The nation’s three major science parks posted combined revenue of NT$1.8 trillion (US$55.8 billion) for the first half of the year, down 11.95 percent year-on-year, the National Science and Technology Council said in a report yesterday.

The council attributed the decline to sluggish end-market demand and industry-wide inventory adjustments amid high global inflation and interest rates, which negatively affected the business performance of companies in the three parks.

However, the first-half figure was still the second-highest ever for the same period on record, it said.

Photo: Wu Po-hsuan, Taipei Times

From January to June, Hsinchu Science Park (新竹科學園區) reported revenue contracted by 19.01 percent annually to NT$668.4 billion and the Central Taiwan Science Park (中部科學園區) posted revenue decline of 19.72 percent to NT$458.8 billion, while the Southern Taiwan Science Park (南部科學園區) saw revenue increase 3.81 percent to NT$677 billion in the same period, the report said.

The parks exported a combined NT$1.11 trillion of goods in the first six months of the year, down 15.69 percent from a year earlier, due to sustained inventory destocking in the supply chain and a high comparison base a year earlier, the council said.

Their combined imports rose 2.45 percent to NT$880.4 billion, as companies continued to build factories and expand production while increasing purchases of precision machinery and equipment from abroad, it said.

Overall, the three parks saw two-way trade fall 8.52 percent year-on-year to NT$1.99 trillion in the first half, it added.

The three parks had a record 323,532 employees, up 3.08 percent from 313,877 last year, the council said.

“Given high inflation and interest rate hikes, and the ongoing war between Russia and Ukraine, global demand was weak during the first half, which also affected orders received by companies in the science parks,” the report said. “However, the continued expansion by major manufacturers and the support of the world’s most advanced and high-value manufacturing processes offered a buffer to the downturn.”

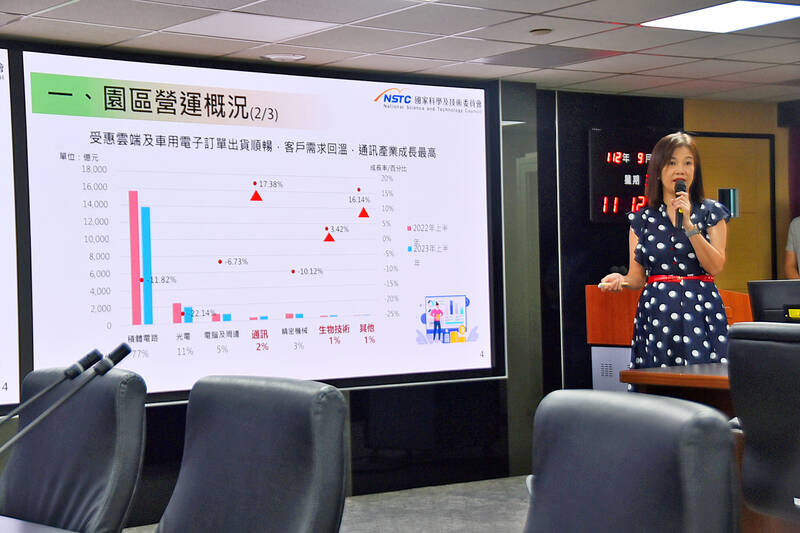

Of the six major industries in the parks, the communications industry placed first in terms of revenue growth, rising 17.38 percent year-on-year to NT$45.64 billion, followed by the biotechnology industry with an increase of 3.42 percent to NT$20.68 billion.

However, the optoelectronics industry’s revenue fell the most by 22.14 percent to NT$191.5 billion due to declining flat-panel prices, inventory adjustments and cooling demand in the end market, while the integrated circuit industry also posted revenue decline of 11.82 percent to NT$1.39 trillion, the report showed.

Meanwhile, the computer and peripherals industry’s revenue decreased 6.72 percent to NT$91.6 billion and the precision machinery industry’s sales dropped 10.12 percent to NT$59.05 billion, the report showed.

As global macroeconomic uncertainties remain in the second half of the year, the council forecast the three parks’ full-year revenue this year would fall slightly from the record number of NT$4.27 trillion last year, but it predicted communications and biotechnology industries’ revenues would continue hitting new highs.

The US dollar was trading at NT$29.7 at 10am today on the Taipei Foreign Exchange, as the New Taiwan dollar gained NT$1.364 from the previous close last week. The NT dollar continued to rise today, after surging 3.07 percent on Friday. After opening at NT$30.91, the NT dollar gained more than NT$1 in just 15 minutes, briefly passing the NT$30 mark. Before the US Department of the Treasury's semi-annual currency report came out, expectations that the NT dollar would keep rising were already building. The NT dollar on Friday closed at NT$31.064, up by NT$0.953 — a 3.07 percent single-day gain. Today,

‘SHORT TERM’: The local currency would likely remain strong in the near term, driven by anticipated US trade pressure, capital inflows and expectations of a US Fed rate cut The US dollar is expected to fall below NT$30 in the near term, as traders anticipate increased pressure from Washington for Taiwan to allow the New Taiwan dollar to appreciate, Cathay United Bank (國泰世華銀行) chief economist Lin Chi-chao (林啟超) said. Following a sharp drop in the greenback against the NT dollar on Friday, Lin told the Central News Agency that the local currency is likely to remain strong in the short term, driven in part by market psychology surrounding anticipated US policy pressure. On Friday, the US dollar fell NT$0.953, or 3.07 percent, closing at NT$31.064 — its lowest level since Jan.

Hong Kong authorities ramped up sales of the local dollar as the greenback’s slide threatened the foreign-exchange peg. The Hong Kong Monetary Authority (HKMA) sold a record HK$60.5 billion (US$7.8 billion) of the city’s currency, according to an alert sent on its Bloomberg page yesterday in Asia, after it tested the upper end of its trading band. That added to the HK$56.1 billion of sales versus the greenback since Friday. The rapid intervention signals efforts from the city’s authorities to limit the local currency’s moves within its HK$7.75 to HK$7.85 per US dollar trading band. Heavy sales of the local dollar by

The Financial Supervisory Commission (FSC) yesterday met with some of the nation’s largest insurance companies as a skyrocketing New Taiwan dollar piles pressure on their hundreds of billions of dollars in US bond investments. The commission has asked some life insurance firms, among the biggest Asian holders of US debt, to discuss how the rapidly strengthening NT dollar has impacted their operations, people familiar with the matter said. The meeting took place as the NT dollar jumped as much as 5 percent yesterday, its biggest intraday gain in more than three decades. The local currency surged as exporters rushed to