Advanced Micro Devices Inc (AMD) has agreed to buy server maker ZT Systems Inc in a cash and stock transaction valued at US$4.9 billion, adding data center technology that would bolster its efforts to challenge Nvidia Corp.

ZT Systems, based in Secaucus, New Jersey, would become part of AMD’s Data Center Solutions Business Group, it said in a statement yesterday.

AMD would retain the business’ design and customer teams and look to sell the manufacturing division. The deal price includes a contingent payment of US$400 million based on certain milestones.

Photo: Bloomberg

AMD shares rose 2.5 percent in premarket trading yesterday after the news.

Closely held ZT has extensive experience making server computers for owners of large data centers — the kind of customers that are pouring billions of dollars into new artificial intelligence (AI) capabilities.

The acquisition would “significantly strengthen our data center AI systems,” AMD chief executive officer Lisa Su (蘇姿丰) said in the statement.

The company has its sights set on Nvidia, the runaway leader in the market for data center gear needed to support AI computing. AMD is adding software and hardware capabilities that would better match the breadth of Nvidia’s offerings and speed up the uptake of its chips.

AMD is the second-biggest provider of the graphics processors that have become so vital to developing AI software. The company has spent more than US$1 billion in the past 12 months to expand its reach in that market.

Last month, the company agreed to buy Silo AI for US$665 million to add a maker of artificial intelligence models.

Santa Clara, California-based AMD is seen as Nvidia’s closest rival in AI processors.

Its new MI range of accelerator chips would bring in more than US$4.5 billion of new revenue this year, the company has projected.

That puts it ahead of all other challengers to Nvidia, but still way behind. Analysts expect Nvidia to generate US$100 billion in data center revenue this fiscal year.

Part of Nvidia’s expansion has been fueled by offering chips, networking, servers, software and services, all aimed at making AI use more pervasive in the economy. Under Su’s leadership, AMD is showing a commitment to match that reach.

AMD shares rose less than 1 percent in New York trading on Friday, leaving the stock little changed this year, but gains over recent years have pushed its market value to US$240 billion, more than twice that of longtime rival Intel Corp.

Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), the world’s biggest contract chipmaker, booked its first-ever profit from its Arizona subsidiary in the first half of this year, four years after operations began, a company financial statement showed. Wholly owned by TSMC, the Arizona unit contributed NT$4.52 billion (US$150.1 million) in net profit, compared with a loss of NT$4.34 billion a year earlier, the statement showed. The company attributed the turnaround to strong market demand and high factory utilization. The Arizona unit counts Apple Inc, Nvidia Corp and Advanced Micro Devices Inc among its major customers. The firm’s first fab in Arizona began high-volume production

VOTE OF CONFIDENCE: The Japanese company is adding Intel to an investment portfolio that includes artificial intelligence linchpins Nvidia Corp and TSMC Softbank Group Corp agreed to buy US$2 billion of Intel Corp stock, a surprise deal to shore up a struggling US name while boosting its own chip ambitions. The Japanese company, which is adding Intel to an investment portfolio that includes artificial intelligence (AI) linchpins Nvidia Corp and Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), is to pay US$23 a share — a small discount to Intel’s last close. Shares of the US chipmaker, which would issue new stock to Softbank, surged more than 5 percent in after-hours trading. Softbank’s stock fell as much as 5.4 percent on Tuesday in Tokyo, its

COLLABORATION: Softbank would supply manufacturing gear to the factory, and a joint venture would make AI data center equipment, Young Liu said Hon Hai Precision Industry Co (鴻海精密) would operate a US factory owned by Softbank Group Corp, setting up what is in the running to be the first manufacturing site in the Japanese company’s US$500 billion Stargate venture with OpenAI and Oracle Corp. Softbank is acquiring Hon Hai’s electric-vehicle plant in Ohio, but the Taiwanese company would continue to run the complex after turning it into an artificial intelligence (AI) server production plant, Hon Hai chairman Young Liu (劉揚偉) said yesterday. Softbank would supply manufacturing gear to the factory, and a joint venture between the two companies would make AI data

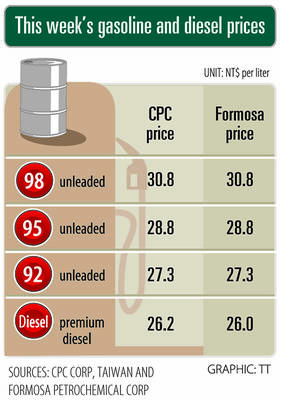

The prices of gasoline and diesel at domestic fuel stations are to rise NT$0.1 and NT$0.4 per liter this week respectively, after international crude oil prices rose last week, CPC Corp, Taiwan (台灣中油) and Formosa Petrochemical Corp (台塑石化) announced yesterday. Effective today, gasoline prices at CPC and Formosa stations are to rise to NT$27.3, NT$28.8 and NT$30.8 per liter for 92, 95 and 98-octane unleaded gasoline respectively, the companies said in separate statements. The price of premium diesel is to rise to NT$26.2 per liter at CPC stations and NT$26 at Formosa pumps, they said. The announcements came after international crude oil prices