Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) is collaborating with Amkor Technology Inc to provide local advanced packaging and test capacities in Arizona to address customer requirements for geographical flexibility in chip manufacturing.

As part of the agreement, TSMC, the world’s biggest contract chipmaker, would contract turnkey advanced packaging and test services from Amkor at their planned facility in Peoria, Arizona, a joint statement released yesterday said.

TSMC would leverage these services to support its customers, particularly those using TSMC’s advanced wafer fabrication facilities in Phoenix, Arizona, it said.

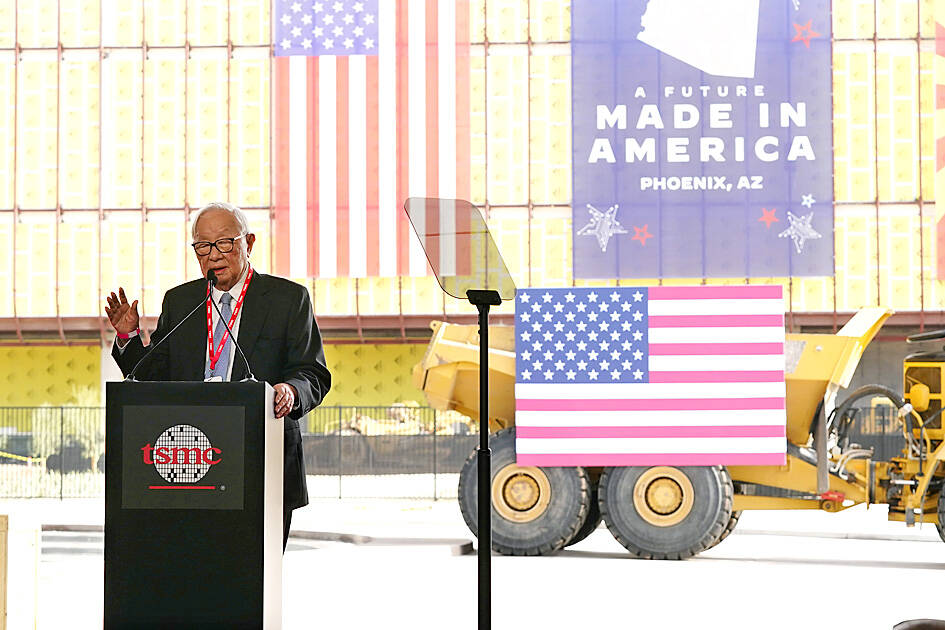

Photo: AP

The companies would jointly define the specific packaging technologies, such as TSMC’s Integrated Fan-Out (InFO) and Chip on Wafer on Substrate (CoWoS) that would be employed to address common customers’ needs, the statement said.

The agreement underscores a shared commitment to supporting customer requirements for geographic flexibility in front-end and back-end manufacturing, as well as fostering the development of a vibrant and comprehensive semiconductor manufacturing ecosystem in the US, the statement said.

“Our customers are increasingly depending on advanced packaging technologies for their breakthroughs in advanced mobile applications, artificial intelligence [AI] and high-performance computing, and TSMC is pleased to work side by side with a trusted long-time strategic partner in Amkor to support them with a more diverse manufacturing footprint,” TSMC senior vice president Kevin Zhang (張曉強) said in the statement.

Amkor, based in Tempe, Arizona, in November last year announced plans to build its first domestic outsourced semiconductor assembly and test in Peoria, Arizona for US$2 billion.

Upon completion, it would be the largest outsourced advanced packaging and test (OSAT) facility in the US.

The advanced packaging and production outsourcing agreement came as TSMC’s first Arizona fab is to begin high-volume production of 4-nanometer chips in the first half of next year, mostly for its US customers, including Apple Inc, Nvidia Corp and Advanced Micro Devices Inc.

In Arizona, TSMC plans to build three fabs to produce advanced chips, such as 3-nanometer and 2-nanometer chips, with a total investment of US$65 billion.

Amkor is already on TSMC’s CoWoS capacity supplier list along with Taiwan’s Siliconware Precision Industries Co (SPIL, 矽品) and Advanced Semiconductor Engineering Inc (ASE, 日月光半導體) to help resolve prolonged capacity scarcity amid surging AI chip demand, TrendForce Technology Corp (集邦科技) analyst Joanne Chiao (喬安) said.

“Due to geopolitical factors, some of TSMC’s US-based customers are seeking localized production,” Chiao said.

As TSMC’s Arizona plant is only designed for front-end chip manufacturing and no back-end packaging capacity was planned, it requires a US-based OSAT partner to supply CoWoS capacity, Chiao said.

Amkor has apparently emerged as a suitable choice, she added.

ASE and SPIL did not build large-scale packaging and testing capacity in the US.

ASE in July unveiled a second testing fab in San Jose, operated by its US subsidiary, to cope with rising demand for AI and high-performance-computing applications.

South Korea’s equity benchmark yesterday crossed a new milestone just a month after surpassing the once-unthinkable 5,000 mark as surging global memory demand powers the country’s biggest chipmakers. The KOSPI advanced as much as 2.6 percent to a record 6,123, with Samsung Electronics Co and SK Hynix Inc each gaining more than 2 percent. With the benchmark now up 45 percent this year, South Korea’s stock market capitalization has also moved past France’s, following last month’s overtaking of Germany’s. Long overlooked by foreign funds, despite being undervalued, South Korean stocks have now emerged as clear winners in the global market. The so-called “artificial intelligence

NEW IDENTITY: Known for its software, India has expanded into hardware, with its semiconductor industry growing from US$38bn in 2023 to US$45bn to US$50bn India on Saturday inaugurated its first semiconductor assembly and test facility, a milestone in the government’s push to reduce dependence on foreign chipmakers and stake a claim in a sector dominated by China. Indian Prime Minister Narendra Modi opened US firm Micron Technology Inc’s semiconductor assembly, test and packaging unit in his home state of Gujarat, hailing the “dawn of a new era” for India’s technology ambitions. “When young Indians look back in the future, they will see this decade as the turning point in our tech future,” Modi told the event, which was broadcast on his YouTube channel. The plant would convert

‘SEISMIC SHIFT’: The researcher forecast there would be about 1.1 billion mobile shipments this year, down from 1.26 billion the prior year and erasing years of gains The global smartphone market is expected to contract 12.9 percent this year due to the unprecedented memorychip shortage, marking “a crisis like no other,” researcher International Data Corp (IDC) said. The new forecast, a dramatic revision down from earlier estimates, gives the latest accounting of the ongoing memory crunch that is affecting every corner of the electronics industry. The demand for advanced memory to power artificial intelligence (AI) tasks has drained global supply until well into next year and jeopardizes the business model of many smartphone makers. IDC forecast about 1.1 billion mobile shipments this year, down from 1.26 billion the prior

People stand in a Pokemon store in Tokyo on Thursday. One of the world highest-grossing franchises is celebrated its 30th anniversary yesterday.