Bhutan and Singapore-based Bitdeer Technologies Group (比特小鹿) have announced plans to raise US$500 million to establish cryptocurrency mining operations that use the Himalayan kingdom’s plentiful hydropower.

Huge amounts of electricity are needed to power the vast computer farms that mine for cryptocurrency, leading to heavy criticism of its effect on the climate and efforts to find greener mining options.

Soaring energy costs have also squeezed crypto firms, leading to the birth of several initiatives to find cheaper and more sustainable ways to power their operations in a notoriously risky and volatile industry.

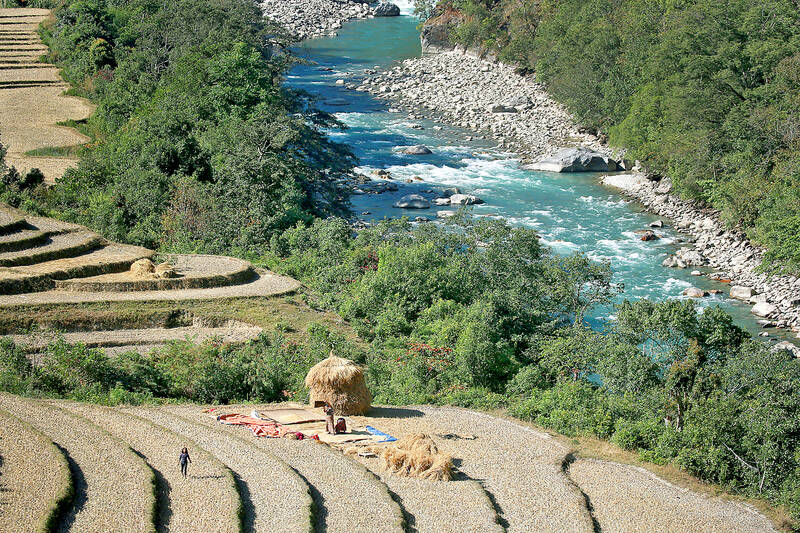

Photo: Reuters

The initiative announced on Wednesday by the Bhutan government’s investment arm Druk Holding & Investments Ltd and NASDAQ-listed crypto-mining firm Bitdeer includes the construction of data centers and investment in renewable energy such as hydropower and hydrogen.

“The partnership with Bitdeer to launch a carbon-free digital asset mining datacenter represents an investment in a more connected and sustainable domestic economy,” Druk CEO Ujjwal Deep Dahal said in a joint statement with Bitdeer.

Bhutan, sandwiched between India and China, is carbon-negative and its constitution mandates that 60 percent of the country remains forested.

It has an abundant supply of hydropower and exports electricity to India, but has ramped up efforts to expand revenue sources and diversify its economy.

Druk and Bitdeer, which already runs data centers in Norway and the US, said they expect to begin raising funds for the initiative by the end of this month.

Bitdeer is owned by Chinese crypto billionaire Jihan Wu (吳忌寒), and began trading on the NASDAQ last month.

Dozens of companies last year united under the umbrella of the Crypto Climate Accord, pledging to achieve carbon neutrality by 2030.

Two US firms — Block Inc and Blockstream Corp — are preparing to launch a fully solar-powered bitcoin mine next month.

Among the rows of vibrators, rubber torsos and leather harnesses at a Chinese sex toys exhibition in Shanghai this weekend, the beginnings of an artificial intelligence (AI)-driven shift in the industry quietly pulsed. China manufactures about 70 percent of the world’s sex toys, most of it the “hardware” on display at the fair — whether that be technicolor tentacled dildos or hyper-realistic personalized silicone dolls. Yet smart toys have been rising in popularity for some time. Many major European and US brands already offer tech-enhanced products that can enable long-distance love, monitor well-being and even bring people one step closer to

Malaysia’s leader yesterday announced plans to build a massive semiconductor design park, aiming to boost the Southeast Asian nation’s role in the global chip industry. A prominent player in the semiconductor industry for decades, Malaysia accounts for an estimated 13 percent of global back-end manufacturing, according to German tech giant Bosch. Now it wants to go beyond production and emerge as a chip design powerhouse too, Malaysian Prime Minister Anwar Ibrahim said. “I am pleased to announce the largest IC (integrated circuit) Design Park in Southeast Asia, that will house world-class anchor tenants and collaborate with global companies such as Arm [Holdings PLC],”

Sales in the retail, and food and beverage sectors last month continued to rise, increasing 0.7 percent and 13.6 percent respectively from a year earlier, setting record highs for the month of March, the Ministry of Economic Affairs said yesterday. Sales in the wholesale sector also grew last month by 4.6 annually, mainly due to the business opportunities for emerging applications related to artificial intelligence (AI) and high-performance computing technologies, the ministry said in a report. The ministry forecast that retail, and food and beverage sales this month would retain their growth momentum as the former would benefit from Tomb Sweeping Day

Thousands of parents in Singapore are furious after a Cordlife Group Ltd (康盛人生集團), a major operator of cord blood banks in Asia, irreparably damaged their children’s samples through improper handling, with some now pursuing legal action. The ongoing case, one of the worst to hit the largely untested industry, has renewed concerns over companies marketing themselves to anxious parents with mostly unproven assurances. This has implications across the region, given Cordlife’s operations in Hong Kong, Macau, Indonesia, the Philippines and India. The parents paid for years to have their infants’ cord blood stored, with the understanding that the stem cells they contained