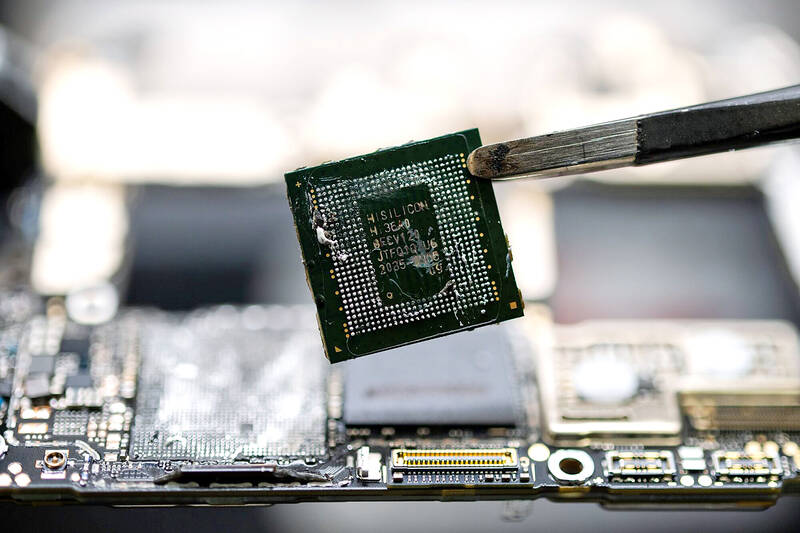

Huawei Technologies Co (華為) and China’s top chipmaker Semiconductor Manufacturing International Corp (SMIC, 中芯) have built an advanced 7-nanometer processor to power its latest smartphone, a teardown report by analysis firm TechInsights showed.

Huawei’s Mate 60 Pro is powered by a new Kirin 9000s chip that was made in China by SMIC, TechInsights said in the report shared with Reuters on Monday.

Huawei started selling its Mate 60 Pro phone last week. The specifications provided advertised its ability to make satellite calls, but offered no information on the power of the chipset inside.

Photo: Bloomberg

The processor is the first to utilize SMIC’s most advanced 7-nanometer technology and suggests that the Chinese government is making some headway in attempts to build a domestic chip ecosystem, the research firm said.

Buyers of the phone in China have been posting tear-down videos and sharing speed tests on social media that suggest the Mate 60 Pro is capable of download speeds exceeding those of top line 5G phones.

The cellphone’s launch sent Chinese social media users and state media into a frenzy, with some saying it coincided with a visit by US Secretary of Commerce Gina Raimondo.

From 2019, the US has restricted Huawei’s access to chipmaking tools essential for producing the most advanced handset models, with the company only able to launch limited batches of 5G models using stockpiled chips.

Research firms in July said that they believed Huawei was planning a return to the 5G smartphone industry by the end of this year, using its own advances in semiconductor design tools along with chipmaking from SMIC.

The Huawei breakthrough comes as China is seeking to raise a US$40 billion fund to bankroll investments in domestic chipmaking and research, people familiar with the matter said.

The state-backed China Integrated Circuit Industry Investment Fund is establishing its third and largest investment pool of about 300 billion yuan (US$41.1 billion), the people said.

The Chinese Ministry of Finance might contribute 60 billion yuan to the fund, which won approval to operate in the past few months, they added.

Known locally as “the Big Fund,” it has backed some of China’s biggest chip enterprises including SMIC.

South Korea’s equity benchmark yesterday crossed a new milestone just a month after surpassing the once-unthinkable 5,000 mark as surging global memory demand powers the country’s biggest chipmakers. The KOSPI advanced as much as 2.6 percent to a record 6,123, with Samsung Electronics Co and SK Hynix Inc each gaining more than 2 percent. With the benchmark now up 45 percent this year, South Korea’s stock market capitalization has also moved past France’s, following last month’s overtaking of Germany’s. Long overlooked by foreign funds, despite being undervalued, South Korean stocks have now emerged as clear winners in the global market. The so-called “artificial intelligence

‘SEISMIC SHIFT’: The researcher forecast there would be about 1.1 billion mobile shipments this year, down from 1.26 billion the prior year and erasing years of gains The global smartphone market is expected to contract 12.9 percent this year due to the unprecedented memorychip shortage, marking “a crisis like no other,” researcher International Data Corp (IDC) said. The new forecast, a dramatic revision down from earlier estimates, gives the latest accounting of the ongoing memory crunch that is affecting every corner of the electronics industry. The demand for advanced memory to power artificial intelligence (AI) tasks has drained global supply until well into next year and jeopardizes the business model of many smartphone makers. IDC forecast about 1.1 billion mobile shipments this year, down from 1.26 billion the prior

People stand in a Pokemon store in Tokyo on Thursday. One of the world highest-grossing franchises is celebrated its 30th anniversary yesterday.

Chinese artificial intelligence (AI) start-up DeepSeek’s (深度求索) latest AI model, set to be released as soon as next week, was trained on Nvidia Corp’s most advanced AI chip, the Blackwell, a senior official of US President Donald Trump’s administration said on Monday, in what could represent a violation of US export controls. The US believes DeepSeek will remove the technical indicators that might reveal its use of American AI chips, the official said, adding that the Blackwells are likely clustered at its data center in Inner Mongolia, an autonomous region of China. The person declined to say how the US government received