Global semiconductor industry revenue is expected to grow 16.8 percent year-on-year next year, following a slump this year, largely fueled by a surge in demand for memory chips, US-based market information advisory firm Gartner Inc said on Monday.

Gartner said the global semiconductor industry is forecast to generate US$624 billion in sales next year, up from US$534 billion this year, during which revenue is predicted to fall 10.9 percent amid inventory adjustments caused by weak demand.

The global market for memory chips is expected to rebound next year by 66.3 percent, following a fall of 38.8 percent this year due to oversupply issues, Gartner said.

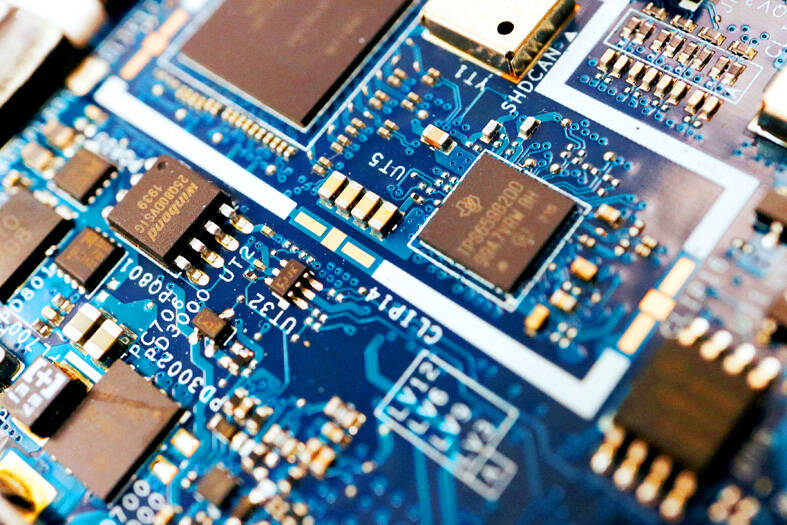

Photo: Reuters

The price of NAND flash memory chips, a type of storage technology that does not require power to retain data, is expected to hit rock bottom over the next three to six months and stage a robust recovery next year, with sales likely to rise 49.6 percent to US$53 billion, Gartner said.

The oversupply of DRAM chips would continue throughout this quarter and trigger a pricing rebound, the full effects of which might emerge next year when sales are estimated to soar 88 percent to US$87.4 billion, it said.

“We are nearing the end of 2023 and strong demand for chips to support artificial intelligence (AI) workloads, such as graphics processing units (GPUs), is not going to be enough to save the semiconductor industry from double-digit decline in 2023,” Gartner vice president analyst Alan Priestley said in a statement.

“Reduced demand from smartphones and PC customers coupled with weakness in data center/hyper scaler spending are influencing the decline in revenue this year,” Priestley added.

Gartner said developments in generative AI and large-language models are driving up demand for high-performance GPU-based servers and accelerator cards in data centers, which subsequently creates a need for workload accelerators.

The US dollar was trading at NT$29.7 at 10am today on the Taipei Foreign Exchange, as the New Taiwan dollar gained NT$1.364 from the previous close last week. The NT dollar continued to rise today, after surging 3.07 percent on Friday. After opening at NT$30.91, the NT dollar gained more than NT$1 in just 15 minutes, briefly passing the NT$30 mark. Before the US Department of the Treasury's semi-annual currency report came out, expectations that the NT dollar would keep rising were already building. The NT dollar on Friday closed at NT$31.064, up by NT$0.953 — a 3.07 percent single-day gain. Today,

‘SHORT TERM’: The local currency would likely remain strong in the near term, driven by anticipated US trade pressure, capital inflows and expectations of a US Fed rate cut The US dollar is expected to fall below NT$30 in the near term, as traders anticipate increased pressure from Washington for Taiwan to allow the New Taiwan dollar to appreciate, Cathay United Bank (國泰世華銀行) chief economist Lin Chi-chao (林啟超) said. Following a sharp drop in the greenback against the NT dollar on Friday, Lin told the Central News Agency that the local currency is likely to remain strong in the short term, driven in part by market psychology surrounding anticipated US policy pressure. On Friday, the US dollar fell NT$0.953, or 3.07 percent, closing at NT$31.064 — its lowest level since Jan.

The New Taiwan dollar and Taiwanese stocks surged on signs that trade tensions between the world’s top two economies might start easing and as US tech earnings boosted the outlook of the nation’s semiconductor exports. The NT dollar strengthened as much as 3.8 percent versus the US dollar to 30.815, the biggest intraday gain since January 2011, closing at NT$31.064. The benchmark TAIEX jumped 2.73 percent to outperform the region’s equity gauges. Outlook for global trade improved after China said it is assessing possible trade talks with the US, providing a boost for the nation’s currency and shares. As the NT dollar

The Financial Supervisory Commission (FSC) yesterday met with some of the nation’s largest insurance companies as a skyrocketing New Taiwan dollar piles pressure on their hundreds of billions of dollars in US bond investments. The commission has asked some life insurance firms, among the biggest Asian holders of US debt, to discuss how the rapidly strengthening NT dollar has impacted their operations, people familiar with the matter said. The meeting took place as the NT dollar jumped as much as 5 percent yesterday, its biggest intraday gain in more than three decades. The local currency surged as exporters rushed to