Berkshire Hathaway Inc’s cash pile hit yet another record as billionaire investor Warren Buffett confronted a dearth of big-ticket deals. Operating earnings also rose, buoyed by his collection of insurance businesses.

The firm’s hoard increased to US$189 billion at the end of the first quarter, topping the record it set at year-end. The company also reported first-quarter operating earnings of US$11.2 billion, versus US$8.07 billion for the same period a year earlier.

Buffett, 93, has long decried a lack of meaningful deals that would give the firm a shot at “eye-popping” results. Even as the company ramped up acquisitions over the past few years, including a US$11.6 billion deal to buy Alleghany Corp and its purchase of shares in Occidental Petroleum Corp, Berkshire has struggled to find sizable deals. That has left Buffett with more cash — what he called an unrivaled mountain of capital — than he and his investing deputies could quickly deploy.

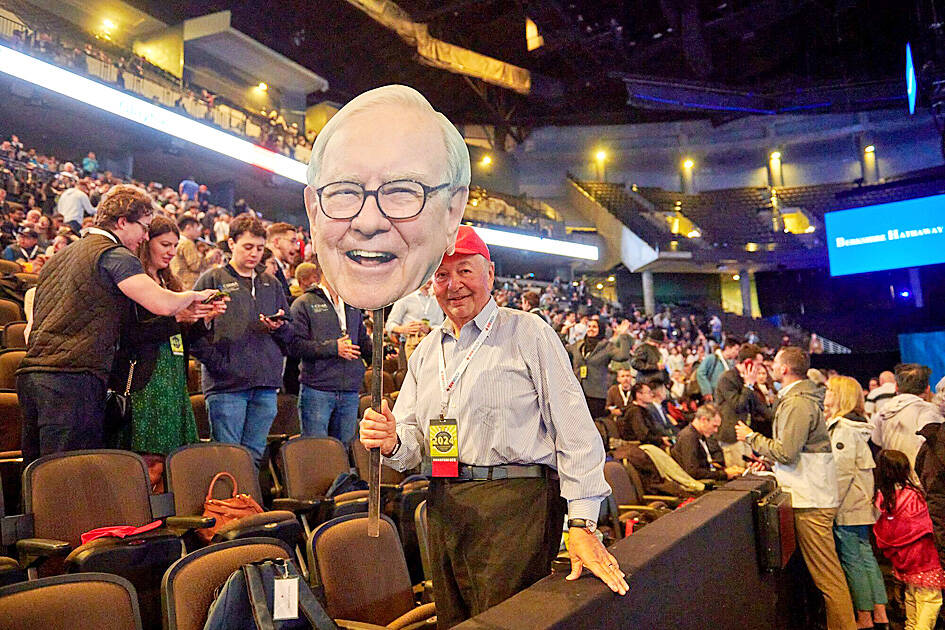

Photo: Bloomberg

As Berkshire’s annual meeting launched in Omaha, Nebraska, on Saturday, Buffett said that “it’s a fair assumption” that its cash pile would hit US$200 billion at the end of this quarter with few opportunities for needle-moving acquisitions on the horizon.

“We’d love to spend it, but we won’t spend it unless we think we’re doing something that has very little risk and can make us a lot of money,” he told the crowd of thousands.

The company hopes for an “occasional big opportunity,” he added, later saying that it is looking at an investment in Canada.

Still, having such a vast sum of cash in an increasingly “complicated and intertwined” world where more can go wrong could allow the firm to step in when opportunities present themselves, Buffett said.

Berkshire wants to be ready to act when that happens, he said.

The company sold some of its Apple Inc shares in the quarter, reporting a US$135.4 billion stake at the end of March, down from US$174.3 billion at the end of last year. Apple has been hit by a drumbeat of negative news, including a US$2 billion antitrust fine, slumping sales in China and the scrapping of a decade-long car project.

Despite the sale, Buffett praised Apple, saying it is an “even better” business than two others it owns shares in — American Express Co and Coca-Cola Co.

Apple would likely remain its top holding by the end of the year, Buffett said.

Berkshire also sold its position in Paramount Global at a loss, Buffett said, adding that he was responsible for the investment.

The company has faced challenges as viewers shifted from traditional TV to online offerings and is the subject of takeover talks.

In the absence of deals, Berkshire has turned to buying back its own shares. It spent about US$2.6 billion doing that in the first quarter, the company said in its earnings statement on Saturday.

With businesses including railroad, retail, construction and energy, Berkshire is closely watched as a litmus test for US economic health, particularly amid elevated inflation and interest rates.

Earnings at the company’s collection of insurance businesses jumped to US$2.6 billion, compared with US$911 million in the same period last year, thanks to improved results at its vehicle insurer Geico Corp, fewer catastrophes and an increase in insurance investment income. The conglomerate’s BNSF Railway Co reported an 8.3 percent decline in earnings from the prior period, which Berkshire said was down to “unfavorable changes in business mix,” as well as lower fuel surcharge revenues.

Berkshire reported US$12.7 billion in earnings attributable to shareholders for the first quarter, compared with US$35.5 billion for the same period a year earlier, largely due to lower investment income.

Buffett advised shareholders against relying on the firm’s net income figures because they include the swings of its stock portfolio value and do not reflect the performance of its vast group of businesses.

Berkshire’s annual meeting drew thousands of Buffett devotees. It is the first without Charlie Munger, Berkshire’s vice chairman and Buffett’s long-time investing partner, who died at the age of 99 in November last year.

To many, Tatu City on the outskirts of Nairobi looks like a success. The first city entirely built by a private company to be operational in east Africa, with about 25,000 people living and working there, it accounts for about two-thirds of all foreign investment in Kenya. Its low-tax status has attracted more than 100 businesses including Heineken, coffee brand Dormans, and the biggest call-center and cold-chain transport firms in the region. However, to some local politicians, Tatu City has looked more like a target for extortion. A parade of governors have demanded land worth millions of dollars in exchange

Hong Kong authorities ramped up sales of the local dollar as the greenback’s slide threatened the foreign-exchange peg. The Hong Kong Monetary Authority (HKMA) sold a record HK$60.5 billion (US$7.8 billion) of the city’s currency, according to an alert sent on its Bloomberg page yesterday in Asia, after it tested the upper end of its trading band. That added to the HK$56.1 billion of sales versus the greenback since Friday. The rapid intervention signals efforts from the city’s authorities to limit the local currency’s moves within its HK$7.75 to HK$7.85 per US dollar trading band. Heavy sales of the local dollar by

Taiwan Semiconductor Manufacturing Co’s (TSMC, 台積電) revenue jumped 48 percent last month, underscoring how electronics firms scrambled to acquire essential components before global tariffs took effect. The main chipmaker for Apple Inc and Nvidia Corp reported monthly sales of NT$349.6 billion (US$11.6 billion). That compares with the average analysts’ estimate for a 38 percent rise in second-quarter revenue. US President Donald Trump’s trade war is prompting economists to retool GDP forecasts worldwide, casting doubt over the outlook for everything from iPhone demand to computing and datacenter construction. However, TSMC — a barometer for global tech spending given its central role in the

An Indonesian animated movie is smashing regional box office records and could be set for wider success as it prepares to open beyond the Southeast Asian archipelago’s silver screens. Jumbo — a film based on the adventures of main character, Don, a large orphaned Indonesian boy facing bullying at school — last month became the highest-grossing Southeast Asian animated film, raking in more than US$8 million. Released at the end of March to coincide with the Eid holidays after the Islamic fasting month of Ramadan, the movie has hit 8 million ticket sales, the third-highest in Indonesian cinema history, Film