Domestic gasoline and diesel prices are to increase NT$0.2 and NT$0.1 per liter respectively this week, after international crude oil prices rose last week as the geopolitical situation in the Middle East remained unstable, CPC Corp, Taiwan (CPC, 台灣中油) and Formosa Petrochemical Corp (台塑石化) said in separate statements yesterday.

In addition, news that oilfields in eastern Libya would be closed and exports halted due to domestic political tension and reports that Iraq plans to reduce its oil production this month as part of a deal with OPEC also helped boost crude oil prices last week, the companies said.

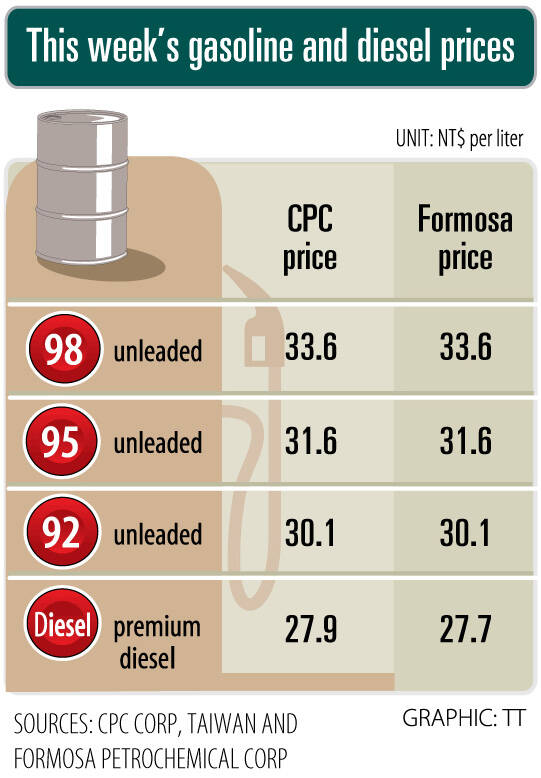

Effective today, gasoline prices at CPC and Formosa stations are to increase to NT$30.1, NT$31.6 and NT$33.6 per liter for 92, 95 and 98-octane unleaded gasoline respectively, the companies said.

Premium diesel would cost NT$27.9 per liter at CPC stations and NT$27.7 at Formosa pumps, they said.

Separately, prices of liquefied petroleum gas (LPG) products, including household and automotive LPG, propane and butane, as well as propane and butane mixes, would remain unchanged this month, CPC said.

Liquefied natural gas prices for retail and industrial users would also stay the same this month, although prices for power generation users such as Taiwan Power Co (台電) would rise 2 percent and those for industrial users like Taiwan Cogeneration Corp (台灣汽電共生) would increase 10 percent from last month, it added.

Taiwanese suppliers to Taiwan Semiconductor Manufacturing Co. (TSMC, 台積電) are expected to follow the contract chipmaker’s step to invest in the US, but their relocation may be seven to eight years away, Minister of Economic Affairs J.W. Kuo (郭智輝) said yesterday. When asked by opposition Chinese Nationalist Party (KMT) Legislator Niu Hsu-ting (牛煦庭) in the legislature about growing concerns that TSMC’s huge investments in the US will prompt its suppliers to follow suit, Kuo said based on the chipmaker’s current limited production volume, it is unlikely to lead its supply chain to go there for now. “Unless TSMC completes its planned six

Power supply and electronic components maker Delta Electronics Inc (台達電) yesterday said second-quarter revenue is expected to surpass the first quarter, which rose 30 percent year-on-year to NT$118.92 billion (US$3.71 billion). Revenue this quarter is likely to grow, as US clients have front-loaded orders ahead of US President Donald Trump’s planned tariffs on Taiwanese goods, Delta chairman Ping Cheng (鄭平) said at an earnings conference in Taipei, referring to the 90-day pause in tariff implementation Trump announced on April 9. While situations in the third and fourth quarters remain unclear, “We will not halt our long-term deployments and do not plan to

‘SHORT TERM’: The local currency would likely remain strong in the near term, driven by anticipated US trade pressure, capital inflows and expectations of a US Fed rate cut The US dollar is expected to fall below NT$30 in the near term, as traders anticipate increased pressure from Washington for Taiwan to allow the New Taiwan dollar to appreciate, Cathay United Bank (國泰世華銀行) chief economist Lin Chi-chao (林啟超) said. Following a sharp drop in the greenback against the NT dollar on Friday, Lin told the Central News Agency that the local currency is likely to remain strong in the short term, driven in part by market psychology surrounding anticipated US policy pressure. On Friday, the US dollar fell NT$0.953, or 3.07 percent, closing at NT$31.064 — its lowest level since Jan.

The New Taiwan dollar and Taiwanese stocks surged on signs that trade tensions between the world’s top two economies might start easing and as US tech earnings boosted the outlook of the nation’s semiconductor exports. The NT dollar strengthened as much as 3.8 percent versus the US dollar to 30.815, the biggest intraday gain since January 2011, closing at NT$31.064. The benchmark TAIEX jumped 2.73 percent to outperform the region’s equity gauges. Outlook for global trade improved after China said it is assessing possible trade talks with the US, providing a boost for the nation’s currency and shares. As the NT dollar