Dressed up and ready for battle, about 10,000 Pokemon fans have descended on Yokohama in Japan this weekend, looking for fun, but also collector’s item cards potentially worth serious money.

Since the launch of Pokemon cards in 1996 following the hit computer game of the same name — meaning “pocket monsters” — an astounding 53 billion cards have been printed.

Almost 30 years on, the card game remains hugely popular as contestants take each other on with cards representing the monsters and their different attributes.

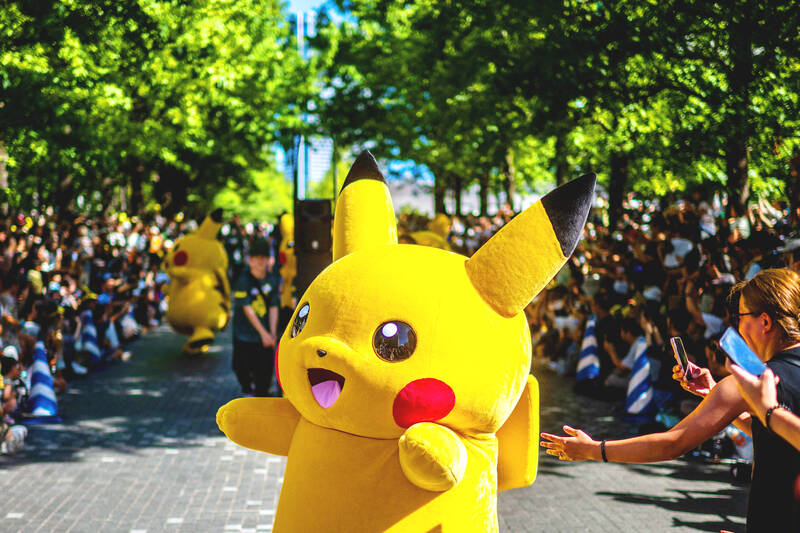

Photo: AFP

The Pokemon World Championships are being held in Japan for the first time this weekend. The world’s best players of the video and the card game are to battle it out for cash prizes at an event attended by thousands.

“I have been playing since I was a kid,” Ajay Sridhar, 33, who traveled halfway around the world from New York to attend with his cards.

“It’s just the competition, it’s the community... A lot of my oldest friends I’ve met through Pokemon,” he said, explaining why he was hooked.

Photo: AFP

“It’s kind of like chess, where if you didn’t play chess and you were watching a high-level chess match, you wouldn’t know what was going on, but once you get to a certain skill level, there is a lot of depth and complexity to it,” said Gilbert McLaughlin, 27, from Scotland.

Ranging from Pikachu to Jigglypuff to the jackal-headed Lucario, there are now more than 1,000 different Pokemon characters, with new “generations” released every few years.

While they have always been swapped and collected, the value of the cards has exploded in the past few years, not just among fans of the game, but also among investors with little or no past interest.

Factors determining value include the cards’ rareness, the character (Mew, Mewtwo, Pikachu and Charizard tend to be more valuable) and the artist, who is credited on the card.

Web sites have sprung up dedicated to helping people understand the dizzying array of different cards and their myriad markings, complete with charts showing their value over time.

The most expensive ever sold was in 2021 when US YouTuber Logan Paul paid — in a Dubai hotel room to a “mystery” seller — US$5.28 million for a supposedly unique, mint-condition “PSA Grade 10 Pikachu.”

The next year, Logan, 28, wore the card — inside a protective plastic case attached to a gold chain — around his neck at a WWE wrestling event in Texas.

Hiroshi Goto is an expert in Pokemon cards who has written a book with advice on how to make money from them.

He said that when he ran a shop selling the cards in the 2000s, his customers were mostly “schoolkids with their dads taking part in tournaments together.”

Yet since the 20th anniversary in 2016, “the perception of cards evolved into being not just toys for children, but also items appreciated by adults, collector’s items with a tangible value,” Goto said.

Demand is such that the Pokemon Co has had to increase production.

In Japan and the US there have been instances of physical fights, including one outside a shop in the Japanese city of Osaka last month that went viral on social media.

There have been cases of shops selling Pokemon cards being broken into in normally low-crime Japan in the past few months.

The gold-rush has also sparked a boom in fake cards. Paul, for instance, paid US$3.75 million in 2021 for a “sealed & authenticated” box of first-edition booster packs that turned out to contain “G.I. Joe” cards instead, he said in one of his videos.

On the sidelines in Yokohama, collectors were busy swapping and selling their cards, including Jeffrey Ng, happy after buying 10 cards for US$1,700. He now hopes to sell them for a profit.

“Conventions like this one are a good place to meet other collectors,” he said.

All cards are painstakingly conceived and designed in the same place, the Tokyo offices of Creatures Inc, which along with Nintendo and Game Freak own the Pokemon Co.

Creatures executive Atsushi Nagashima said while the firm was “very happy” about the success of the cards, “that doesn’t change how we do our job.”

Creatures employs 18 testers who spend their working days playing Pokemon to make sure that the new cards fit harmoniously with the vast number of existing ones.

“[But] we never hire people from competitions,” said Kohei Kobayashi, another manager at Creatures. “We want to leave the good players where they are, there where they shine.”

Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), the world’s biggest contract chipmaker, booked its first-ever profit from its Arizona subsidiary in the first half of this year, four years after operations began, a company financial statement showed. Wholly owned by TSMC, the Arizona unit contributed NT$4.52 billion (US$150.1 million) in net profit, compared with a loss of NT$4.34 billion a year earlier, the statement showed. The company attributed the turnaround to strong market demand and high factory utilization. The Arizona unit counts Apple Inc, Nvidia Corp and Advanced Micro Devices Inc among its major customers. The firm’s first fab in Arizona began high-volume production

VOTE OF CONFIDENCE: The Japanese company is adding Intel to an investment portfolio that includes artificial intelligence linchpins Nvidia Corp and TSMC Softbank Group Corp agreed to buy US$2 billion of Intel Corp stock, a surprise deal to shore up a struggling US name while boosting its own chip ambitions. The Japanese company, which is adding Intel to an investment portfolio that includes artificial intelligence (AI) linchpins Nvidia Corp and Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), is to pay US$23 a share — a small discount to Intel’s last close. Shares of the US chipmaker, which would issue new stock to Softbank, surged more than 5 percent in after-hours trading. Softbank’s stock fell as much as 5.4 percent on Tuesday in Tokyo, its

COLLABORATION: Softbank would supply manufacturing gear to the factory, and a joint venture would make AI data center equipment, Young Liu said Hon Hai Precision Industry Co (鴻海精密) would operate a US factory owned by Softbank Group Corp, setting up what is in the running to be the first manufacturing site in the Japanese company’s US$500 billion Stargate venture with OpenAI and Oracle Corp. Softbank is acquiring Hon Hai’s electric-vehicle plant in Ohio, but the Taiwanese company would continue to run the complex after turning it into an artificial intelligence (AI) server production plant, Hon Hai chairman Young Liu (劉揚偉) said yesterday. Softbank would supply manufacturing gear to the factory, and a joint venture between the two companies would make AI data

DOLLAR SIGNS: The central bank rejected claims that the NT dollar had appreciated 10 percentage points more than the yen or the won against the greenback The New Taiwan dollar yesterday fell for a sixth day to its weakest level in three months, driven by equity-related outflows and reactions to an economics official’s exchange rate remarks. The NT dollar slid NT$0.197, or 0.65 percent, to close at NT$30.505 per US dollar, central bank data showed. The local currency has depreciated 1.97 percent so far this month, ranking as the weakest performer among Asian currencies. Dealers attributed the retreat to foreign investors wiring capital gains and dividends abroad after taking profit in local shares. They also pointed to reports that Washington might consider taking equity stakes in chipmakers, including Taiwan Semiconductor