Qualcomm Inc is betting the future of artificial intelligence (AI) will require more computing power than what the cloud alone can provide.

The world’s largest maker of smartphone processors is transitioning from a communications company into an “intelligent edge computing” firm, Qualcomm senior vice president Alex Katouzian said.

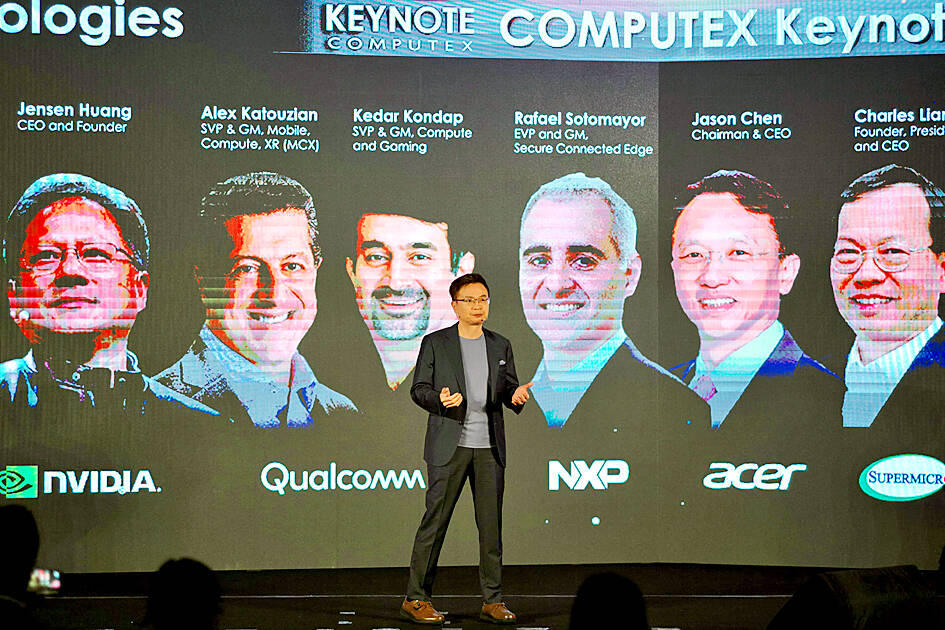

The edge in question is the mobile device that a user taps to access a network or service, and Katouzian used his time headlining one of the major keynote events at the Computex show in Taipei to make the case for how big a market that would be.

Photo: Sam Yeh, AFP

The US company’s chips help smartphones harness AI for everything from processing photographs to detecting malware. In emphasizing the “AI-capable” aspects of their products, Katouzian and his colleagues joined a flurry of companies positioning themselves as beneficiaries of a spike in demand for AI.

The company has shipped 2 billion AI-capable products to date, he said.

“As growth in the number of connected devices and data traffic continues to accelerate and data center costs climb, it simply won’t be possible to send everything to the cloud,” Katouzian said.

Nor will people want to do so when personal information is involved, he added.

Rocketing demand for chips behind AI tools such as Open AI’s ChatGPT is driving shares of chipmaking peer Nvidia Corp to record highs.

In contrast to Nvidia, Qualcomm’s outlook fell well short of estimates on sluggish global demand for mobile devices.

Katouzian sees the inventory glut depleting in the third or fourth quarter of this year.

Some customers have begun increasing orders for smaller components, a leading indicator for an uptick in demand, he said.

The wider enthusiasm for AI has prompted many companies to focus attention on their AI-related services, with more than one executive declaring a new computing era had dawned.

Arm Ltd, for instance, said its technology is enabling many AI applications already taken for granted and it would be fundamental to building the next wave of AI innovations, Arm chief executive officer Rene Haa said in a keynote address at Computex on Monday.

Citing examples from Amazon.com Inc’s Alexa voice assistant and Alphabet Inc’s Google Pixel phones to smart traffic light management and robotic beehive maintenance, Haas made the argument that on-device and small-scale AI processors would all run Arm technology.

He also pointed to Nvidia’s Grace Hopper next-generation architecture for accelerating AI as another example of Arm technology in the AI supply chain.

The company still intends to go public by the end of the year, a spokesperson confirmed on Monday. Arm, in search of a lofty valuation to satisfy parent Softbank Group Corp, is looking to present itself as another avenue for investors to tap into this vein of technology optimism.

“Given the chase for ‘AI stocks’, we think SBG [Softbank Group] may like to present Arm as an ‘AI play,’ although most of its current business is based on designing and licensing semiconductor IP [intellectual property], particularly for mobile devices,” Jefferies analyst Atul Goyal said.

The US dollar was trading at NT$29.7 at 10am today on the Taipei Foreign Exchange, as the New Taiwan dollar gained NT$1.364 from the previous close last week. The NT dollar continued to rise today, after surging 3.07 percent on Friday. After opening at NT$30.91, the NT dollar gained more than NT$1 in just 15 minutes, briefly passing the NT$30 mark. Before the US Department of the Treasury's semi-annual currency report came out, expectations that the NT dollar would keep rising were already building. The NT dollar on Friday closed at NT$31.064, up by NT$0.953 — a 3.07 percent single-day gain. Today,

‘SHORT TERM’: The local currency would likely remain strong in the near term, driven by anticipated US trade pressure, capital inflows and expectations of a US Fed rate cut The US dollar is expected to fall below NT$30 in the near term, as traders anticipate increased pressure from Washington for Taiwan to allow the New Taiwan dollar to appreciate, Cathay United Bank (國泰世華銀行) chief economist Lin Chi-chao (林啟超) said. Following a sharp drop in the greenback against the NT dollar on Friday, Lin told the Central News Agency that the local currency is likely to remain strong in the short term, driven in part by market psychology surrounding anticipated US policy pressure. On Friday, the US dollar fell NT$0.953, or 3.07 percent, closing at NT$31.064 — its lowest level since Jan.

The New Taiwan dollar and Taiwanese stocks surged on signs that trade tensions between the world’s top two economies might start easing and as US tech earnings boosted the outlook of the nation’s semiconductor exports. The NT dollar strengthened as much as 3.8 percent versus the US dollar to 30.815, the biggest intraday gain since January 2011, closing at NT$31.064. The benchmark TAIEX jumped 2.73 percent to outperform the region’s equity gauges. Outlook for global trade improved after China said it is assessing possible trade talks with the US, providing a boost for the nation’s currency and shares. As the NT dollar

The Financial Supervisory Commission (FSC) yesterday met with some of the nation’s largest insurance companies as a skyrocketing New Taiwan dollar piles pressure on their hundreds of billions of dollars in US bond investments. The commission has asked some life insurance firms, among the biggest Asian holders of US debt, to discuss how the rapidly strengthening NT dollar has impacted their operations, people familiar with the matter said. The meeting took place as the NT dollar jumped as much as 5 percent yesterday, its biggest intraday gain in more than three decades. The local currency surged as exporters rushed to