Mercedes-Benz Group AG shares yesterday fell the most in four years after a deepening slowdown in China prompted the world’s biggest luxury car maker to cut its outlook.

The stock slid as much as 8.4 percent in Frankfurt, the steepest intraday decline since 2020. Mercedes’ profit warning weighed across the sector, with BMW AG falling 4.4 percent.

The deepening rout in China has particularly hurt sales of Mercedes’ most expensive models like the S-Class and Maybach sedans. The manufacturer cut expectations for its main cars unit and now sees adjusted returns between 7.5 percent and 8.5 percent, compared with a prior forecast of as much as 11 percent. Earnings before interest and taxes would be “significantly below” the prior year level.

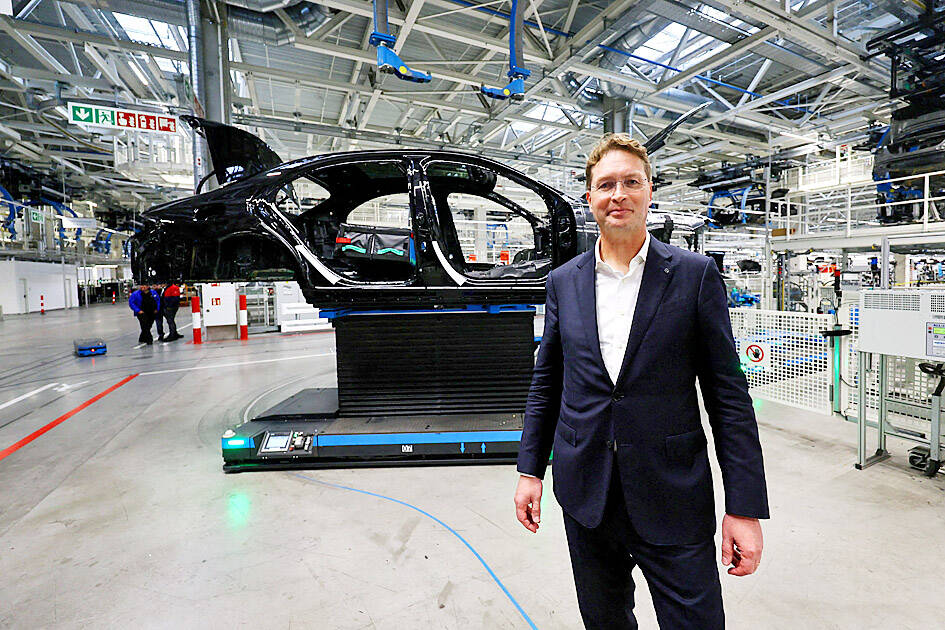

Photo: Reuters

Mercedes is planning a sales offensive in China with new products, chief executive officer Ola Kallenius said yesterday.

The profit warning is a setback for Mercedes’ push further upmarket and yet another warning sign for Germany’s marquee industry, which is struggling with a bumpy transition to electric vehicles (EVs) and headwinds in China. Volkswagen AG this month scrapped a decades-old labor pact and might close factories in Germany for the first time due to lagging demand. BMW last week cut its full-year earnings guidance, held back by the China downturn and sluggish EV sales.

The cutbacks undermine Mercedes’ strategy of selling more of its most luxurious vehicles to boost profitability. China’s macroeconomic environment has deteriorated further, driven by the persistent downturn in the real estate sector, the company said.

“China is turning into a nightmare,” Oddo BHF analysts wrote in a note, with risk of yet deeper problems as consumers in the country shift to EVs and away from high-margin S-Classes.

The company’s latest EVs have met with a tepid response from consumers in Asia’s powerhouse economy and elsewhere. Younger drivers in China are increasingly turning to homegrown brands that are perceived to have more advanced in-car digital and entertainment technology.

While business in China is sliding, sales in Europe are also under pressure. Mercedes deliveries across the region slumped 13 percent last month and were down 3 percent during the first eight months. Cratering EV sales are undermining efforts to meet EU emissions rules that would tighten next year, exposing the industry to billions of euros in fines.

German Minister for Economic Affairs and Climate Action Robert Habeck is holding an industry summit in Berlin on Monday to discuss ways out of the current crisis.

South Korea’s equity benchmark yesterday crossed a new milestone just a month after surpassing the once-unthinkable 5,000 mark as surging global memory demand powers the country’s biggest chipmakers. The KOSPI advanced as much as 2.6 percent to a record 6,123, with Samsung Electronics Co and SK Hynix Inc each gaining more than 2 percent. With the benchmark now up 45 percent this year, South Korea’s stock market capitalization has also moved past France’s, following last month’s overtaking of Germany’s. Long overlooked by foreign funds, despite being undervalued, South Korean stocks have now emerged as clear winners in the global market. The so-called “artificial intelligence

‘SEISMIC SHIFT’: The researcher forecast there would be about 1.1 billion mobile shipments this year, down from 1.26 billion the prior year and erasing years of gains The global smartphone market is expected to contract 12.9 percent this year due to the unprecedented memorychip shortage, marking “a crisis like no other,” researcher International Data Corp (IDC) said. The new forecast, a dramatic revision down from earlier estimates, gives the latest accounting of the ongoing memory crunch that is affecting every corner of the electronics industry. The demand for advanced memory to power artificial intelligence (AI) tasks has drained global supply until well into next year and jeopardizes the business model of many smartphone makers. IDC forecast about 1.1 billion mobile shipments this year, down from 1.26 billion the prior

People stand in a Pokemon store in Tokyo on Thursday. One of the world highest-grossing franchises is celebrated its 30th anniversary yesterday.

Chinese artificial intelligence (AI) start-up DeepSeek’s (深度求索) latest AI model, set to be released as soon as next week, was trained on Nvidia Corp’s most advanced AI chip, the Blackwell, a senior official of US President Donald Trump’s administration said on Monday, in what could represent a violation of US export controls. The US believes DeepSeek will remove the technical indicators that might reveal its use of American AI chips, the official said, adding that the Blackwells are likely clustered at its data center in Inner Mongolia, an autonomous region of China. The person declined to say how the US government received