State-run Mega International Commercial Bank (兆豐銀行) yesterday ended its currency exchange settlements services for online credit cards after peers and regulators raised issues regarding legal compliance.

The termination came one day after the lender announced it would lower fees to NT$10 per currency exchange settlement valued at less than NT$500,000.

Peers and regulators voiced concern that the offer was tantamount to marketing a cash advance, in contravention of constraints on lenders.

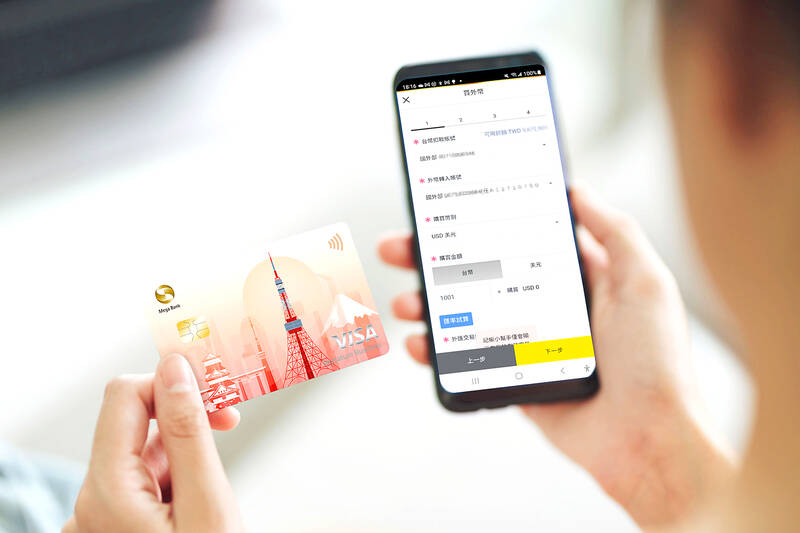

Photo courtesy of Mega International Commercial Bank

Underregulated promotion of cash advances were an issue linked to a credit card debt problem in Taiwan in 2005 and 2006.

Mega Bank said it might have misunderstandings about an exclusive regulatory permit for online credit card operations involving foreign exchange settlements and would halt the disputed service.

Demand for currency exchange settlements is escalating as overseas travel has expanded multifold after countries around the world ditched border restrictions amid the COVID-19 pandemic.

Phil Tong (童政彰), deputy director of the Financial Supervisory Commission’s Banking Bureau, said that lenders should diligently review legal compliance issues and refrain from questionable practices regardless of whether they are explicitly banned.

The market has undergone drastic changes in the 20 years since Mega Bank was granted a regulatory permit, Tong said, adding that the commission would frown on similar business propositions by other banks.

Credit cards should be used as a payment tool and should provide cash advances only in emergency cases, he said.

The central bank said that in 2005 it approved online currency exchange settlements to facilitate easy transactions, but never agreed to marketing of cash advances.

Mega Bank’s offer of currency exchange settlements to online credit card operations drew protests from peers partly because the local banking market is excessively competitive, rendering exclusive practices controversial.

LIMITED IMPACT: Investor confidence was likely sustained by its relatively small exposure to the Chinese market, as only less advanced chips are made in Nanjing Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) saw its stock price close steady yesterday in a sign that the loss of the validated end user (VEU) status for its Nanjing, China, fab should have a mild impact on the world’s biggest contract chipmaker financially and technologically. Media reports about the waiver loss sent TSMC down 1.29 percent during the early trading session yesterday, but the stock soon regained strength and ended at NT$1,160, unchanged from Tuesday. Investors’ confidence in TSMC was likely built on its relatively small exposure to the Chinese market, as Chinese customers contributed about 9 percent to TSMC’s revenue last

With this year’s Semicon Taiwan trade show set to kick off on Wednesday, market attention has turned to the mass production of advanced packaging technologies and capacity expansion in Taiwan and the US. With traditional scaling reaching physical limits, heterogeneous integration and packaging technologies have emerged as key solutions. Surging demand for artificial intelligence (AI), high-performance computing (HPC) and high-bandwidth memory (HBM) chips has put technologies such as chip-on-wafer-on-substrate (CoWoS), integrated fan-out (InFO), system on integrated chips (SoIC), 3D IC and fan-out panel-level packaging (FOPLP) at the center of semiconductor innovation, making them a major focus at this year’s trade show, according

DEBUT: The trade show is to feature 17 national pavilions, a new high for the event, including from Canada, Costa Rica, Lithuania, Sweden and Vietnam for the first time The Semicon Taiwan trade show, which opens on Wednesday, is expected to see a new high in the number of exhibitors and visitors from around the world, said its organizer, SEMI, which has described the annual event as the “Olympics of the semiconductor industry.” SEMI, which represents companies in the electronics manufacturing and design supply chain, and touts the annual exhibition as the most influential semiconductor trade show in the world, said more than 1,200 enterprises from 56 countries are to showcase their innovations across more than 4,100 booths, and that the event could attract 100,000 visitors. This year’s event features 17

Hon Hai Precision Industry Co (鴻海精密), which assembles servers for Nvidia Corp, yesterday said that revenue last month rose 10.61 percent year-on-year, driven by strong growth in cloud and networking products amid continued front-loading orders for artificial intelligence (AI) server racks. Consolidated revenue expanded to NT$606.51 billion (US$19.81 billion) last month from NT$548.31 billion a year earlier, marking the highest ever in August, the company said in a statement. On a monthly basis, revenue was down 1.2 percent from NT$613.86 billion. Hon Hai, which is also a major iPhone assembler, added that its electronic components division saw significant revenue growth last month, boosted