House prices could climb higher next quarter on improved buying interest induced by the government’s continued interest subsidy for first-home purchases, a survey by Evertrust Rehouse Co (永慶房屋) showed yesterday.

Fifty-two percent of respondents expect house prices to pick up during the second quarter of the year, a finding that is 12 percentage points higher than three months earlier, the largest real-estate broker by number of offices told a news conference in Taipei.

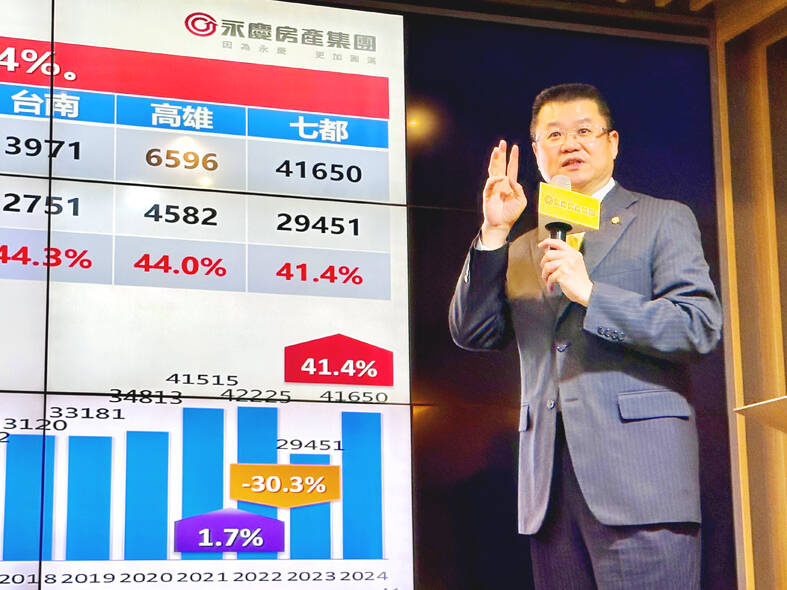

The uptrend would come on top of an average 46.1 percent hike since the first quarter of 2020 when Evertrust teamed up with National Chengchi University to track real house price changes, Evertrust general manager Yeh Ling-chi (葉凌棋) said.

Photo: Hsu Yi-ping, Taipei Times

Yesterday marked the first time the university and Evertrust released their real house price index, which panel members said better captures housing market price movements than the government’s real price transaction platform.

Only 15 percent of respondents are expecting price corrections, as Taiwan is coming out of an economic slowdown, giving people less grounds for being pessimistic, Evertrust research manager Daniel Chen (陳賜傑) said.

Transaction data so far lent support to the positive views.

Housing transactions could total 81,000 to 85,000 units this quarter, suggesting a spike of up to 32 percent year-on-year, Chen said, adding that the government’s interest subsidy for first-home purchases has played a role in facilitating deals.

Exactly 50 percent of respondents said it is wise to buy a house this year, while 46 percent think it is time to sell, with house prices unlikely to boom or bust, Evertrust said.

House prices have soared more than 50 percent in major cities except Taipei, limiting the room for further growth, it said, adding that credit controls would also rein in prices.

However, rising land and building material prices mean that developers would likely not make price concessions, Evertrust said.

In the first half of this year, there could be 169,000 to 174,000 transactions, an increase of 22 to 25 percent, it said.

The property market would receive support from the favorable wealth effect linked to the TAIEX remaining above 20,000 points, while seeking to digest the central bank’s unexpected interest rate hike of 0.125 percentage points, it said.

The rate hike would not affect first-home purchases as the Ministry of Finance has expressed a willingness to absorb the extra borrowing costs, it added.

NEW IDENTITY: Known for its software, India has expanded into hardware, with its semiconductor industry growing from US$38bn in 2023 to US$45bn to US$50bn India on Saturday inaugurated its first semiconductor assembly and test facility, a milestone in the government’s push to reduce dependence on foreign chipmakers and stake a claim in a sector dominated by China. Indian Prime Minister Narendra Modi opened US firm Micron Technology Inc’s semiconductor assembly, test and packaging unit in his home state of Gujarat, hailing the “dawn of a new era” for India’s technology ambitions. “When young Indians look back in the future, they will see this decade as the turning point in our tech future,” Modi told the event, which was broadcast on his YouTube channel. The plant would convert

‘SEISMIC SHIFT’: The researcher forecast there would be about 1.1 billion mobile shipments this year, down from 1.26 billion the prior year and erasing years of gains The global smartphone market is expected to contract 12.9 percent this year due to the unprecedented memorychip shortage, marking “a crisis like no other,” researcher International Data Corp (IDC) said. The new forecast, a dramatic revision down from earlier estimates, gives the latest accounting of the ongoing memory crunch that is affecting every corner of the electronics industry. The demand for advanced memory to power artificial intelligence (AI) tasks has drained global supply until well into next year and jeopardizes the business model of many smartphone makers. IDC forecast about 1.1 billion mobile shipments this year, down from 1.26 billion the prior

People stand in a Pokemon store in Tokyo on Thursday. One of the world highest-grossing franchises is celebrated its 30th anniversary yesterday.

Zimbabwe’s ban on raw lithium exports is forcing Chinese miners to rethink their strategy, speeding up plans to process the metal locally instead of shipping it to China’s vast rechargeable battery industry. The country is Africa’s largest lithium producer and has one of the world’s largest reserves, according to the US Geological Survey (USGS). Zimbabwe already banned the export of lithium ore in 2022 and last year announced it would halt exports of lithium concentrates from January next year. However, on Wednesday it imposed the ban with immediate effect, leaving unclear what the lithium mining sector would do in the