The race to replace China’s top spot in emerging market equity portfolios is heating up, with Taiwan and India running neck and neck as formidable rivals.

Thanks to record stock rallies, Taiwan and India now command more than 19 percent weightings each in the MSCI EM Index. That compares with China’s 22.8 percent, whose standing has steadily shrunk over the past few years, Bloomberg-compiled data showed.

The rise of Taiwan and India is allowing investors to better diversify by betting on artificial intelligence (AI) chipmakers and the infrastructure boom coming from Indian Prime Minister Narendra Modi’s programs to modernize the country.

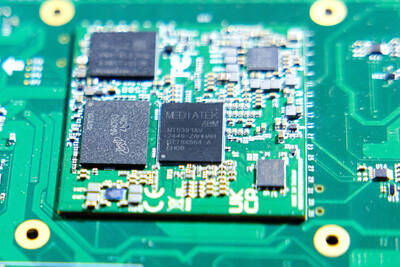

Photo: CNA

As the US rate cycle peaks out, having attractive options in emerging markets is fundamental to any pivoting of capital flows.

“Investors are seeking ways to manage the risk associated with China’s outsized weight in emerging markets by diversifying into other markets,” Straits Investment Holdings Pte Ltd fund manager Manish Bhargava said in Singapore.

“Taiwan’s technological prowess, particularly in the semiconductor industry, and India’s growing tech sector and digital economy make them attractive alternatives,” Bhargava added.

At its peak in 2020, China accounted for 40 percent of the MSCI EM Index, with investors attracted by thriving e-commerce to sales of expensive liquor. That heavy weightage cost money managers dearly, with trillions of dollars wiped out as Beijing embarked on regulatory crackdowns and went on a deleveraging campaign for its indebted property sector.

If recent trends hold, Taiwan or India might catch up with China’s standing in MSCI EM this year, marking a shift into a multipolar emerging markets world.

Taiwan’s ascent is all the more notable considering its market capitalization — at US$2.6 trillion — stands at less than a third of China’s. The TAIEX has risen 33 percent this year to become one of the best-performing major benchmarks, bolstered by gains in Nvidia Corp supplier Taiwan Semiconductor Manufacturing Co (台積電).

Meanwhile, India’s NIFTY 50 Index has advanced more than 12 percent this year, hitting a fresh high as Modi promised policy continuity.

That’s in contrast to the sluggishness in Chinese stocks. Benchmarks have barely gained for the year, highlighting an urgency for policymakers to unveil a road map to resolve woes like the property crisis.

Underscoring the trend, the number of EM Ex-China fund launches so far this year is just three short of last year’s annual record, data compiled by Bloomberg showed.

Earnings are a crucial factor behind the allocation preferences. The 12-month forward earnings estimates for the MSCI China Index have barely changed year to date, while those for Taiwan and India have increased by at least 13 percent each.

“EM ex-China looks solid from an earnings angle,” Bloomberg Intelligence quantitative strategist Kumar Gautam said. “The gap between China and EM ex-China earnings revision is at a historical high and China’s earnings revision is too slow to pick up.”

To be sure, valuations can put some brakes on the bullish sentiment. The TAIEX and NIFTY 50 both trade at about 20 times of forward estimated earnings, compared with MSCI China at a little above nine.

Still, money continues to support the shift.

Emerging Asia ex-China’s equity markets recorded net inflows of about US$9 billion since the start of last month, with South Korea, India and Taiwan among the top recipients, data compiled by Bloomberg showed.

Meanwhile, mainland China has seen outflows via the trading links with Hong Kong during the period.

“Tech is eating the world,” Abrdn PLC senior investment director Pruksa Iamthongthong said. “This only compounds with AI, and we see the real winners as Asian tech hardware and semiconductor supply chain names.”

On Ireland’s blustery western seaboard, researchers are gleefully flying giant kites — not for fun, but in the hope of generating renewable electricity and sparking a “revolution” in wind energy. “We use a kite to capture the wind and a generator at the bottom of it that captures the power,” said Padraic Doherty of Kitepower, the Dutch firm behind the venture. At its test site in operation since September 2023 near the small town of Bangor Erris, the team transports the vast 60-square-meter kite from a hangar across the lunar-like bogland to a generator. The kite is then attached by a

Leading Taiwanese bicycle brands Giant Manufacturing Co (巨大機械) and Merida Industry Co (美利達工業) on Sunday said that they have adopted measures to mitigate the impact of the tariff policies of US President Donald Trump’s administration. The US announced at the beginning of this month that it would impose a 20 percent tariff on imported goods made in Taiwan, effective on Thursday last week. The tariff would be added to other pre-existing most-favored-nation duties and industry-specific trade remedy levy, which would bring the overall tariff on Taiwan-made bicycles to between 25.5 percent and 31 percent. However, Giant did not seem too perturbed by the

Foxconn Technology Co (鴻準精密), a metal casing supplier owned by Hon Hai Precision Industry Co (鴻海精密), yesterday announced plans to invest US$1 billion in the US over the next decade as part of its business transformation strategy. The Apple Inc supplier said in a statement that its board approved the investment on Thursday, as part of a transformation strategy focused on precision mold development, smart manufacturing, robotics and advanced automation. The strategy would have a strong emphasis on artificial intelligence (AI), the company added. The company said it aims to build a flexible, intelligent production ecosystem to boost competitiveness and sustainability. Foxconn

TARIFF CONCERNS: Semiconductor suppliers are tempering expectations for the traditionally strong third quarter, citing US tariff uncertainty and a stronger NT dollar Several Taiwanese semiconductor suppliers are taking a cautious view of the third quarter — typically a peak season for the industry — citing uncertainty over US tariffs and the stronger New Taiwan dollar. Smartphone chip designer MediaTek Inc (聯發科技) said that customers accelerated orders in the first half of the year to avoid potential tariffs threatened by US President Donald Trump’s administration. As a result, it anticipates weaker-than-usual peak-season demand in the third quarter. The US tariff plan, announced on April 2, initially proposed a 32 percent duty on Taiwanese goods. Its implementation was postponed by 90 days to July 9, then