While bitcoin has captured the limelight in the past few weeks as it surged to a new record high, another major cryptocurrency, ether, has been enjoying its own meteoric rise.

Launched in 2015, ether, also known as ethereum, is by far the second-largest digital currency in terms of total value, now estimated at more than US$460 billion.

Along with other cryptocurrencies including Solana and Dogecoin, it benefited from the regulatory approval in the US of a new bitcoin investment product, the exchange traded fund (ETF) in mid-January, CoinShares International Ltd research head James Butterfill said.

Photo: Bloomberg

These ETFs allow investors to profit from any change to the price of cryptocurrencies without having to buy them directly, while also letting them sell at any time.

The launch of crypto ETFs has led to an influx of new money, sending bitcoin to a fresh record on Friday of US$70,085.

Bitcoin’s rise has been well-documented, but ether’s has been even more impressive, surging almost 72 percent year to date in comparison with bitcoin’s 61 percent rise.

This strong performance is largely due to “expectations that an ethereum ETF could be approved in the United States,” Kaiko senior analyst Dessislava Aubert said.

Several asset management companies have applied for authorization from the US financial markets regulator, the Securities and Exchange Commission (SEC), to market these ether investment products.

The SEC must rule on the first such applications, from VanEck and Ark 21Shares, by May 23 at the latest.

“Ethereum has started to wake up as investors are anticipating a potential approval,” crypto consultancy MN Trading founder Michael van de Poppe said, adding that “people are rotating from bitcoin to ethereum as a potential investment opportunity.”

Beyond the ETF effect, the digital currency dreamed up by Russian programmer Vitaly Buterin has several other cards up its sleeve.

For cryptocurrency exchange eToro analyst Simon Peters, ethereum is also buoyed by the prospect of “Dencun,” a major upgrade to the technology underlying this digital currency, scheduled for March 13.

This major change would improve transaction processing capacity and cut transaction costs, but also has the potential to unleash the growth of an ecosystem with multiple applications.

“Bitcoin’s primary use is as store of value, while ethereum has much more potential use cases,” Peters said.

For example, it is the destination of choice for non-fungible tokens (NFTs) — the certificates of digital authenticity that caused such a stir three years ago.

The two cryptocurrencies are not in direct competition, because bitcoin is “hard money,” while ether “is basically an investment for the entire blockchain and smart contract ecosystem,” Van de Poppe said.

Ethereum has already successfully negotiated two major technical transformations in the past few years, including the switch to a less energy-intensive system in September 2022.

James Butterfill said there is “increasing optimism” that a “Dencun” upgrade would “go without a hitch,” which would reinforce the currency’s credibility.

He added that ether, by the very nature of its operation, offers the “added benefit” of interest generated by its holders.

The mechanism for creating this currency involves owners putting up existing ether coins as collateral in a process known as “Proof of Stake,” which differs from bitcoin’s energy-intensive method involving highly complex calculations, known as “Proof of Work.”

Ether investors who agree to put up some or all of their holdings receive a fee of a few percent a year, in addition to any potential capital gain if the currency appreciates in value.

The “Proof of Stake” process adopted in September 2022 has significantly increased the amount of ether used as collateral, Peters said, currently at 21 percent compared with just 10 percent 18 months ago.

“There is less ethereum in circulation,” he said, adding: “If demand increases, given the squeeze in supply, then price should follow.”

“I think that ethereum is going to be outperforming bitcoin,” Van de Poppe said, adding that the total market capitalization of ethereum could end up exceeding that of bitcoin.

Taiwan’s rapidly aging population is fueling a sharp increase in homes occupied solely by elderly people, a trend that is reshaping the nation’s housing market and social fabric, real-estate brokers said yesterday. About 850,000 residences were occupied by elderly people in the first quarter, including 655,000 that housed only one resident, the Ministry of the Interior said. The figures have nearly doubled from a decade earlier, Great Home Realty Co (大家房屋) said, as people aged 65 and older now make up 20.8 percent of the population. “The so-called silver tsunami represents more than just a demographic shift — it could fundamentally redefine the

The US government on Wednesday sanctioned more than two dozen companies in China, Turkey and the United Arab Emirates, including offshoots of a US chip firm, accusing the businesses of providing illicit support to Iran’s military or proxies. The US Department of Commerce included two subsidiaries of US-based chip distributor Arrow Electronics Inc (艾睿電子) on its so-called entity list published on the federal register for facilitating purchases by Iran’s proxies of US tech. Arrow spokesman John Hourigan said that the subsidiaries have been operating in full compliance with US export control regulations and his company is discussing with the US Bureau of

Taiwan’s foreign exchange reserves hit a record high at the end of last month, surpassing the US$600 billion mark for the first time, the central bank said yesterday. Last month, the country’s foreign exchange reserves rose US$5.51 billion from a month earlier to reach US$602.94 billion due to an increase in returns from the central bank’s portfolio management, the movement of other foreign currencies in the portfolio against the US dollar and the bank’s efforts to smooth the volatility of the New Taiwan dollar. Department of Foreign Exchange Director-General Eugene Tsai (蔡炯民)said a rate cut cycle launched by the US Federal Reserve

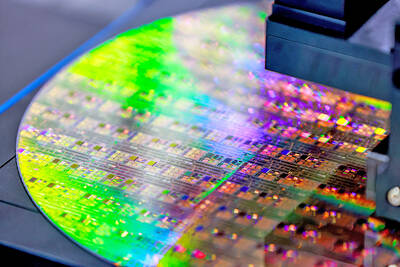

Businesses across the global semiconductor supply chain are bracing themselves for disruptions from an escalating trade war, after China imposed curbs on rare earth mineral exports and the US responded with additional tariffs and restrictions on software sales to the Asian nation. China’s restrictions, the most targeted move yet to limit supplies of rare earth materials, represent the first major attempt by Beijing to exercise long-arm jurisdiction over foreign companies to target the semiconductor industry, threatening to stall the chips powering the artificial intelligence (AI) boom. They prompted US President Donald Trump on Friday to announce that he would impose an additional