France beat out competition from Germany and the Netherlands for ProLogium Technology Co’s (輝能科技) first overseas vehicle-battery plant with lobbying from French President Emmanuel Macron, deal sweeteners and competitive power prices, executives from the Taiwanese company said.

After narrowing a list of countries down from 13 to three, ProLogium said it this week settled on the northern French port city of Dunkirk for its second gigafactory and first outside Taiwan.

With production slated to begin in 2026, the factory would be the fourth battery plant in northern France, adding to an emerging specialized cluster central to Europe’s electric-vehicle industry.

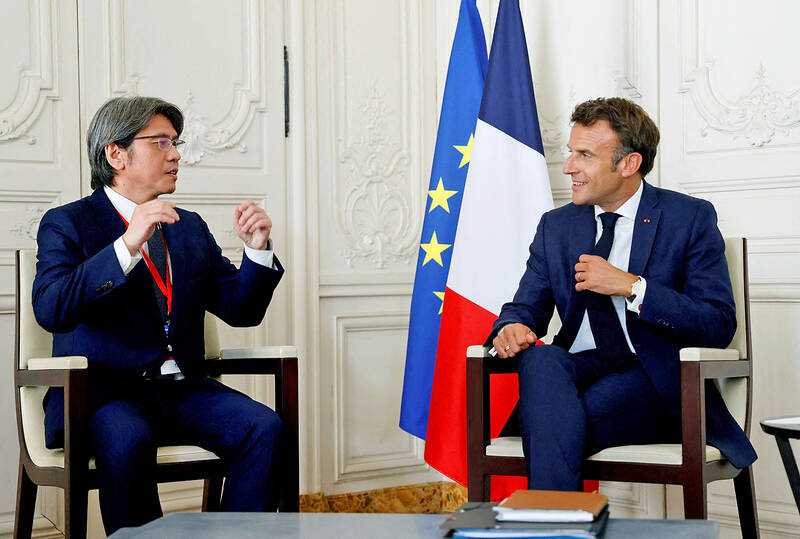

Photo: REUTERS

Europe largely depends on batteries made in Asia for electric vehicles, and national leaders are offering incentives to kickstart the industry.

That has become more urgent since the US last year passed its US$430 billion Inflation Reduction Act, which includes major tax subsidies to cut carbon emissions while boosting domestic production and manufacturing.

Macron, who met with ProLogium chief executive officer Vincent Yang (楊思枬) at the start of the vetting process, was yesterday due to officially announce the 5.2 billion euros (US$5.7 billion) investment in Dunkirk.

ProLogium executive vice president Gilles Normand said that after Macron, a former investment banker, pitched Yang more than a year ago, French Minister of Finance Bruno Le Maire followed up and helped make the company’s case with the European Commission for EU financial incentives.

“There was then the realization that there might be some interesting possibilities, which was maybe a little bit different from the cliches about France,” Normand told reporters.

ProLogium expects the project to create 3,000 jobs directly, and four times as many indirectly.

The emergence of an industrial cluster around the three battery plants already in the works was in itself an attraction, offering a critical mass of material suppliers and skilled workers, Normand said.

Also playing in France’s favor was its competitively priced zero-carbon electricity, produced by one of the biggest fleets of nuclear plants in the world, but also increasingly by offshore wind farms and solar.

Normand added that the government sweetened the deal with an incentives package, but could not give details while further subsidies were under review at the European Commission.

Macron’s government is eager to use the recent relaxation of EU state aid rules to offer tax breaks and other subsidies to encourage investment in green technologies.

He on Thursday announced that the government would offer a tax credit worth up to 40 percent of a company’s capital investment in wind, solar, heat-pump and battery projects.

Sweeping policy changes under US Secretary of Health and Human Services Robert F. Kennedy Jr are having a chilling effect on vaccine makers as anti-vaccine rhetoric has turned into concrete changes in inoculation schedules and recommendations, investors and executives said. The administration of US President Donald Trump has in the past year upended vaccine recommendations, with the country last month ending its longstanding guidance that all children receive inoculations against flu, hepatitis A and other diseases. The unprecedented changes have led to diminished vaccine usage, hurt the investment case for some biotechs, and created a drag that would likely dent revenues and

Macronix International Co (旺宏), the world’s biggest NOR flash memory supplier, yesterday said it would spend NT$22 billion (US$699.1 million) on capacity expansion this year to increase its production of mid-to-low-density memory chips as the world’s major memorychip suppliers are phasing out the market. The company said its planned capital expenditures are about 11 times higher than the NT$1.8 billion it spent on new facilities and equipment last year. A majority of this year’s outlay would be allocated to step up capacity of multi-level cell (MLC) NAND flash memory chips, which are used in embedded multimedia cards (eMMC), a managed

CULPRITS: Factors that affected the slip included falling global crude oil prices, wait-and-see consumer attitudes due to US tariffs and a different Lunar New Year holiday schedule Taiwan’s retail sales ended a nine-year growth streak last year, slipping 0.2 percent from a year earlier as uncertainty over US tariff policies affected demand for durable goods, data released on Friday by the Ministry of Economic Affairs showed. Last year’s retail sales totaled NT$4.84 trillion (US$153.27 billion), down about NT$9.5 billion, or 0.2 percent, from 2024. Despite the decline, the figure was still the second-highest annual sales total on record. Ministry statistics department deputy head Chen Yu-fang (陳玉芳) said sales of cars, motorcycles and related products, which accounted for 17.4 percent of total retail rales last year, fell NT$68.1 billion, or

In the wake of strong global demand for AI applications, Taiwan’s export-oriented economy accelerated with the composite index of economic indicators flashing the first “red” light in December for one year, indicating the economy is in booming mode, the National Development Council (NDC) said yesterday. Moreover, the index of leading indicators, which gauges the potential state of the economy over the next six months, also moved higher in December amid growing optimism over the outlook, the NDC said. In December, the index of economic indicators rose one point from a month earlier to 38, at the lower end of the “red” light.