Spurred on by major technological advances and huge private investment, the US nuclear fusion sector could be producing electricity within 10 years, industry players say.

The process, which powers the Sun and other stars, sees two atomic nuclei combine — and release massive amounts of energy. However, private companies on Earth are also hoping that decades of research might finally culminate in fusion power plants being connected to the grid in the 2030s.

The buzz comes amid an influx of cash: In two years, the private sector has more than doubled its investments, reaching a total of US$5.9 billion at the end of last year, compared with just US$271 million from the public sector.

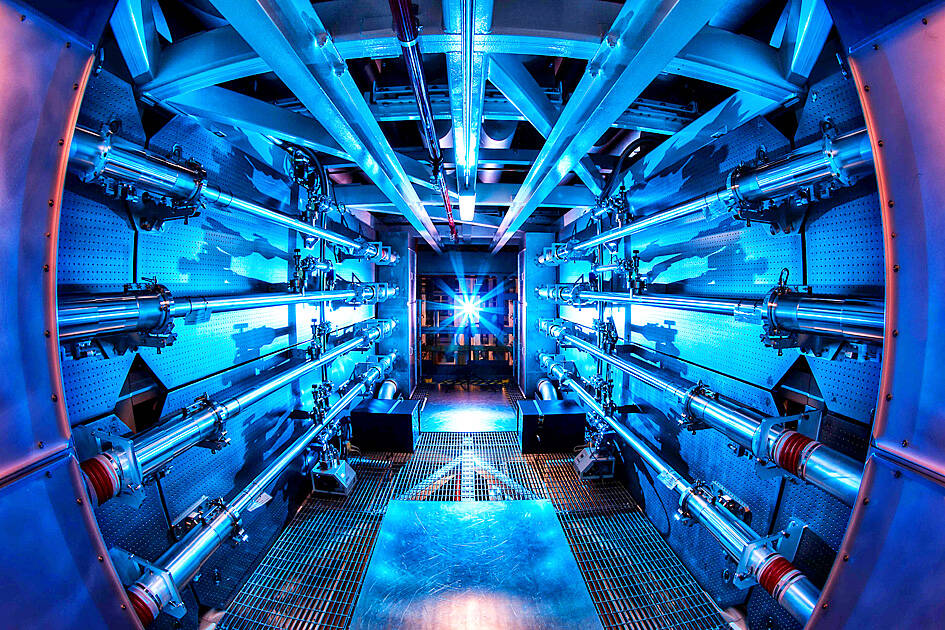

Photo: AFP/Lawrence Livermore National Laboratory

Part of the hype is derived from what experts see as an impending tipping point, where theoretical science would soon become a reality.

“It’s not just about doing science, it’s actually about delivering products,” Massachusetts Institute of Technology (MIT) Plasma Science and Fusion Center director Dennis Whyte said.

About two-thirds of start-ups from various countries, surveyed by the Fusion Industry Association see the first fusion power plant connected to the power grid by 2035 at the latest.

Last year, Helion Energy Inc, a fusion power start-up in Washington state, signed an agreement with Microsoft Corp for 50 megawatts of capacity to be operational by 2029.

“Remarkable things have happened just in the last couple of years,” Focused Energy Inc chief technology officer Pravesh Patel said at the CERAWeek energy conference in March.

“It’s like the first time the Wright brothers took off the ground,” he said, referring to the first-ever flight of a powered aircraft in 1903. “People can see that it’s possible. It’s no longer theoretical.”

Major recent milestones include an experiment by the Lawrence Livermore National Laboratory (LLNL) in California in December 2022, in which more energy was released from the fusion than was used to produce it.

Fusion consists of assembling two atomic nuclei derived from hydrogen, usually deuterium and tritium, in a confined enclosure, at a heat of more than 100 million degrees Celsius.

Together, they form a helium nucleus and release neutrons, which bombard the reactor walls and raise their temperature.

This heat is then converted into electricity, via steam produced when water comes into contact with the outside of the reactor.

Fusion has the advantage of being emissions-free. It also produces less waste than its cousin fission and cannot cause a radiation disaster.

Most start-ups have opted for the magnetic confinement technology used in the tokamak, the best-known reactor model. This differs from the inertial confinement method chosen by LLNL, which uses lasers.

Helion, on the other hand, recovers energy directly from inside the reactor, without using steam, and its process produces less neutrons, thus reducing projections on the walls and their erosion.

Such methods “offer an advantage in getting to commercialization,” a Helion spokesperson said.

Until recently, the economic viability of nuclear fusion appeared uncertain, as magnetic confinement required the manufacture of gigantic magnets.

However, recently published studies by researchers at MIT and start-up Commonwealth Fusion Systems have shown that fusion is possible with much smaller magnets than originally imagined.

“Overnight, this has divided the cost per watt by 40,” Whyte told MIT News. “Now fusion has a chance” to become a reality in energy supply, he said.

With US$2 billion in private capital, Commonwealth is by far the company to have raised the most funds in the sector. It plans to activate its demonstration reactor, SPARC, next year, then open its first power plant in the early 2030s.

Many uncertainties remain, but if Commonwealth and Helion are successful, it would enable the US to become the first country to produce commercial electricity through fusion, a step no other nation is aiming for before 2035 at best.

“Commonwealth is a great example of what you can do, and how fast you can go, when you have this commercial incentive in the private sector versus in the public sector,” Patel said.

“The US has a particularly excellent track record of this,” Whyte said.

US university labs’ ability to translate research into products is often smoother than in other countries, Whyte said, adding that the US has a strong venture capital sector to enable start-ups to get off the ground.

From the semiconductor revolution to that of the Internet, “the US has won these kinds of races,” Whyte said.

Taiwan’s rapidly aging population is fueling a sharp increase in homes occupied solely by elderly people, a trend that is reshaping the nation’s housing market and social fabric, real-estate brokers said yesterday. About 850,000 residences were occupied by elderly people in the first quarter, including 655,000 that housed only one resident, the Ministry of the Interior said. The figures have nearly doubled from a decade earlier, Great Home Realty Co (大家房屋) said, as people aged 65 and older now make up 20.8 percent of the population. “The so-called silver tsunami represents more than just a demographic shift — it could fundamentally redefine the

The US government on Wednesday sanctioned more than two dozen companies in China, Turkey and the United Arab Emirates, including offshoots of a US chip firm, accusing the businesses of providing illicit support to Iran’s military or proxies. The US Department of Commerce included two subsidiaries of US-based chip distributor Arrow Electronics Inc (艾睿電子) on its so-called entity list published on the federal register for facilitating purchases by Iran’s proxies of US tech. Arrow spokesman John Hourigan said that the subsidiaries have been operating in full compliance with US export control regulations and his company is discussing with the US Bureau of

Businesses across the global semiconductor supply chain are bracing themselves for disruptions from an escalating trade war, after China imposed curbs on rare earth mineral exports and the US responded with additional tariffs and restrictions on software sales to the Asian nation. China’s restrictions, the most targeted move yet to limit supplies of rare earth materials, represent the first major attempt by Beijing to exercise long-arm jurisdiction over foreign companies to target the semiconductor industry, threatening to stall the chips powering the artificial intelligence (AI) boom. They prompted US President Donald Trump on Friday to announce that he would impose an additional

China Airlines Ltd (CAL, 中華航空) said it expects peak season effects in the fourth quarter to continue to boost demand for passenger flights and cargo services, after reporting its second-highest-ever September sales on Monday. The carrier said it posted NT$15.88 billion (US$517 million) in consolidated sales last month, trailing only September last year’s NT$16.01 billion. Last month, CAL generated NT$8.77 billion from its passenger flights and NT$5.37 billion from cargo services, it said. In the first nine months of this year, the carrier posted NT$154.93 billion in cumulative sales, up 2.62 percent from a year earlier, marking the second-highest level for the January-September