South Korean experts have created a committee to verify claims about a potential breakthrough in superconductor technology that has been driving both excitement and controversy among markets and industry participants.

The Korean Society of Superconductivity and Cryogenics (KSSC) asked the Quantum Energy Research Centre to submit samples that are required in the verification process of room-temperature superconductors, the institution said in a statement on Wednesday.

“The claim of a room temperature superconductor discovery is causing a great controversy at home and abroad, but we are concerned about the situation in which unverified claims are being poured out by fellow researchers without an entity responsible for verifying it,” said the KSSC, which consists of professors and experts.

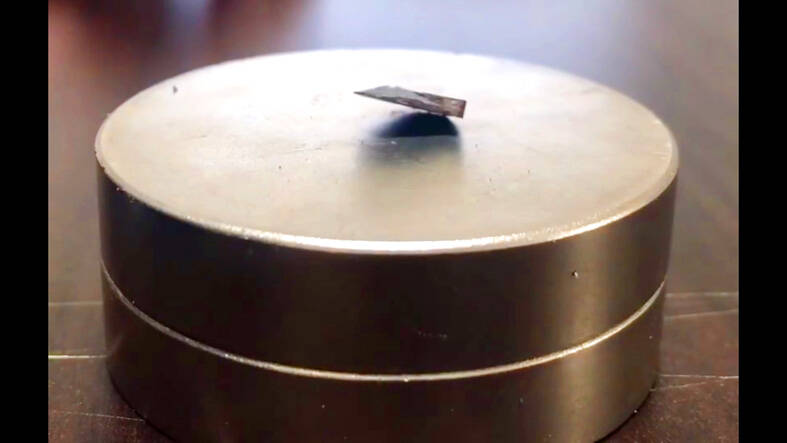

Photo: screen grab from the Web site of ScienceCast

Papers published on July 22 showed researchers at the Quantum Energy Research Centre and other South Korean experts synthesized the world’s first superconductor known as LK-99 that is capable of conducting electricity at room temperature with ambient pressure.

Excitement grew further after a video of a team of Chinese scientists replicating the South Korean team’s findings went viral.

The KSSC said it is difficult to say if the material is a room-temperature superconductor at this point, based on the archived papers and published videos.

Research institutes of KSSC members are to conduct cross verification if the Quantum Energy Research Centre provides samples, the statement said.

The verification committee is to be led by Kim Chang-young, a Seoul National University professor who is an expert in a related field.

“If it is verified, it will be a groundbreaking research result that will have a great impact on science and technology. However, it is worrisome that this verification is being disclosed without academic review, and that it is having economic and social impacts,” the KSSC said.

Meanwhile, investors continued to pile into some South Korean stocks seen as related to superconductors, even as the stock exchange warned of speculative bets and unfair trades.

Korea Exchange late on Wednesday asked investors to be wary before investing in Duksung Co, Mobiis Co and Shinsung Delta Tech Co.

“Investors should be cautious on increased volatility in these superconductor theme stocks as their substance is not clear,” Kiwoom Securities Co analyst Han Ji-young said.

NEW IDENTITY: Known for its software, India has expanded into hardware, with its semiconductor industry growing from US$38bn in 2023 to US$45bn to US$50bn India on Saturday inaugurated its first semiconductor assembly and test facility, a milestone in the government’s push to reduce dependence on foreign chipmakers and stake a claim in a sector dominated by China. Indian Prime Minister Narendra Modi opened US firm Micron Technology Inc’s semiconductor assembly, test and packaging unit in his home state of Gujarat, hailing the “dawn of a new era” for India’s technology ambitions. “When young Indians look back in the future, they will see this decade as the turning point in our tech future,” Modi told the event, which was broadcast on his YouTube channel. The plant would convert

‘SEISMIC SHIFT’: The researcher forecast there would be about 1.1 billion mobile shipments this year, down from 1.26 billion the prior year and erasing years of gains The global smartphone market is expected to contract 12.9 percent this year due to the unprecedented memorychip shortage, marking “a crisis like no other,” researcher International Data Corp (IDC) said. The new forecast, a dramatic revision down from earlier estimates, gives the latest accounting of the ongoing memory crunch that is affecting every corner of the electronics industry. The demand for advanced memory to power artificial intelligence (AI) tasks has drained global supply until well into next year and jeopardizes the business model of many smartphone makers. IDC forecast about 1.1 billion mobile shipments this year, down from 1.26 billion the prior

People stand in a Pokemon store in Tokyo on Thursday. One of the world highest-grossing franchises is celebrated its 30th anniversary yesterday.

Zimbabwe’s ban on raw lithium exports is forcing Chinese miners to rethink their strategy, speeding up plans to process the metal locally instead of shipping it to China’s vast rechargeable battery industry. The country is Africa’s largest lithium producer and has one of the world’s largest reserves, according to the US Geological Survey (USGS). Zimbabwe already banned the export of lithium ore in 2022 and last year announced it would halt exports of lithium concentrates from January next year. However, on Wednesday it imposed the ban with immediate effect, leaving unclear what the lithium mining sector would do in the