Intel Corp, the largest maker of computer processors, tumbled in late trading on Thursday after giving a disappointing forecast for this quarter, signaling that it continues to struggle to defend its once-dominant position in data center chips.

Sales in the first quarter would be US$12.2 billion to US$13.2 billion, the company said in a statement.

That compared with analysts’ average estimate of US$14.25 billion, according to data compiled by Bloomberg.

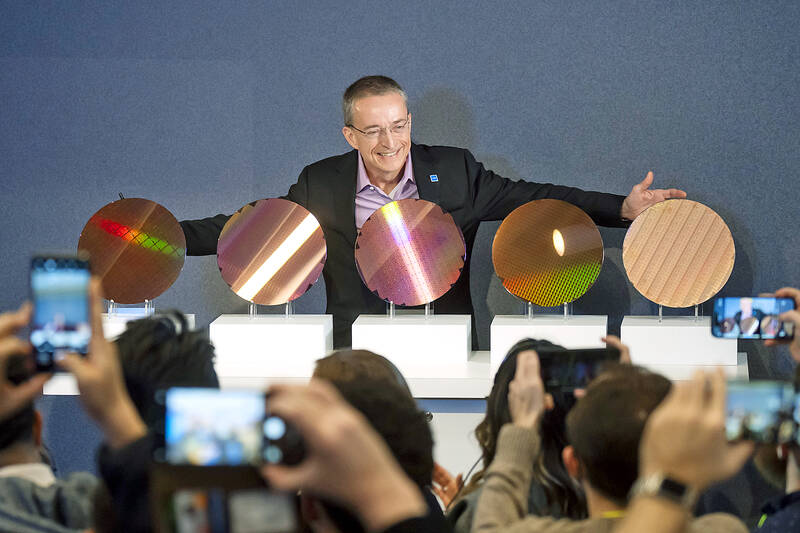

Photo: AP

Profit would be US$0.13 a share, minus certain items, versus analysts’ projection of US$0.34.

The outlook suggests that Intel CEO Pat Gelsinger still has a long way to go in restoring Intel’s former prowess.

Although the chipmaker’s PC business is recovering, it has been losing ground in the lucrative market for data center chips. The company is also contending with weaker demand at units that make programmable chips and components for self-driving vehicles, as well as a fledgling foundry business.

Intel shares fell more than 6 percent in extended trading following the announcement.

The Santa Clara, California-based company also said it was looking for ways to further tighten its belt.

“We expect to unlock further efficiencies in 2024,” Intel chief financial officer David Zinsner said in the statement.

Intel’s gross margin would be 44.5 percent this quarter. That compared with analysts’ average estimate of 45.5 percent.

The measure is an indicator of how productive Intel’s multibillion-dollar factory network is. Prior to the onset of its current problems around 2019, Intel typically reported profitability of more than 60 percent.

Last quarter, earnings came in at US$0.54 a share on sales of US$15.4 billion. Analysts had estimated earnings per share of US$0.44 and revenue of US$15.2 billion.

Data center sales were US$4 billion, falling short of the average projection of US$4.08 billion. Client computing, Intel’s PC chip business, had sales of US$8.84 billion. That compared with an estimate of about US$8.42 billion.

Intel has said that the PC market is emerging from an inventory glut and its largest customers are returning to ordering parts.

Total PC shipments should rise to about 300 million units a year, Gelsinger has said, aided by demand for new machines that are better able to handle artificial intelligence (AI) software and services.

In servers, where Intel once had a market share of more than 99 percent, the company is facing more competition and a shift in spending patterns.

The frenzy of spending on AI hardware has not done much to help Intel. Most of that money has gone toward so-called accelerator chips made by Nvidia Corp. Those components are better able to handle the massive data requirements of developing AI models.

However, Intel has its own accelerator, called Gaudi, and an improved version should help the company compete, Gelsinger said.

He is also pushing Intel into the foundry business. As part of that expansion, the company is spending heavily on a network of plants around the world, aiming to meet rising demand.

Intel has yet to go public with the names of any of the large customers it has lined up for this project.

HORMUZ ISSUE: The US president said he expected crude prices to drop at the end of the war, which he called a ‘minor excursion’ that could continue ‘for a little while’ The United Arab Emirates (UAE) and Kuwait started reducing oil production, as the near-closure of the crucial Strait of Hormuz ripples through energy markets and affects global supply. Abu Dhabi National Oil Co (ADNOC) is “managing offshore production levels to address storage requirements,” the company said in a statement, without giving details. Kuwait Petroleum Corp said it was lowering production at its oil fields and refineries after “Iranian threats against safe passage of ships through the Strait of Hormuz.” The war in the Middle East has all but closed Hormuz, the narrow waterway linking the Persian Gulf to the open seas,

RATIONING: The proposal would give the Trump administration ample leverage to negotiate investments in the US as it decides how many chips to give each country US officials are debating a new regulatory framework for exporting artificial intelligence (AI) chips and are considering requiring foreign nations to invest in US AI data centers or security guarantees as a condition for granting exports of 200,000 chips or more, according to a document seen by Reuters. The rules are not yet final and could change. They would be the first attempt to regulate the flow of AI chips to US allies and partners since US President Donald Trump’s administration said it rescinded its predecessor’s so-called AI diffusion rules. Those rules sought to keep a significant amount of AI

Apple Inc increased iPhone production in India by about 53 percent last year and now makes a quarter of its marquee devices there, reflecting the US company’s efforts to avoid tariffs on China. The company assembled about 55 million iPhones in India last year, up from 36 million a year earlier, people familiar with the matter said, asking not to be named because the numbers aren’t public. Apple makes about 220 million to 230 million iPhones a year globally, with India’s share of the total increasing rapidly. Apple has accelerated its expansion in the world’s most populous country in recent years, bolstered

HEADWINDS: The company said it expects its computer business, as well as consumer electronics and communications segments to see revenue declines due to seasonality Pegatron Corp (和碩) yesterday said it aims to grow its artificial intelligence (AI) server revenue more than 10-fold this year from last year, driven by orders from neocloud solutions clients and large cloud service providers. The electronics manufacturing service provider said AI server revenue growth would be driven primarily by the Nvidia Corp GB300 server platform. Server shipments are expected to increase each quarter this year, with the second half likely to outperform the first half, it said. The AI server market is expected to broaden this year as more inference applications emerge, which would drive demand for system-on-chip, application-specific integrated circuits