US President Joe Biden is planning to sign an executive order to limit critical US technology investments in China by the middle of next month, according to people familiar with the internal deliberations.

The order focuses on semiconductors, artificial intelligence and quantum computing. It would not affect any existing investments and would only prohibit certain transactions. Other deals would have to be disclosed to the government.

The timing for the order, slated for the second week of next month, has slipped many times before, and there is no guarantee it would not be delayed again, but internal discussions have already shifted from the substance of the measures to rolling out the order and accompanying rule, said the sources, who spoke on condition of anonymity.

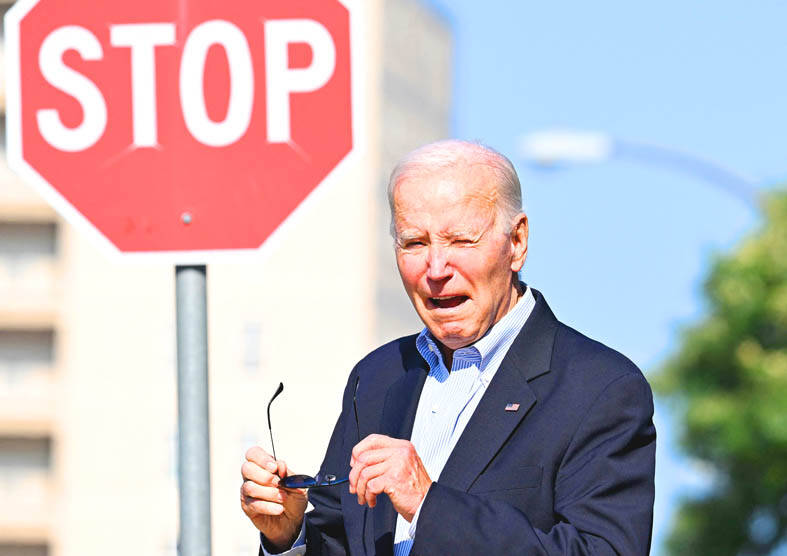

Photo: AFP

The restrictions would not take effect until next year, and their scope would be laid out in a rulemaking process, involving a comment period so stakeholders can weigh in on the final version.

A spokeswoman for the National Security Council declined to comment.

The investment controls are part of a broader White House effort to limit China’s capabilities to develop the next-generation technologies expected to dominate national and economic security. The effort has complicated the Biden administration’s already fraught relations with China, which sees the restrictions as an effort to contain and isolate the country.

China’s envoy in Washington said earlier this month that Beijing would retaliate if the US imposes new limits on technology or capital flows but did not detail what actions the country could take.

US Secretary of the Treasury Janet Yellen has sought to calm Chinese anger over the curbs, saying they would not significantly damage the ability to attract US investment and were narrowly tailored.

“These would not be broad controls that would affect US investment broadly in China, or in my opinion, have a fundamental impact on affecting the investment climate for China,” Yellen said in an interview with Bloomberg Television earlier this month.

Yellen emphasized the restrictions as well as existing export controls were not in retaliation for any specific actions from China or intended to curtail its growth.

US National Security Adviser Jake Sullivan first publicly discussed the concept in July 2021. China hawks in the US are eager for tougher and faster action. Lawmakers from both parties have also shown interest in legislating on the matter, although a bill has not yet made it to Biden’s desk.

The Senate last week passed an amendment to the national defense policy bill that would require firms to notify the government about certain investments in China and other countries of concern, although they would not be subject to review or possible prohibition.

NEW IDENTITY: Known for its software, India has expanded into hardware, with its semiconductor industry growing from US$38bn in 2023 to US$45bn to US$50bn India on Saturday inaugurated its first semiconductor assembly and test facility, a milestone in the government’s push to reduce dependence on foreign chipmakers and stake a claim in a sector dominated by China. Indian Prime Minister Narendra Modi opened US firm Micron Technology Inc’s semiconductor assembly, test and packaging unit in his home state of Gujarat, hailing the “dawn of a new era” for India’s technology ambitions. “When young Indians look back in the future, they will see this decade as the turning point in our tech future,” Modi told the event, which was broadcast on his YouTube channel. The plant would convert

‘SEISMIC SHIFT’: The researcher forecast there would be about 1.1 billion mobile shipments this year, down from 1.26 billion the prior year and erasing years of gains The global smartphone market is expected to contract 12.9 percent this year due to the unprecedented memorychip shortage, marking “a crisis like no other,” researcher International Data Corp (IDC) said. The new forecast, a dramatic revision down from earlier estimates, gives the latest accounting of the ongoing memory crunch that is affecting every corner of the electronics industry. The demand for advanced memory to power artificial intelligence (AI) tasks has drained global supply until well into next year and jeopardizes the business model of many smartphone makers. IDC forecast about 1.1 billion mobile shipments this year, down from 1.26 billion the prior

People stand in a Pokemon store in Tokyo on Thursday. One of the world highest-grossing franchises is celebrated its 30th anniversary yesterday.

Zimbabwe’s ban on raw lithium exports is forcing Chinese miners to rethink their strategy, speeding up plans to process the metal locally instead of shipping it to China’s vast rechargeable battery industry. The country is Africa’s largest lithium producer and has one of the world’s largest reserves, according to the US Geological Survey (USGS). Zimbabwe already banned the export of lithium ore in 2022 and last year announced it would halt exports of lithium concentrates from January next year. However, on Wednesday it imposed the ban with immediate effect, leaving unclear what the lithium mining sector would do in the