The nation’s machine tool exports fell 1.9 percent month-on-month to US$230.4 million last month as shipments in six out of the 10 biggest product categories declined, data compiled by the Taiwan Machine Tool & Accessory Builders’ Association showed yesterday.

Among all machine tool products, exports of pressing and shearing machines dropped 24 percent from the previous month to US$25.26 million, metal forming machinery slid 17.6 percent to US$31.41 million and grinding machines retreated 16.4 percent to US$17.36 million, the association said in a statement.

Bucking the trend, exports of metal-cutting machine tools edged up 1.1 percent to US$198.99 million and machine centers advanced 7.8 percent to US$79.3 million, the association said.

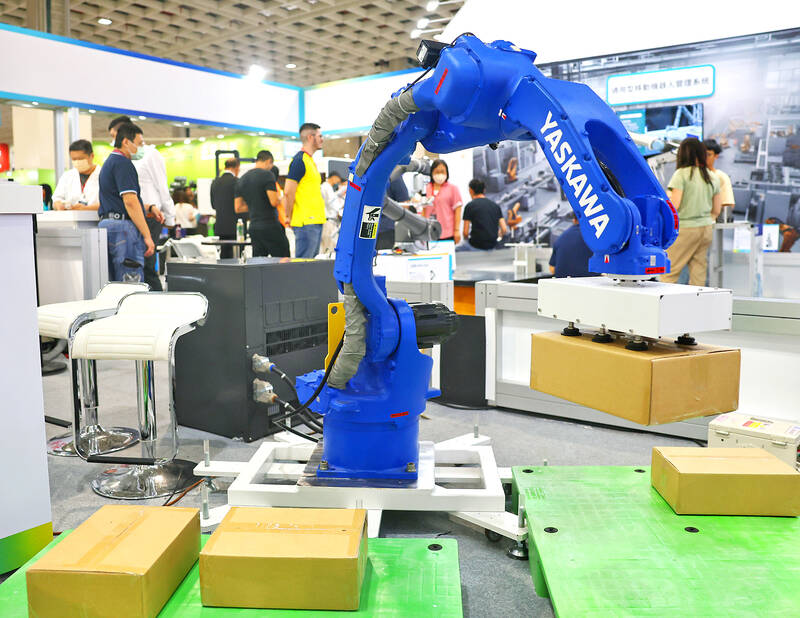

Photo: CNA

On an annual basis, machine tool exports dropped 4.5 percent last month, it said.

By destination, Taiwan’s machine tool exports last month declined nearly across the board, except for India and Turkey.

Exports to China (including Hong Kong), the sector’s main export market, fell 4.4 percent month-on-month to US$62.26 million and those to the US, the second-largest overseas market for Taiwan’s goods, dropped 3.3 percent to US$33.3 million last month, the association’s data showed.

Outbound shipments to other markets such as the Netherlands, Germany, Vietnam, Italy, Japan and Thailand registered monthly declines of 15.2 percent to 54.9 percent, the data showed.

However, exports to Turkey, the third-largest market, surged 52 percent to US$36.8 million and those to India, the fourth-largest, rose 29.1 percent to US$13.16 million, the data showed.

In the first nine months of this year, total machine tool exports fell 11.4 percent to US$1.98 billion compared with the same period last year, with metal-cutting machine tools dropping 10 percent, machine centers sinking 12.9 percent, pressing and shearing machines dipping 17 percent and metal-forming machine tools declining 19 percent, the data showed.

The Taichung-based association said that the outbreak of hostilities between Israel and Palestinian militant group Hamas, as well as the ongoing war between Ukraine and Russia, has triggered volatility in international crude oil prices, which is expected to increase global inflationary pressures and add more uncertainty to the machine tool market.

Another machinery association, the Taiwan Association of Machinery Industry (TAMI), yesterday said the Israel-Hamas conflict would have a limited impact on Taiwan’s machinery exports.

Taiwan’s machinery exports to Israel totaled US$129 million last year, accounting for a mere 0.4 percent of total outbound shipments, the Taipei-based group said.

However, the conflict in the Middle East could negatively affect Taiwan’s imports of semiconductor testing instruments and equipment from Israel, the ninth-largest importer of such goods last year, TAMI said.

Taiwan imported US$1.13 billion of semiconductor testing instruments and equipment from Israel last year, or 1.8 percent of total machinery imports, the group said.

TAMI said that the Israeli-Hamas war warrants further observation, as the Middle East, especially Turkey. is one of the major export destinations for Taiwanese machinery.

TAMI’s latest trade data, also released yesterday, showed that machinery exports — comprising inspection and testing equipment, electronic equipment and machine tools — last month fell 5.1 percent year-on-year, dropping for a 14th straight month due to the continued weakness in the global macroeconomic environment.

While the annual decline in exports was less than August’s 10.9 percent contraction, last month’s outbound shipments were still 4.9 percent lower than the previous month’s level, it said.

In the first nine months, machinery exports slid 17.1 percent year-on-year to US$22.04 billion, following an 18.4 percent fall in the first eight months, TAMI data showed.

Taiwanese suppliers to Taiwan Semiconductor Manufacturing Co. (TSMC, 台積電) are expected to follow the contract chipmaker’s step to invest in the US, but their relocation may be seven to eight years away, Minister of Economic Affairs J.W. Kuo (郭智輝) said yesterday. When asked by opposition Chinese Nationalist Party (KMT) Legislator Niu Hsu-ting (牛煦庭) in the legislature about growing concerns that TSMC’s huge investments in the US will prompt its suppliers to follow suit, Kuo said based on the chipmaker’s current limited production volume, it is unlikely to lead its supply chain to go there for now. “Unless TSMC completes its planned six

Intel Corp has named Tasha Chuang (莊蓓瑜) to lead Intel Taiwan in a bid to reinforce relations between the company and its Taiwanese partners. The appointment of Chuang as general manager for Intel Taiwan takes effect on Thursday, the firm said in a statement yesterday. Chuang is to lead her team in Taiwan to pursue product development and sales growth in an effort to reinforce the company’s ties with its partners and clients, Intel said. Chuang was previously in charge of managing Intel’s ties with leading Taiwanese PC brand Asustek Computer Inc (華碩), which included helping Asustek strengthen its global businesses, the company

Power supply and electronic components maker Delta Electronics Inc (台達電) yesterday said second-quarter revenue is expected to surpass the first quarter, which rose 30 percent year-on-year to NT$118.92 billion (US$3.71 billion). Revenue this quarter is likely to grow, as US clients have front-loaded orders ahead of US President Donald Trump’s planned tariffs on Taiwanese goods, Delta chairman Ping Cheng (鄭平) said at an earnings conference in Taipei, referring to the 90-day pause in tariff implementation Trump announced on April 9. While situations in the third and fourth quarters remain unclear, “We will not halt our long-term deployments and do not plan to

The New Taiwan dollar and Taiwanese stocks surged on signs that trade tensions between the world’s top two economies might start easing and as US tech earnings boosted the outlook of the nation’s semiconductor exports. The NT dollar strengthened as much as 3.8 percent versus the US dollar to 30.815, the biggest intraday gain since January 2011, closing at NT$31.064. The benchmark TAIEX jumped 2.73 percent to outperform the region’s equity gauges. Outlook for global trade improved after China said it is assessing possible trade talks with the US, providing a boost for the nation’s currency and shares. As the NT dollar