Huawei Technologies Co (華為) is among a field of “very formidable” competitors to Nvidia Corp in the race to produce the best artificial intelligence (AI) chips, Nvidia chief executive officer Jensen Huang (黃仁勳) said yesterday.

Huawei, Intel Corp and an expanding group of semiconductor start-ups pose a stiff challenge to Nvidia’s dominant position in the market for AI accelerators, Huang told reporters in Singapore.

Shenzhen-based Huawei has grown into China’s chip tech champion and returned to the spotlight this year with an advanced made-in-China smartphone processor.

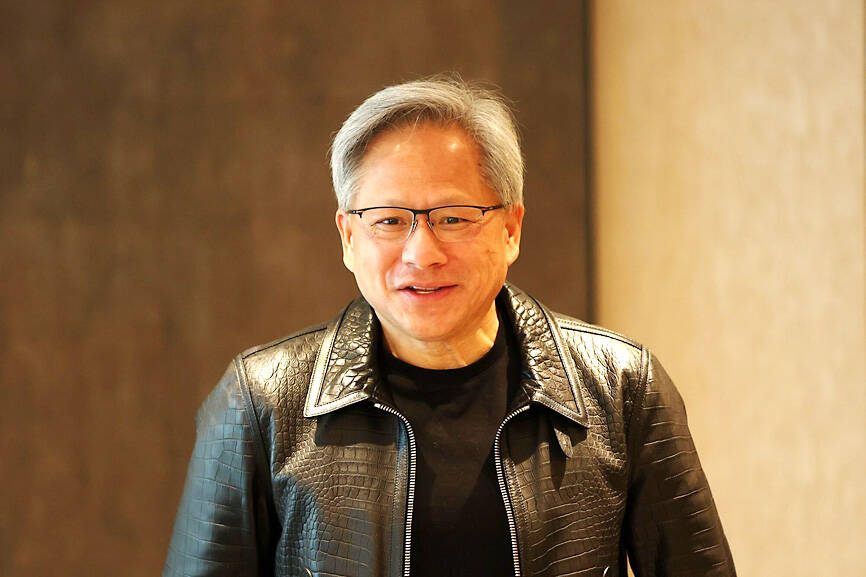

Photo: Bloomberg

“We have a lot of competitors, in China and outside China,” Huang said. “Most of our competitors don’t really care where I am. They want to compete with us everywhere we go.”

Questions about China were prominent during Huang’s visit to Singapore, where he met Singaporean Prime Minister Lee Hsien Loong (李顯龍) to discuss the city-state’s strategy to compete in the global AI race.

However, the US has raised barriers on the company’s sales to China, further tightening China’s access to Nvidia’s AI chips in the middle of October.

China has historically accounted for about 20 percent of Nvidia’s sales and the company will continue to adhere with trade regulations “perfectly,” Huang said.

The company is to deliver a new set of products for the Chinese market that is in line with the latest rules coming from Washington, the 60-year-old executive added.

Santa Clara, California-based Nvidia does serve Chinese customers in Singapore, Huang said.

Among the biggest Chinese firms with a presence there are ByteDance Ltd (字節跳動), Tencent Holdings Ltd (騰訊) and Alibaba Group Holding Ltd (阿里巴巴).

Sales to customers in the city-state, including Chinese firms, accounted for about 15 percent of Nvidia’s revenue in the three months ended in October, a regulatory filing showed.

Singapore sees the expansion of its digital economy as instrumental to stimulating broader growth. It hosts less-advanced chipmaking factories operated by GlobalFoundries Inc and other global players. Nvidia’s go-to maker of AI accelerators Taiwan Semiconductor Manufacturing Co (台積電) and NXP Semiconductors NV also run a joint venture in the country.

The US dollar was trading at NT$29.7 at 10am today on the Taipei Foreign Exchange, as the New Taiwan dollar gained NT$1.364 from the previous close last week. The NT dollar continued to rise today, after surging 3.07 percent on Friday. After opening at NT$30.91, the NT dollar gained more than NT$1 in just 15 minutes, briefly passing the NT$30 mark. Before the US Department of the Treasury's semi-annual currency report came out, expectations that the NT dollar would keep rising were already building. The NT dollar on Friday closed at NT$31.064, up by NT$0.953 — a 3.07 percent single-day gain. Today,

‘SHORT TERM’: The local currency would likely remain strong in the near term, driven by anticipated US trade pressure, capital inflows and expectations of a US Fed rate cut The US dollar is expected to fall below NT$30 in the near term, as traders anticipate increased pressure from Washington for Taiwan to allow the New Taiwan dollar to appreciate, Cathay United Bank (國泰世華銀行) chief economist Lin Chi-chao (林啟超) said. Following a sharp drop in the greenback against the NT dollar on Friday, Lin told the Central News Agency that the local currency is likely to remain strong in the short term, driven in part by market psychology surrounding anticipated US policy pressure. On Friday, the US dollar fell NT$0.953, or 3.07 percent, closing at NT$31.064 — its lowest level since Jan.

The New Taiwan dollar and Taiwanese stocks surged on signs that trade tensions between the world’s top two economies might start easing and as US tech earnings boosted the outlook of the nation’s semiconductor exports. The NT dollar strengthened as much as 3.8 percent versus the US dollar to 30.815, the biggest intraday gain since January 2011, closing at NT$31.064. The benchmark TAIEX jumped 2.73 percent to outperform the region’s equity gauges. Outlook for global trade improved after China said it is assessing possible trade talks with the US, providing a boost for the nation’s currency and shares. As the NT dollar

The Financial Supervisory Commission (FSC) yesterday met with some of the nation’s largest insurance companies as a skyrocketing New Taiwan dollar piles pressure on their hundreds of billions of dollars in US bond investments. The commission has asked some life insurance firms, among the biggest Asian holders of US debt, to discuss how the rapidly strengthening NT dollar has impacted their operations, people familiar with the matter said. The meeting took place as the NT dollar jumped as much as 5 percent yesterday, its biggest intraday gain in more than three decades. The local currency surged as exporters rushed to