Export orders contracted about 18 percent year-on-year to US$42.5 billion last month, as demand for chips and other electronic components remained sluggish due to prolonged inventory adjustments and faltering consumer spending caused by macroeconomic uncertainty, the Ministry of Economic Affairs (MOEA) said yesterday.

Last month’s export orders marked the eighth straight month of decline, with decreases posted across the board. As global economic conditions remain unstable and consumers are cautious about spending on nonessential items, the ministry said it expects export orders to lose further steam this month.

Export orders — measured by product and component shipments to overseas markets over the next one to three months — are this month likely to fall by 23.3 to 26.9 percent annually, reaching US$40.5 billion to US$42.5 billion, the ministry said.

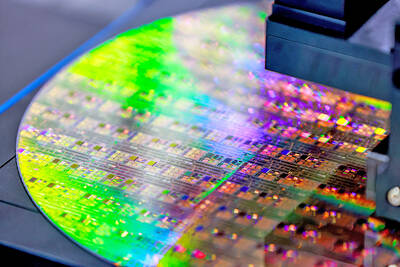

Photo: CNA

On a monthly basis, the best-case scenario would be flat orders, or there could be a fall of 4.7 percent at worst, the ministry said.

“Market demand is still very weak as customers remain in inventory digestion mode,” Department of Statistics Director Huang Yu-ling (黃于玲) said via telephone. “Raw materials and component prices are still hovering at a high level on an annual basis. The prices of flat panels are still lower than the level in the same period of last year.”

However, “the seasonal pattern will arrive this year, meaning orders received in the second half will be higher than the first half. That is what we feel now,” Huang said.

The ministry expects increased demand for emerging technologies such as high-performance computing, artificial intelligence and automotive electronics, which would drive growth momentum for local exporters.

However, rising external risks, including Russia’s invasion of Ukraine, global inflationary pressure and a US-China technology dispute, could hinder the nation’s trade growth momentum, it said.

Last month, orders for electronics products — primarily semiconductors — shrank 21.9 percent annually to US$13.93 billion, due to decreased demand for foundry services, memory chips and other electronic components due to inventory corrections, the ministry said.

Orders for information and communication technology products edged down 0.9 percent to US$12.03 billion, due to lower demand for smartphones, graphics cards and other products, it said.

Optoelectronics orders fell 19 percent to US$1.46 billion, as display and camera lens orders declined, while average selling prices of such products also decreased from a year earlier.

Orders for basic metals such as steel fell 26.5 percent to US$2.16 billion, due to weak steel demand and lower product prices, while machine tools orders decreased 21 percent to US$1.64 billion, as the global economic outlook turned sour and affected manufacturers’ capital investment plans.

Orders for plastics products fell 36.6 percent to US$1.55 billion, while those for petrochemical products decreased 35.1 percent to US$1.43 billion, as customers digested excess inventory amid weak demand, it said.

Other negative factors included increased supply from global rivals and crude oil price cuts by OPEC, the ministry said.

Taiwan’s foreign exchange reserves hit a record high at the end of last month, surpassing the US$600 billion mark for the first time, the central bank said yesterday. Last month, the country’s foreign exchange reserves rose US$5.51 billion from a month earlier to reach US$602.94 billion due to an increase in returns from the central bank’s portfolio management, the movement of other foreign currencies in the portfolio against the US dollar and the bank’s efforts to smooth the volatility of the New Taiwan dollar. Department of Foreign Exchange Director-General Eugene Tsai (蔡炯民)said a rate cut cycle launched by the US Federal Reserve

The US government on Wednesday sanctioned more than two dozen companies in China, Turkey and the United Arab Emirates, including offshoots of a US chip firm, accusing the businesses of providing illicit support to Iran’s military or proxies. The US Department of Commerce included two subsidiaries of US-based chip distributor Arrow Electronics Inc (艾睿電子) on its so-called entity list published on the federal register for facilitating purchases by Iran’s proxies of US tech. Arrow spokesman John Hourigan said that the subsidiaries have been operating in full compliance with US export control regulations and his company is discussing with the US Bureau of

Businesses across the global semiconductor supply chain are bracing themselves for disruptions from an escalating trade war, after China imposed curbs on rare earth mineral exports and the US responded with additional tariffs and restrictions on software sales to the Asian nation. China’s restrictions, the most targeted move yet to limit supplies of rare earth materials, represent the first major attempt by Beijing to exercise long-arm jurisdiction over foreign companies to target the semiconductor industry, threatening to stall the chips powering the artificial intelligence (AI) boom. They prompted US President Donald Trump on Friday to announce that he would impose an additional

Pegatron Corp (和碩), a key assembler of Apple Inc’s iPhones, on Thursday reported a 12.3 percent year-on-year decline in revenue for last quarter to NT$257.86 billion (US$8.44 billion), but it expects revenue to improve in the second half on traditional holiday demand. The fourth quarter is usually the peak season for its communications products, a company official said on condition of anonymity. As Apple released its new iPhone 17 series early last month, sales in the communications segment rose sequentially last month, the official said. Shipments to Apple have been stable and in line with earlier expectations, they said. Pegatron shipped 2.4 million notebook