Microsoft Corp yesterday said that it would create Thailand’s first data center region to boost cloud and artificial intelligence (AI) infrastructure, promising AI training to more than 100,000 people to develop tech.

Bangkok is a key economic player in Southeast Asia, but it has lagged behind Indonesia and Singapore when it comes to the tech industry.

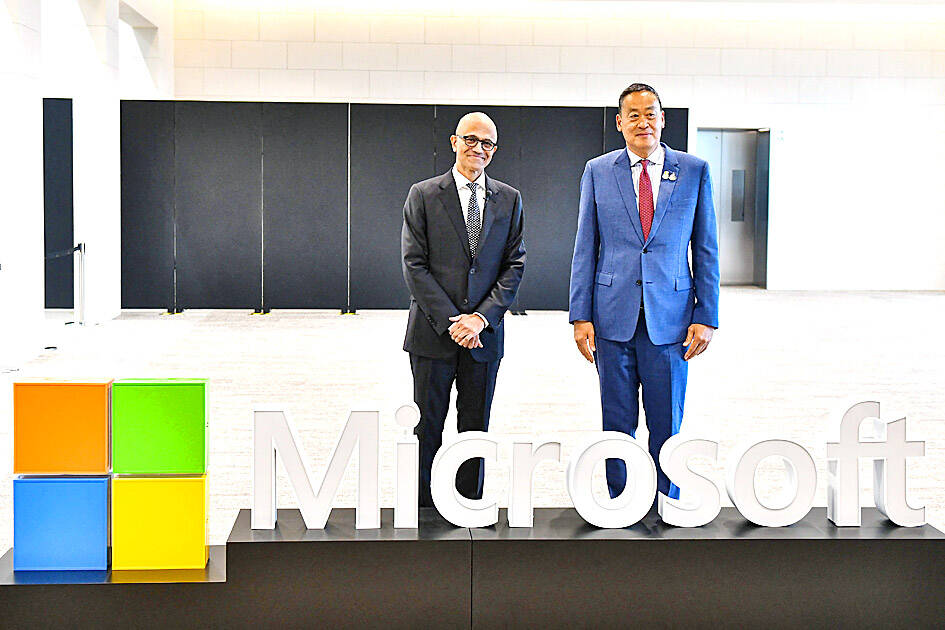

Thailand has an “incredible opportunity to build a digital-first, AI-powered future,” Microsoft chairman and chief executive officer Satya Nadella said at an event in Bangkok.

Photo: AFP / Royal Thai Government

Data center regions are physical locations that store computing infrastructure, allowing secure and reliable access to cloud platforms.

The global embrace of AI has boosted sales of Microsoft’s key cloud services such as Azure, which have become the core of its business under Nadella’s leadership.

Nadella said that the “full Azure region” was going to come to Thailand.

Thai Prime Minister Srettha Thavisin, who has pushed digital infrastructure and cloud investments, has undertaken numerous international tours in the past year as he attempts to woo tech firms to invest in the kingdom.

“Thailand is ready for AI,” Srettha said ahead of a meeting with Nadella.

“The government will fully support the growth of the AI industry in this country,” he added.

Thailand is the latest stop on Nadella’s regional tour.

He was in Indonesia on Tuesday, where he pledged to invest US$1.7 billion around AI and cloud computing, and is later to visit Malaysia.

Microsoft has been rewarded by investors since it rolled out generative AI, starting with its US$13 billion partnership with OpenAI, the creator of ChatGPT, last year.

However, eight US newspapers on Tuesday sued OpenAI and Microsoft in a New York federal court for violating their copyright to train the technology behind the ChatGPT and Copilot chatbots.

The newspapers, which include the New York Daily News and the Chicago Tribune, are owned by Alden Global Capital, a Florida-based hedge fund that created the second-largest US newspaper group behind USA Today owner Gannett Co when it bought the Tribune publishing chain in 2021.

OpenAI and Microsoft were also accused of offering verbatim excerpts of full articles, as well as attributing misleading or inaccurate reporting to the publications in some requests.

Other newspapers involved in the suit were the Orlando Sentinel, the Sun Sentinel of Florida, the San Jose Mercury News, the Denver Post, the Orange County Register and the St Paul Pioneer Press.

The suit on Tuesday closely resembles a case filed by the New York Times in December last year, in which OpenAI is also accused of stealing content to train its AI.

Yet several other news firms have entered partnerships with the Microsoft-backed start-up instead of going to court.

They include The Associated Press, the Financial Times, Germany’s Axel Springer, French daily Le Monde and Spanish conglomerate Prisa Media.

South Korea’s equity benchmark yesterday crossed a new milestone just a month after surpassing the once-unthinkable 5,000 mark as surging global memory demand powers the country’s biggest chipmakers. The KOSPI advanced as much as 2.6 percent to a record 6,123, with Samsung Electronics Co and SK Hynix Inc each gaining more than 2 percent. With the benchmark now up 45 percent this year, South Korea’s stock market capitalization has also moved past France’s, following last month’s overtaking of Germany’s. Long overlooked by foreign funds, despite being undervalued, South Korean stocks have now emerged as clear winners in the global market. The so-called “artificial intelligence

NEW IDENTITY: Known for its software, India has expanded into hardware, with its semiconductor industry growing from US$38bn in 2023 to US$45bn to US$50bn India on Saturday inaugurated its first semiconductor assembly and test facility, a milestone in the government’s push to reduce dependence on foreign chipmakers and stake a claim in a sector dominated by China. Indian Prime Minister Narendra Modi opened US firm Micron Technology Inc’s semiconductor assembly, test and packaging unit in his home state of Gujarat, hailing the “dawn of a new era” for India’s technology ambitions. “When young Indians look back in the future, they will see this decade as the turning point in our tech future,” Modi told the event, which was broadcast on his YouTube channel. The plant would convert

‘SEISMIC SHIFT’: The researcher forecast there would be about 1.1 billion mobile shipments this year, down from 1.26 billion the prior year and erasing years of gains The global smartphone market is expected to contract 12.9 percent this year due to the unprecedented memorychip shortage, marking “a crisis like no other,” researcher International Data Corp (IDC) said. The new forecast, a dramatic revision down from earlier estimates, gives the latest accounting of the ongoing memory crunch that is affecting every corner of the electronics industry. The demand for advanced memory to power artificial intelligence (AI) tasks has drained global supply until well into next year and jeopardizes the business model of many smartphone makers. IDC forecast about 1.1 billion mobile shipments this year, down from 1.26 billion the prior

People stand in a Pokemon store in Tokyo on Thursday. One of the world highest-grossing franchises is celebrated its 30th anniversary yesterday.