The central bank yesterday kept its policy rate unchanged for the second straight quarter, saying that a rate pause would help support the economy, as consumer prices have moderated and would return to the 2 percent target next year.

“The board gave unanimous support to a policy hold, although some members voiced concern over lingering inflationary pressures and called for close monitoring,” central bank Governor Yang Chin-long (楊金龍) told a media briefing after its quarterly board meeting.

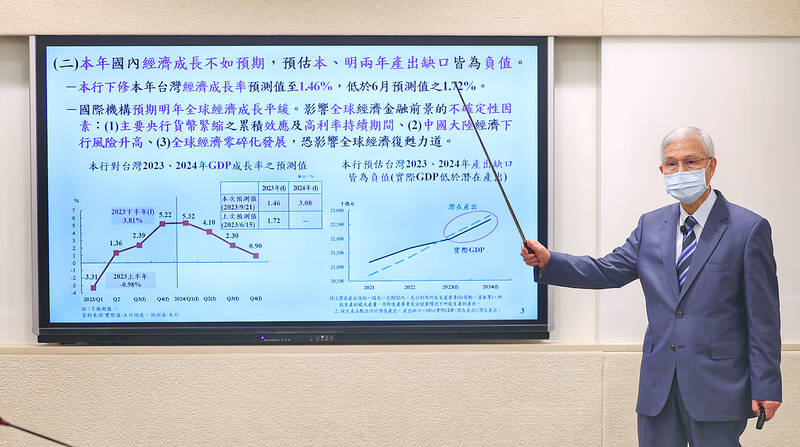

The consumer price index (CPI) would grow 1.83 percent next year, while core CPI after stripping out volatile items would advance a milder 1.73 percent, giving the central bank room to handle Taiwan’s negative output gaps or the lag between actual GDP and potential GDP.

Photo: CNA

However, Yang refused to equate the monetary policy decision as going loose, saying it would lean toward a tight stance for longer, taking cues from the US Federal Reserve’s hawkish rhetoric overnight.

The central bank again cut its forecast for the nation’s GDP growth this year from 1.72 percent to 1.46 percent, saying it is difficult to make projections due to dense economic uncertainties.

Ongoing restrictive monetary policy in the West curbs demand for goods and prolongs inventory adjustments, Yang said, adding that people in the post-COVID-19-pandemic era have shifted their resources away from purchases of technology products and assign more importance to in-person experiences.

The trend explains why prices for services picked up steeply at home and abroad, and are to blame for bolstering inflationary pressures, the top monetary official said.

“Demand for services will remain healthy ahead, but high comparison bases will weaken its ability to be the main CPI driver,” Yang said.

By contrast, inventory corrections, though turning out worse and longer than expected, are coming to an end, allowing Taiwan to breathe a sigh of relief and embark on a course of recovery from next quarter onward, the governor said.

GDP growth next year would improve to 3.08 percent, aided by a recovery in exports and private investment, its report showed.

Consumer spending would also continue to be the major growth driver, meaning the pace of improvement for exports would be limited.

The central bank did not introduce new credit controls for the property market, saying previous measures had borne fruit judging by a slowdown in property transactions and house prices, as well as house and construction loans.

“Credit controls are intended to prevent funds from overflowing to the property sector, create real-estate bubbles and threaten the stability of financial markets,” Yang said.

The US dollar was trading at NT$29.7 at 10am today on the Taipei Foreign Exchange, as the New Taiwan dollar gained NT$1.364 from the previous close last week. The NT dollar continued to rise today, after surging 3.07 percent on Friday. After opening at NT$30.91, the NT dollar gained more than NT$1 in just 15 minutes, briefly passing the NT$30 mark. Before the US Department of the Treasury's semi-annual currency report came out, expectations that the NT dollar would keep rising were already building. The NT dollar on Friday closed at NT$31.064, up by NT$0.953 — a 3.07 percent single-day gain. Today,

‘SHORT TERM’: The local currency would likely remain strong in the near term, driven by anticipated US trade pressure, capital inflows and expectations of a US Fed rate cut The US dollar is expected to fall below NT$30 in the near term, as traders anticipate increased pressure from Washington for Taiwan to allow the New Taiwan dollar to appreciate, Cathay United Bank (國泰世華銀行) chief economist Lin Chi-chao (林啟超) said. Following a sharp drop in the greenback against the NT dollar on Friday, Lin told the Central News Agency that the local currency is likely to remain strong in the short term, driven in part by market psychology surrounding anticipated US policy pressure. On Friday, the US dollar fell NT$0.953, or 3.07 percent, closing at NT$31.064 — its lowest level since Jan.

The New Taiwan dollar and Taiwanese stocks surged on signs that trade tensions between the world’s top two economies might start easing and as US tech earnings boosted the outlook of the nation’s semiconductor exports. The NT dollar strengthened as much as 3.8 percent versus the US dollar to 30.815, the biggest intraday gain since January 2011, closing at NT$31.064. The benchmark TAIEX jumped 2.73 percent to outperform the region’s equity gauges. Outlook for global trade improved after China said it is assessing possible trade talks with the US, providing a boost for the nation’s currency and shares. As the NT dollar

The Financial Supervisory Commission (FSC) yesterday met with some of the nation’s largest insurance companies as a skyrocketing New Taiwan dollar piles pressure on their hundreds of billions of dollars in US bond investments. The commission has asked some life insurance firms, among the biggest Asian holders of US debt, to discuss how the rapidly strengthening NT dollar has impacted their operations, people familiar with the matter said. The meeting took place as the NT dollar jumped as much as 5 percent yesterday, its biggest intraday gain in more than three decades. The local currency surged as exporters rushed to