Taiwan’s GDP growth might slow to 2 percent this year, from last year’s 2.5 percent, as weak external demand hampers exports and private investment, the Asian Development Bank (ADB) said yesterday.

Growth this year would be largely fueled by private consumption, the bank said.

The bank’s projection is slightly lower than the government’s 2.12 percent growth forecast and puts Taiwan behind the wider region’s expected 4.8 percent growth, faster than last year’s 4.2 percent.

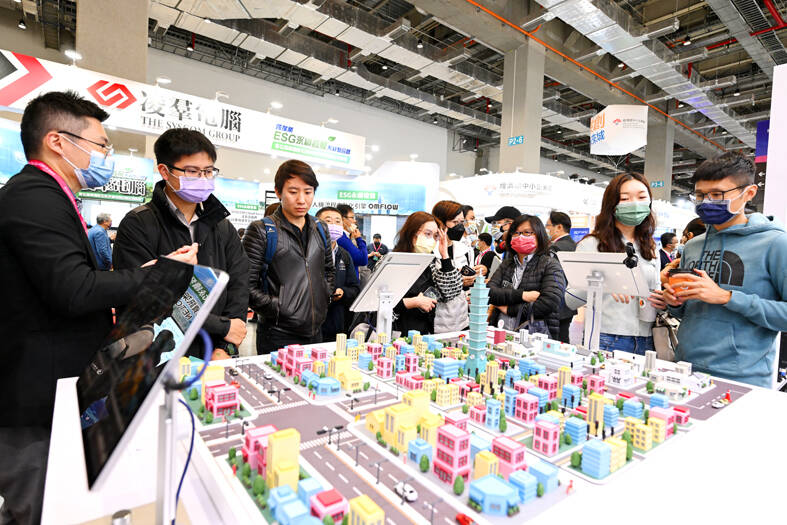

Photo: Tien Yu-hua, Taipei Times

That is because COVID-19 pandemic-driven demand for electronics used in remote work has waned and growth in external demand slowed, the Manila-based regional development bank said.

Taiwan is a critical export hub for semiconductors and other high-tech products, supplying 63 percent of the world’s semiconductors in 2020, when sales reached US$85.1 billion, it said.

Its specialization in the export of technology products has established a strong information technology supply chain, which has become the basis for a large concentration of world-class technology firms, it said.

Taiwan needs to find new growth drivers by taking advantage of the dynamism of its high-tech export sector to encourage entrepreneurial development, the ADB said.

Exports and imports are expected to post similar growth of 2 percent, as weak external demand curtails exports and investment, while stabilizing commodity prices dampen imports, it said.

Drastic monetary tightening by developed economies and most of developing Asia has dimmed global growth prospects, which is unfavorable for Taiwan’s export-driven economy, the ADB said.

Export orders from China, which account for about 40 percent of Taiwan’s overall exports, have declined, although the downtrend was partly offset by orders from the US, it said.

Private investment would slow down in line with exports, although the retreat would be mitigated by continued reshoring of overseas companies, investment in offshore wind energy projects and fleet expansions by airlines, it added.

Resilient private consumption would prop up Taiwan’s GDP growth as COVID-19 restrictions are further eased, the ADB said.

Price pressures would ease to 2 percent this year and next year, helped by stabilizing commodity prices and tighter monetary policy, it said.

The costs of rent, transportation and dining out, which drove inflation last year, would continue to rise this year, even as global commodity prices stabilize, it added.

The ADB said Taiwan should step up efforts to create an environment that nurtures innovation, as the percentage of people in the country who are starting or running a new business is relatively low at 5 percent, compared with 12 percent in South Korea, 18 percent in the US and 25 percent in the United Arab Emirates (UAE).

More than 60 percent of Taiwanese adults in a poll said it is difficult to start a business, although the country ranks 15th among 190 economies in the World Bank’s Doing Business 2020 study, suggesting a gap between public perception and the actual process of setting up a business, the ADB said.

Respondents said the pandemic decreased household incomes and made starting a business more difficult, the survey found, adding that people are generally reluctant to engage in entrepreneurial activity.

That explains why only 15 percent of Taiwanese respondents expected to start a business in the next three years, lower than the 45 percent in the UAE and 23 percent in South Korea.

Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) last week recorded an increase in the number of shareholders to the highest in almost eight months, despite its share price falling 3.38 percent from the previous week, Taiwan Stock Exchange data released on Saturday showed. As of Friday, TSMC had 1.88 million shareholders, the most since the week of April 25 and an increase of 31,870 from the previous week, the data showed. The number of shareholders jumped despite a drop of NT$50 (US$1.59), or 3.38 percent, in TSMC’s share price from a week earlier to NT$1,430, as investors took profits from their earlier gains

In a high-security Shenzhen laboratory, Chinese scientists have built what Washington has spent years trying to prevent: a prototype of a machine capable of producing the cutting-edge semiconductor chips that power artificial intelligence (AI), smartphones and weapons central to Western military dominance, Reuters has learned. Completed early this year and undergoing testing, the prototype fills nearly an entire factory floor. It was built by a team of former engineers from Dutch semiconductor giant ASML who reverse-engineered the company’s extreme ultraviolet lithography (EUV) machines, according to two people with knowledge of the project. EUV machines sit at the heart of a technological Cold

Taiwan’s long-term economic competitiveness will hinge not only on national champions like Taiwan Semiconductor Manufacturing Co. (TSMC, 台積電) but also on the widespread adoption of artificial intelligence (AI) and other emerging technologies, a US-based scholar has said. At a lecture in Taipei on Tuesday, Jeffrey Ding, assistant professor of political science at the George Washington University and author of "Technology and the Rise of Great Powers," argued that historical experience shows that general-purpose technologies (GPTs) — such as electricity, computers and now AI — shape long-term economic advantages through their diffusion across the broader economy. "What really matters is not who pioneers

TAIWAN VALUE CHAIN: Foxtron is to fully own Luxgen following the transaction and it plans to launch a new electric model, the Foxtron Bria, in Taiwan next year Yulon Motor Co (裕隆汽車) yesterday said that its board of directors approved the disposal of its electric vehicle (EV) unit, Luxgen Motor Co (納智捷汽車), to Foxtron Vehicle Technologies Co (鴻華先進) for NT$787.6 million (US$24.98 million). Foxtron, a half-half joint venture between Yulon affiliate Hua-Chuang Automobile Information Technical Center Co (華創車電) and Hon Hai Precision Industry Co (鴻海精密), expects to wrap up the deal in the first quarter of next year. Foxtron would fully own Luxgen following the transaction, including five car distributing companies, outlets and all employees. The deal is subject to the approval of the Fair Trade Commission, Foxtron said. “Foxtron will be