South Korea’s financial watchdog said it has so far uncovered 211.2 billion won (US$156 million) worth of illegal short trades by nine global investment banks, providing its latest formal update on a probe that began late last year.

The nine banks, whose names were not disclosed, violated mostly procedural rules while collectively shorting 164 stocks, a Financial Supervisory Service (FSS) briefing said. It is continuing to probe five other banks in the matter.

Two of the nine banks are already facing penalties imposed by the financial authorities and have been referred to prosecutors for further investigation for allegedly violating the nation’s capital markets law, FSS Senior Deputy Governor Hahm Yong-il told reporters on Friday. The watchdog plans to review penalties on the other seven banks.

Photo: AP

Activities of global banks and hedge funds have come under increased scrutiny in recent months in South Korea, as authorities boost steps to weed out naked short selling — a practice of selling shares without even borrowing them first. While short selling remains legal in many markets, it is a contentious political issue in the emerging Asian nation, with its powerful retail investors often blaming it for stock declines.

Describing the practice as “rampant,” authorities in November last year imposed a ban on all forms of short-selling until the end of next month, inviting criticism from some investors that the move would hurt the market’s appeal among global funds.

At the same time, a special team was formed to probe all short-selling activities by major global investment banks since May 2021 — when South Korea partially lifted a pandemic-era ban and allowed the resumption of short selling in stocks on the KOSPI 200 Index and the KOSDAQ 150 Index.

Most short-selling trades by global banks in South Korea are aimed at hedging their swap contracts with their end clients, the FSS said.

Europe-headquartered banks committed more breaches compared to those based in the US, and most trades under investigation were conducted from their Hong Kong offices, Hahm said. FSS officials plan to visit Hong Kong later this month to update global banks on South Korea’s regulations related to short-selling.

Overall, the 14 banks being probed by authorities accounted for 90 percent of short-selling trades by overseas firms in the country, the FSS said.

Regulators are also developing a platform to monitor short-selling that can help identify illegal transactions, it said.

The probe launch came after authorities in October last year accused two global banks of “routinely and intentionally” breaching short-selling rules in trades totaling 56 billion won. Then in December, BNP Paribas SA and HSBC Holdings PLC were fined by regulators for claims tied to short selling.

In March, HSBC’s Hong Kong unit and three of its traders were indicted by prosecutors. Credit Suisse Group AG, which was acquired by UBS Group AG, is also facing a fine, South Korean media reported earlier this month.

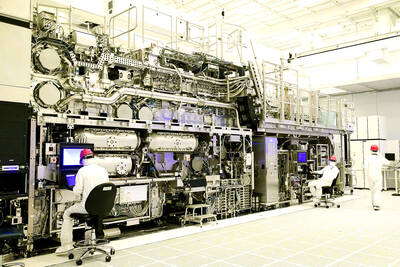

ASML Holding NV’s new advanced chip machines have a daunting price tag, said Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), one of the Dutch company’s biggest clients. “The cost is very high,” TSMC senior vice president Kevin Zhang (張曉強) said at a technology symposium in Amsterdam on Tuesday, referring to ASML’s latest system known as high-NA extreme ultraviolet (EUV). “I like the high-NA EUV’s capability, but I don’t like the sticker price,” Zhang said. ASML’s new chip machine can imprint semiconductors with lines that are just 8 nanometers thick — 1.7 times smaller than the previous generation. The machines cost 350 million euros (US$378 million)

Apple Inc has closed in on an agreement with OpenAI to use the start-up’s technology on the iPhone, part of a broader push to bring artificial intelligence (AI) features to its devices, people familiar with the matter said. The two sides have been finalizing terms for a pact to use ChatGPT features in Apple’s iOS 18, the next iPhone operating system, said the people, who asked not to be identified because the situation is private. Apple also has held talks with Alphabet Inc’s Google about licensing its Gemini chatbot. Those discussions have not led to an agreement, but are ongoing. An OpenAI

EXPLOSION: A driver who was transporting waste material from the site was hit by a blunt object after an uncontrolled pressure release and thrown 6m from the truck Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) said yesterday there was no damage to its facilities after an incident at its Arizona factory construction site where a waste disposal truck driver was transported to hospital. Firefighters responded to an explosion on Wednesday afternoon at the TSMC plant in Phoenix, the Arizona Republic reported, citing the local fire department. Cesar Anguiano-Guitron, 41, was transporting waste material from the project site and stopped to inspect the tank when he was made aware of a potential problem, a police report seen by Bloomberg News showed. Following an “uncontrolled pressure release,” he was hit by a blunt

‘FULL SUPPORT’: Kumamoto Governor Takashi Kimura said he hopes more companies would settle in the prefecture to create an area similar to Taiwan’s Hsinchu Science Park The newly elected governor of Japan’s Kumamoto Prefecture said he is ready to ensure wide-ranging support to woo Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) to build its third Japanese chip factory there. Concerns of groundwater shortages when TSMC’s two plants begin operations in the prefecture’s Kikuyo have spurred discussions about the possibility of tapping unused dam water, Kumamoto Governor Takashi Kimura said in an interview on Saturday. While Kimura said talks about a third plant have yet to occur, Bloomberg had reported TSMC is already considering its third Japanese fab — also in Kumamoto — which would make more advanced chips. “We are