The Organisation for Economic Co-operation and Development (OECD) yesterday slightly raised its growth outlook for the world economy as inflation eases and China has dropped COVID-19 restrictions, but it warned that the recovery faces a “long road.”

The Paris-based organization forecast an economic expansion of 2.7 percent, up from 2.6 percent in its previous report in March, with upgrades for the US, China and the eurozone.

It is still below the 3.3 percent growth recorded last year.

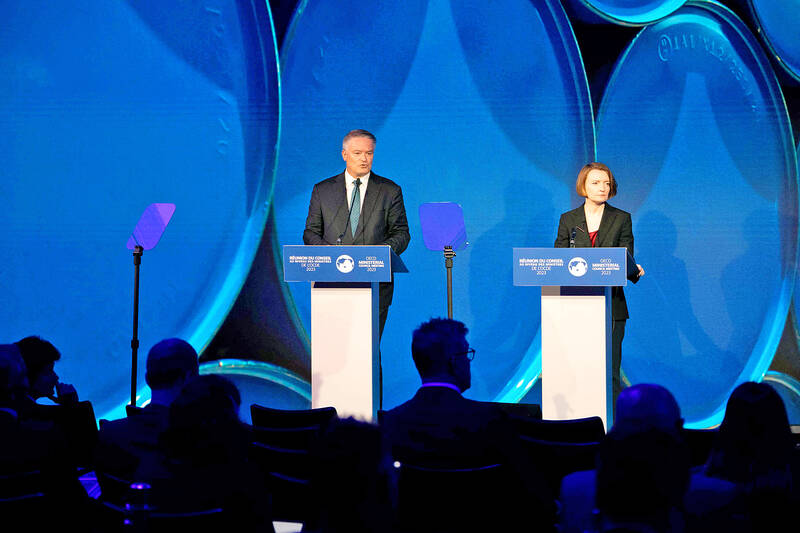

Photo: AFP

“The global economy is turning a corner, but faces a long road ahead to attain strong and sustainable growth,” OECD chief economist Clare Lombardelli wrote in the organization’s Economic Outlook. “The recovery will be weak by past standards.”

The growth forecast for next year remains unchanged at 2.9 percent, the report said.

A drop in energy prices, the untangling of supply chain bottlenecks and China’s sooner-than-expected reopening are contributing to the recovery, it said.

However, core inflation, which strips out volatile energy and food prices, is higher than previously expected, it said.

This might force central banks, which have already raised interest rates in efforts to tame consumer prices, to further hike borrowing costs, the OECD said.

“Central banks need to maintain restrictive monetary policies until there are clear signs that underlying inflationary pressures are abating,” Lombardelli said.

At the same time, the organization warned that higher interest rates around the world are “increasingly being felt,” notably in property and financial markets.

“Signs of stress have started to appear in some financial market segments as investors reassess risks, and credit conditions are tightening,” the report said.

The banking sector was rocked in March by the collapse of US regional lender Silicon Valley Bank, whose demise was partly blamed on high rates bringing down the value of its bond portfolio.

The crisis reverberated across the Atlantic, with the Swiss government forcing Swiss banking giant UBS Group AG to take over troubled rival Credit Suisse Group AG.

“Should further financial market stress arise, central banks should deploy financial policy instruments to enhance liquidity and minimize contagion risks,” Lombardelli wrote.

The OECD also warned that almost all countries have budget deficits and higher debt levels than before the COVID-19 pandemic as they propped up their economies to withstand the shocks of virus restrictions and Russia’s war in Ukraine.

“As the recovery takes hold, fiscal support should be scaled back and better targeted,” Lombardelli said.

As energy prices, which soared following the Russian invasion of Ukraine, fall further, governments should withdraw schemes aimed at supporting consumers, the OECD said.

The organization raised this year’s growth forecasts for the US to 1.6 percent and China to 5.4 percent — both an increase of 0.1 percentage points.

The eurozone also got a slight 0.1-point bump to 0.9 percent.

Britain was upgraded out of recession territory, with growth forecast at 0.3 percent instead of a contraction.

However, the OECD sharply lowered the outlook for Germany to zero growth, while Japan’s GDP is forecast to grow 1.3 percent, a slight downgrade.

Merida Industry Co (美利達) has seen signs of recovery in the US and European markets this year, as customers are gradually depleting their inventories, the bicycle maker told shareholders yesterday. Given robust growth in new orders at its Taiwanese factory, coupled with its subsidiaries’ improving performance, Merida said it remains confident about the bicycle market’s prospects and expects steady growth in its core business this year. CAUTION ON CHINA However, the company must handle the Chinese market with great caution, as sales of road bikes there have declined significantly, affecting its revenue and profitability, Merida said in a statement, adding that it would

i Gasoline and diesel prices at fuel stations are this week to rise NT$0.1 per liter, as tensions in the Middle East pushed crude oil prices higher last week, CPC Corp, Taiwan (台灣中油) and Formosa Petrochemical Corp (台塑石化) said yesterday. International crude oil prices last week rose for the third consecutive week due to an escalating conflict between Israel and Iran, as the market is concerned that the situation in the Middle East might affect crude oil supply, CPC and Formosa said in separate statements. Front-month Brent crude oil futures — the international oil benchmark — rose 3.75 percent to settle at US$77.01

RISING: Strong exports, and life insurance companies’ efforts to manage currency risks indicates the NT dollar would eventually pass the 29 level, an expert said The New Taiwan dollar yesterday rallied to its strongest in three years amid inflows to the nation’s stock market and broad-based weakness in the US dollar. Exporter sales of the US currency and a repatriation of funds from local asset managers also played a role, said two traders, who asked not to be identified as they were not authorized to speak publicly. State-owned banks were seen buying the greenback yesterday, but only at a moderate scale, the traders said. The local currency gained 0.77 percent, outperforming almost all of its Asian peers, to close at NT$29.165 per US dollar in Taipei trading yesterday. The

RECORD LOW: Global firms’ increased inventories, tariff disputes not yet impacting Taiwan and new graduates not yet entering the market contributed to the decrease Taiwan’s unemployment rate last month dropped to 3.3 percent, the lowest for the month in 25 years, as strong exports and resilient domestic demand boosted hiring across various sectors, the Directorate-General of Budget, Accounting and Statistics (DGBAS) said yesterday. After seasonal adjustments, the jobless rate eased to 3.34 percent, the best performance in 24 years, suggesting a stable labor market, although a mild increase is expected with the graduation season from this month through August, the statistics agency said. “Potential shocks from tariff disputes between the US and China have yet to affect Taiwan’s job market,” Census Department Deputy Director Tan Wen-ling