Taiwan Semiconductor Manufacturing Co’s (TSMC, 台積電) global capacity expansion would help it minimize its asset concentration risk and assuage major customers’ concerns about supply chain resilience amid geopolitical tensions in the long term, Taiwan Ratings Corp (中華信評) said in a report yesterday.

The ratings agency released the report on the heels of TSMC’s announcement on Tuesday that it planned to build a new wafer manufacturing facility in Dresden, Germany, through a joint venture with its customers Robert Bosch GmbH, Infineon Technologies AG and NXP Semiconductors NV.

“We believe this [German] investment is in line with TSMC’s long-term strategy to increase its global footprint, partly in response to major client concerns over geopolitical tension,” Taiwan Ratings said.

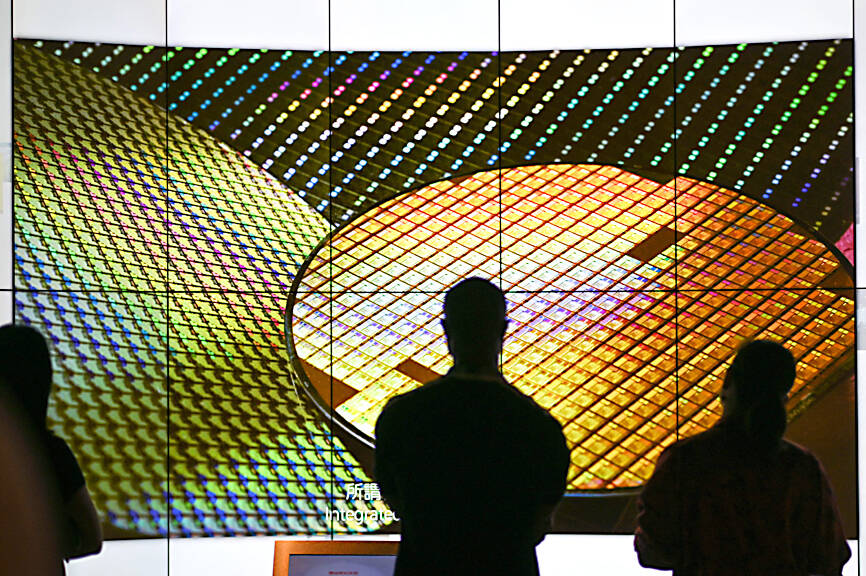

Photo: Sam Yeh, AFP

The joint venture is likely to take advantage of the eurozone’s 43 billion euros (US$47.4 billion) subsidy program, which aims to cultivate the local semiconductor supply chain, it said.

As Taiwan would continue to be the major manufacturing hub for the company’s most advanced technologies — 2-nanometer and 3-nanometer — the company’s overseas expansions in the US, Japan, Europe and China are “unlikely to materially lower its geographic concentration risk over the next two years,” the report said.

As of the end of last year, Taiwan generated 90 percent of TSMC’s overall wafer capacity, and the company has said it intended to shift 20 percent of its capacity using 28-nanometer and below technologies beyond Taiwan over the next few years.

With those overseas investment expansions unfolding, TSMC would encounter higher manufacturing costs and margin dilution, but the company should be able to minimize such adverse impacts on its profitability, thanks to customers’ strong demand and the governments’ support to build local semiconductor supply chains, the report said.

In addition, TSMC’s overseas expansion would help the company better manage the increasingly tight supply of water, green power and talent in Taiwan, it said.

Taiwan Ratings said the planned German fab would have a low financial impact on TSMC’s debt leverage this year and next year, as the major spending on equipment would come two to three years later.

The agency expects TSMC’s capital expenditure to be US$32 billion to US$36 billion this year and next year, compared with last year’s US$36 billion, due to weakening demand.

Lower capital spending should help strengthen the company’s financial buffer, it said.

TSMC is forecast to generate NT$100 billion to NT$150 billion (US$3.15 billion to US$4.72 billion) in free cash flow this year, despite weaker profitability and a moderate increase in the company’s cash dividends, it added.

Sweeping policy changes under US Secretary of Health and Human Services Robert F. Kennedy Jr are having a chilling effect on vaccine makers as anti-vaccine rhetoric has turned into concrete changes in inoculation schedules and recommendations, investors and executives said. The administration of US President Donald Trump has in the past year upended vaccine recommendations, with the country last month ending its longstanding guidance that all children receive inoculations against flu, hepatitis A and other diseases. The unprecedented changes have led to diminished vaccine usage, hurt the investment case for some biotechs, and created a drag that would likely dent revenues and

Macronix International Co (旺宏), the world’s biggest NOR flash memory supplier, yesterday said it would spend NT$22 billion (US$699.1 million) on capacity expansion this year to increase its production of mid-to-low-density memory chips as the world’s major memorychip suppliers are phasing out the market. The company said its planned capital expenditures are about 11 times higher than the NT$1.8 billion it spent on new facilities and equipment last year. A majority of this year’s outlay would be allocated to step up capacity of multi-level cell (MLC) NAND flash memory chips, which are used in embedded multimedia cards (eMMC), a managed

CULPRITS: Factors that affected the slip included falling global crude oil prices, wait-and-see consumer attitudes due to US tariffs and a different Lunar New Year holiday schedule Taiwan’s retail sales ended a nine-year growth streak last year, slipping 0.2 percent from a year earlier as uncertainty over US tariff policies affected demand for durable goods, data released on Friday by the Ministry of Economic Affairs showed. Last year’s retail sales totaled NT$4.84 trillion (US$153.27 billion), down about NT$9.5 billion, or 0.2 percent, from 2024. Despite the decline, the figure was still the second-highest annual sales total on record. Ministry statistics department deputy head Chen Yu-fang (陳玉芳) said sales of cars, motorcycles and related products, which accounted for 17.4 percent of total retail rales last year, fell NT$68.1 billion, or

In the wake of strong global demand for AI applications, Taiwan’s export-oriented economy accelerated with the composite index of economic indicators flashing the first “red” light in December for one year, indicating the economy is in booming mode, the National Development Council (NDC) said yesterday. Moreover, the index of leading indicators, which gauges the potential state of the economy over the next six months, also moved higher in December amid growing optimism over the outlook, the NDC said. In December, the index of economic indicators rose one point from a month earlier to 38, at the lower end of the “red” light.