in the fourth quarter to continue to boost demand for passenger flights and cargo services, after reporting its second-highest-ever September sales on Monday. The carrier said it posted NT$15.88 billion (US$517 million) in consolidated sales last month, trailing only September last year’s NT$16.01 billion. Last month, CAL generated NT$8.77 billion from its passenger flights and NT$5.37 billion from cargo services, it said. In the first nine months of this year, the carrier posted NT$154.93 billion in cumulative sales, up 2.62 percent from a year earlier, marking the second-highest level for the January-September

‘DRAMATIC AND POSITIVE’: AI growth would be better than it previously forecast and would stay robust even if the Chinese market became inaccessible for customers, it said Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) yesterday raised its full-year revenue growth outlook after posting record profit for last quarter, despite growing market concern about an artificial intelligence (AI) bubble. The company said it expects revenue to expand about 35 percent year-on-year, driven mainly by faster-than-expected demand for leading-edge chips for AI applications. The world’s biggest contract chipmaker in July projected that revenue this year would expand about 30 percent in US dollar terms. The company also slightly hiked its capital expenditure for this year to US$40 billion to US$42 billion, compared with US$38 billion to US$42 billion it set previously. “AI demand actually

Jensen Huang (黃仁勳), founder and CEO of US-based artificial intelligence chip designer Nvidia Corp and Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) on Friday celebrated the first Nvidia Blackwell wafer produced on US soil. Huang visited TSMC’s advanced wafer fab in the US state of Arizona and joined the Taiwanese chipmaker’s executives to witness the efforts to “build the infrastructure that powers the world’s AI factories, right here in America,” Nvidia said in a statement. At the event, Huang joined Y.L. Wang (王英郎), vice president of operations at TSMC, in signing their names on the Blackwell wafer to