The Indian government, after years of watching from the sidelines of the chips race, now has to evaluate US$21 billion of semiconductor proposals and divvy up taxpayer support between foreign chipmakers, local champions or some combination of the two.

Israel’s Tower Semiconductor Ltd is proposing a US$9 billion plant, while India’s Tata Group has put forward an US$8 billion chip fabrication unit, people familiar with the matter said. Both projects would be in Indian Prime Minister Narendra Modi’s home state of Gujarat, the people said.

Semiconductors have grown into a key geopolitical battleground, with the US, Japan and China investing heavily in developing domestic capabilities.

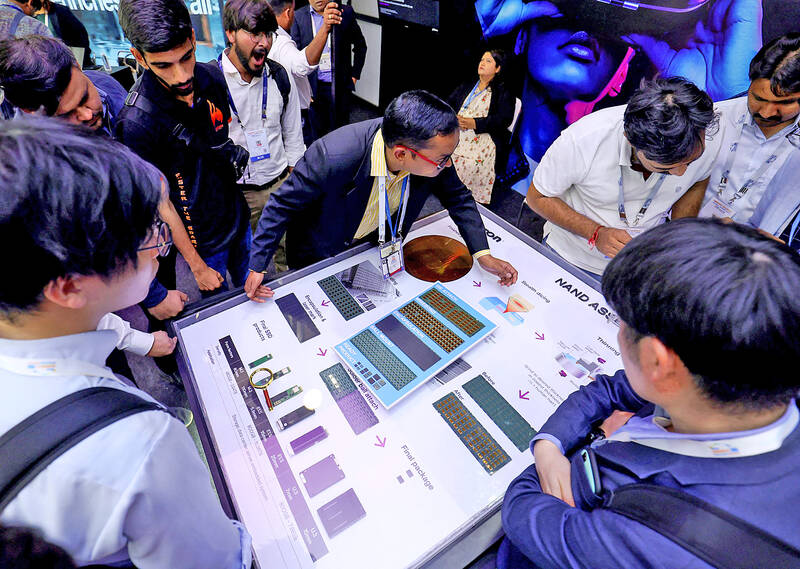

Photo: Reuters

Modi’s push to turn India into a global manufacturing hub also includes luring international chipmakers to the country — a bid to catch up in the sector to save money on expensive imports and enhance a growing smartphone assembly industry.

Under India’s chipmaking incentive plan, the government would bear half the cost of any approved project, with an initial budget of US$10 billion for the task. However, the world’s most populous country is yet to find success in this sphere, with the high-profile partnership between local firm Vedanta Resources Ltd and Taiwan’s Hon Hai Precision Industry Co (鴻海精密) collapsing after failing to find a suitable partner for chip design technology.

An India plant for manufacturing would give Tower a foothold in a key emerging market and help it move out of the shadow of its failed acquisition bid by Intel Corp. Although Tower’s sales are a fraction of giants Intel and Taiwan Semiconductor Manufacturing Co (台積電), it makes components for large customers such as Broadcom Inc and serves fast-growing sectors like electric vehicles.

Tower’s plan is to scale up a plant over a decade and eventually produce 80,000 silicon wafers per month, one of the people said. If approved, this would be the first fabrication unit in India operated by a major semiconductor company.

The Tata conglomerate is expected to partner with Taiwan’s Powerchip Semiconductor Manufacturing Corp (力積電) for its project, though it has also held talks with United Microelectronics Corp (聯電), the people said.

The US$150 billion Tata group has previously said it plans to begin construction of a chip fabrication plant in Dholera this year.

Both Tower and Tata’s facilities would produce so-called mature chips — using 40-nanometer or older technology — that are very widely used in consumer electronics, automobiles, defense systems and aircrafts, the people said.

The Tata Group is also planning to build a 250-billion-rupee (US$3 billion) chip-packaging plant in eastern India that would assemble and export chips, including for automakers such as the group-controlled Tata Motors Ltd. That would similarly require the government’s approval before proceeding.

The moves are part of Tata’s nascent push to invest billions of dollars in high-tech businesses. Tata operates India’s biggest smartphone component plant, constructed at a cost of more than US$700 million, in southern India. It also bought Apple supplier Wistron Corp’s (緯創) India factory last year and is seeking to build its own iPhone plant.

Separately, Japan’s Renesas Electronics Corp is looking to forge a venture with Murugappa Group’s CG Power and Industrial Solutions Ltd arm for a chip-packaging facility.

All of the chip proposals require the assent of Modi’s Cabinet, which could come within weeks. To qualify for state subsidies, any chip project would have to make detailed disclosures including whether it has binding agreements with a technology partner for production.

Applicants also need to disclose financing plans as well as the type of semiconductors they plan to make and their target customers.

CHIP RACE: Three years of overbroad export controls drove foreign competitors to pursue their own AI chips, and ‘cost US taxpayers billions of dollars,’ Nvidia said China has figured out the US strategy for allowing it to buy Nvidia Corp’s H200s and is rejecting the artificial intelligence (AI) chip in favor of domestically developed semiconductors, White House AI adviser David Sacks said, citing news reports. US President Donald Trump on Monday said that he would allow shipments of Nvidia’s H200 chips to China, part of an administration effort backed by Sacks to challenge Chinese tech champions such as Huawei Technologies Co (華為) by bringing US competition to their home market. On Friday, Sacks signaled that he was uncertain about whether that approach would work. “They’re rejecting our chips,” Sacks

NATIONAL SECURITY: Intel’s testing of ACM tools despite US government control ‘highlights egregious gaps in US technology protection policies,’ a former official said Chipmaker Intel Corp has tested chipmaking tools this year from a toolmaker with deep roots in China and two overseas units that were targeted by US sanctions, according to two sources with direct knowledge of the matter. Intel, which fended off calls for its CEO’s resignation from US President Donald Trump in August over his alleged ties to China, got the tools from ACM Research Inc, a Fremont, California-based producer of chipmaking equipment. Two of ACM’s units, based in Shanghai and South Korea, were among a number of firms barred last year from receiving US technology over claims they have

It is challenging to build infrastructure in much of Europe. Constrained budgets and polarized politics tend to undermine long-term projects, forcing officials to react to emergencies rather than plan for the future. Not in Austria. Today, the country is to officially open its Koralmbahn tunnel, the 5.9 billion euro (US$6.9 billion) centerpiece of a groundbreaking new railway that will eventually run from Poland’s Baltic coast to the Adriatic Sea, transforming travel within Austria and positioning the Alpine nation at the forefront of logistics in Europe. “It is Austria’s biggest socio-economic experiment in over a century,” said Eric Kirschner, an economist at Graz-based Joanneum

France is developing domestic production of electric vehicle (EV) batteries with an eye on industrial independence, but Asian experts are proving key in launching operations. In the Verkor factory outside the northern city of Dunkirk, which was inaugurated on Thursday, foreign specialists, notably from South Korea and Malaysia, are training the local staff. Verkor is the third battery gigafactory to open in northern France in a region that has become known as “Battery Valley.” At the Automotive Energy Supply Corp (AESC) factory near the city of Douai, where production has been under way for several months, Chinese engineers and technicians supervise French recruits. “They