Exports by Taiwanese machine tool manufacturers are expected to remain flat or grow slightly this year after outbound shipments fell 14 percent annually to US$2.6 billion last year amid a slowing global economy and geopolitical tensions, the Taiwan Machine Tool and Accessory Builders’ Association said yesterday.

The industry’s production value is expected to increase to US$3.37 billion this year from US$3.31 billion the previous year as end-market demand recovers and inventories return to healthy levels, the Taichung-based association said.

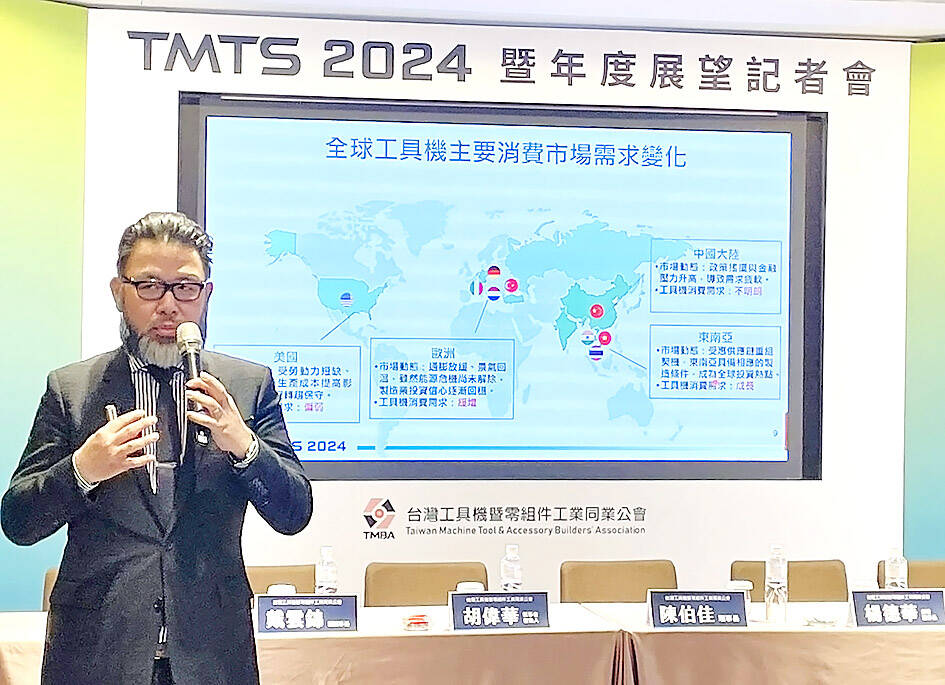

“The business climate for the machine tool industry this year is similar to that of last year, with the industry’s global output estimated to increase to US$78.04 billion from US$74.32 billion,” association chairman Patrick Chen (陳伯佳) told a news conference in Taipei.

Photo: CNA

However, the nation’s machine tool and components manufacturers this year still face challenges stemming from global geopolitics, inflation, carbon reduction requirements and demographic changes, as well as national elections around the world, including the US presidential election, and China’s weakening economy and real-estate bubble, Chen said.

“The machine tool industry has a four-year business cycle, with the bottom in 2022 and 2023, so local manufacturers are expected to see early signs of recovery at the end of the second quarter or in the third quarter,” he said.

Machine tool exports last year declined across the board, with metal-cutting tools dropping 13.3 percent from the previous year to US$2.2 billion, metal-forming machinery sliding 17.7 percent to US$395.32 million and machine centers retreating 16.5 percent to US$871.64 million, association data showed.

Exports to China, including Hong Kong, the local industry’s main export market, fell 11.9 percent year-on-year to US$711.93 million, while those to the US, the second-largest overseas market for Taiwan’s goods, dropped 15.1 percent to US$377.82 million, the data showed.

Shipments to Turkey, the third-largest market, rose 13.9 percent to US$289.79 million and those to India, the fourth-largest, rose 29.1 percent to US$120.69 million, the data showed.

Shipments to other markets such as the Netherlands, Germany, Vietnam, Italy, Japan and Thailand registered annual declines of 1.2 percent to 39 percent, the data showed.

The association has high hopes for the Taiwan International Machine Tool Show, which is scheduled to take place at Taipei Nangang Exhibition Center’s Hall 1 and 2 from March 27 to 31.

The association, which organizes the trade fair, expects the event to help local firms secure orders and bolster their presence in the global market, Chen said.

Goodway Machine Corp (程泰機械) chairman Edward Yang (楊德華), the association’s founding chairman, said that the trade show should be watched, despite the expected headwinds.

With the global economy this year not expected to be worse than last year and with inventory adjustments in the supply chain almost at an end, Goodway is targeting business growth of double-digit percentage points this year, Yang told the news conference.

Tongtai Machine and Tool Co (東台精機) also expects a recovery this year, company vice president Lulu Yen (嚴璐) said, adding that it has a special focus on aerospace, electric vehicle and semiconductor applications this year.

Tongtai is targeting the Southeast Asian market as demand for energy applications recovers, Yen said.

Representatives from Fair Friend Enterprise Group (友嘉集團) and Taiwan Takisawa Technology Co (台灣瀧澤) said they are cautiously optimistic about the industry’s prospects this year on the back of a recovery in orders from Europe, Southeast Asia and India.

Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), the world’s biggest contract chipmaker, booked its first-ever profit from its Arizona subsidiary in the first half of this year, four years after operations began, a company financial statement showed. Wholly owned by TSMC, the Arizona unit contributed NT$4.52 billion (US$150.1 million) in net profit, compared with a loss of NT$4.34 billion a year earlier, the statement showed. The company attributed the turnaround to strong market demand and high factory utilization. The Arizona unit counts Apple Inc, Nvidia Corp and Advanced Micro Devices Inc among its major customers. The firm’s first fab in Arizona began high-volume production

VOTE OF CONFIDENCE: The Japanese company is adding Intel to an investment portfolio that includes artificial intelligence linchpins Nvidia Corp and TSMC Softbank Group Corp agreed to buy US$2 billion of Intel Corp stock, a surprise deal to shore up a struggling US name while boosting its own chip ambitions. The Japanese company, which is adding Intel to an investment portfolio that includes artificial intelligence (AI) linchpins Nvidia Corp and Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), is to pay US$23 a share — a small discount to Intel’s last close. Shares of the US chipmaker, which would issue new stock to Softbank, surged more than 5 percent in after-hours trading. Softbank’s stock fell as much as 5.4 percent on Tuesday in Tokyo, its

COLLABORATION: Softbank would supply manufacturing gear to the factory, and a joint venture would make AI data center equipment, Young Liu said Hon Hai Precision Industry Co (鴻海精密) would operate a US factory owned by Softbank Group Corp, setting up what is in the running to be the first manufacturing site in the Japanese company’s US$500 billion Stargate venture with OpenAI and Oracle Corp. Softbank is acquiring Hon Hai’s electric-vehicle plant in Ohio, but the Taiwanese company would continue to run the complex after turning it into an artificial intelligence (AI) server production plant, Hon Hai chairman Young Liu (劉揚偉) said yesterday. Softbank would supply manufacturing gear to the factory, and a joint venture between the two companies would make AI data

DOLLAR SIGNS: The central bank rejected claims that the NT dollar had appreciated 10 percentage points more than the yen or the won against the greenback The New Taiwan dollar yesterday fell for a sixth day to its weakest level in three months, driven by equity-related outflows and reactions to an economics official’s exchange rate remarks. The NT dollar slid NT$0.197, or 0.65 percent, to close at NT$30.505 per US dollar, central bank data showed. The local currency has depreciated 1.97 percent so far this month, ranking as the weakest performer among Asian currencies. Dealers attributed the retreat to foreign investors wiring capital gains and dividends abroad after taking profit in local shares. They also pointed to reports that Washington might consider taking equity stakes in chipmakers, including Taiwan Semiconductor