Taiwanese stocks are likely to shrug off geopolitical concerns to mount a recovery next year, led by a resurgence in chip-sector earnings, according to the nation’s largest active equity fund manager.

Taiwan’s semiconductor companies will see earnings growth of around 30 percent next year, with 20 percent growth expected for Taiwan-listed companies as a whole, Ivy Chen (陳彥婷), general manager and head of Taiwan at Allianz Global Investors, said in an interview on Tuesday.

Escalating tensions between Taiwan, China and the US and fears of a global economic slowdown have driven foreign investors to pull US$7.4 billion from Taiwanese stocks this year, the most in Asia, according to Bloomberg-compiled data. Still, the benchmark TAIEX has gained 16 percent year to date, the second-best-performing major stock market in Asia after Japan.

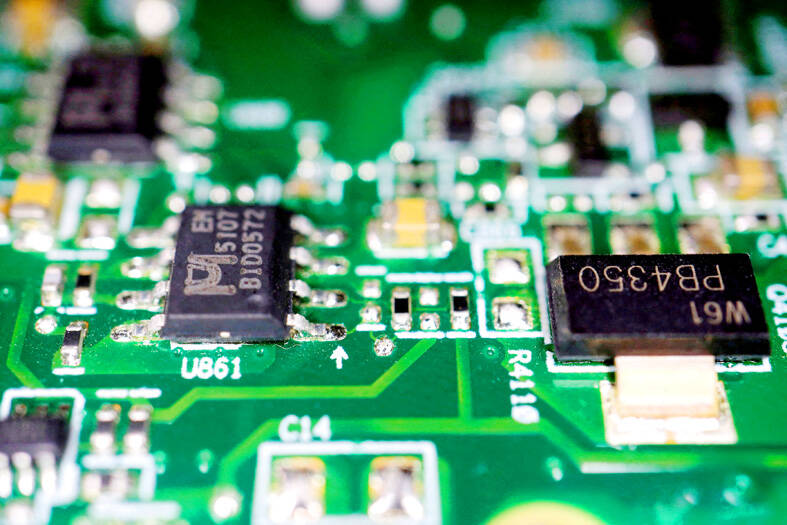

Photo: Reuters

Geopolitical risk is “not news for Taiwanese people,” Chen said, adding that similar risks could emerge anywhere in the world in the wake of the Russian-Ukraine war and the Israel-Hamas conflict. “The best way to reduce geopolitical risks is by diversifying in terms of asset class or sector.”

The main drivers of growth for Taiwan’s chip companies include improving end-consumer demand and the destocking of the sector coming to an end, Chen said, adding that demand for semiconductors related to artificial intelligence will continue to boom.

She expects Taiwanese stocks next year to top this year’s gains.

The Taipei-based Market Intelligence and Consulting Institute on Wednesday forecast that production value of Taiwan’s semiconductor industry next year would increase 13.7 percent to NT$4.29 trillion, from NT$3.77 trillion this year.

The increase in output would be driven mainly by the wafer foundry sector as chipmakers expand capacity for advanced manufacturing, the institute said in a report.

Institute consultant Sagitta Pan (潘健光) said the growth momentum of the semiconductor industry would rely on emerging applications such as innovative information services, energy and environmental protection, and technology integration.

In particular, artificial intelligence (AI), new energy and artificial intelligence of things will become the main growth momentum, Pan said.

Chen said she is confident that Taiwanese stocks will attract foreign investors again with their earnings growth. Taiwan’s manufacturers have also increasingly diversified their production base, which will help boost their competitiveness as it alleviates geopolitical concerns, she said.

Over the longer term, the firm is positive on sectors including bicycles, textiles, shoe manufacturing, machine tools and biotech.

Allianz Global Investors Taiwan manages NT$69.5 billion (US$2.15 billion) in onshore Taiwanese stock funds as of September, the most in Taiwan, according to data from the Securities Investment Trust and Consulting Association. That includes a technology fund which beat 96 percent of peers in the past year, according to Bloomberg-compiled data, with Alchip Technologies Ltd (世芯), Quanta Computer Inc (廣達) and MediaTek Inc (聯發科) among its top holdings.

Additional reporting by staff writer

The US dollar was trading at NT$29.7 at 10am today on the Taipei Foreign Exchange, as the New Taiwan dollar gained NT$1.364 from the previous close last week. The NT dollar continued to rise today, after surging 3.07 percent on Friday. After opening at NT$30.91, the NT dollar gained more than NT$1 in just 15 minutes, briefly passing the NT$30 mark. Before the US Department of the Treasury's semi-annual currency report came out, expectations that the NT dollar would keep rising were already building. The NT dollar on Friday closed at NT$31.064, up by NT$0.953 — a 3.07 percent single-day gain. Today,

‘SHORT TERM’: The local currency would likely remain strong in the near term, driven by anticipated US trade pressure, capital inflows and expectations of a US Fed rate cut The US dollar is expected to fall below NT$30 in the near term, as traders anticipate increased pressure from Washington for Taiwan to allow the New Taiwan dollar to appreciate, Cathay United Bank (國泰世華銀行) chief economist Lin Chi-chao (林啟超) said. Following a sharp drop in the greenback against the NT dollar on Friday, Lin told the Central News Agency that the local currency is likely to remain strong in the short term, driven in part by market psychology surrounding anticipated US policy pressure. On Friday, the US dollar fell NT$0.953, or 3.07 percent, closing at NT$31.064 — its lowest level since Jan.

Hong Kong authorities ramped up sales of the local dollar as the greenback’s slide threatened the foreign-exchange peg. The Hong Kong Monetary Authority (HKMA) sold a record HK$60.5 billion (US$7.8 billion) of the city’s currency, according to an alert sent on its Bloomberg page yesterday in Asia, after it tested the upper end of its trading band. That added to the HK$56.1 billion of sales versus the greenback since Friday. The rapid intervention signals efforts from the city’s authorities to limit the local currency’s moves within its HK$7.75 to HK$7.85 per US dollar trading band. Heavy sales of the local dollar by

The Financial Supervisory Commission (FSC) yesterday met with some of the nation’s largest insurance companies as a skyrocketing New Taiwan dollar piles pressure on their hundreds of billions of dollars in US bond investments. The commission has asked some life insurance firms, among the biggest Asian holders of US debt, to discuss how the rapidly strengthening NT dollar has impacted their operations, people familiar with the matter said. The meeting took place as the NT dollar jumped as much as 5 percent yesterday, its biggest intraday gain in more than three decades. The local currency surged as exporters rushed to