GlobalWafers Co (環球晶圓), the world’s third-largest silicon wafer supplier, yesterday said that the financial turmoil in the US and Europe has dimmed the outlook for chip demand in the second half of this year, as growing economic uncertainty could dampen consumer spending.

The Hsinchu-based wafer manufacturer said it is seeing greater pressure from economic uncertainty on the industry’s recovery, as customers would have not expected Silicon Valley Bank, Signature Bank and a tier-one bank like Credit Suisse Group SA to collapse suddenly.

Although the failures are unlikely to cause systemic risks, consumers would be cautious of spending on non-essential items, such as electronics, GlobalWafers said.

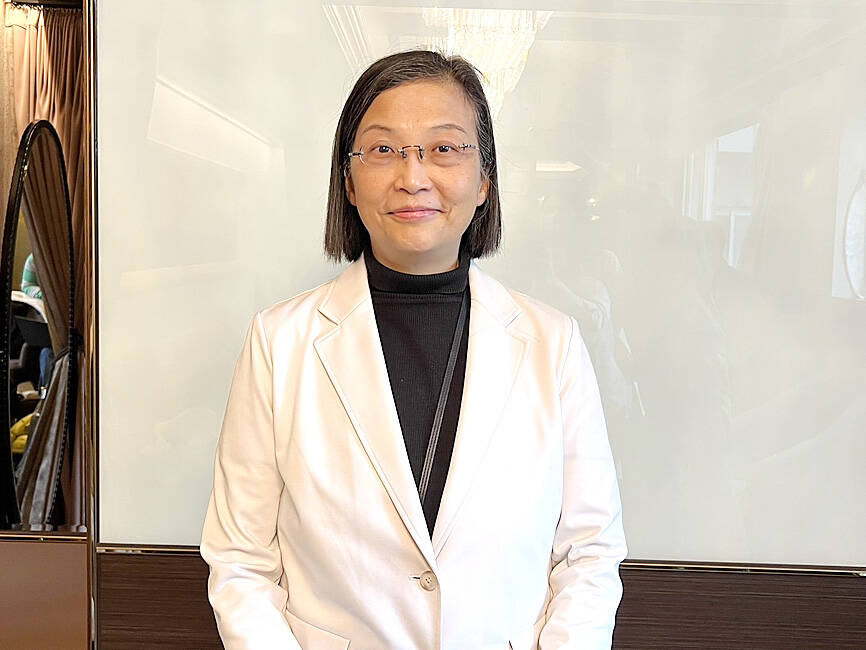

Photo: Grace Hung, Taipei Times

“We previously expected that the third quarter would be a better period. However, some customers have turned more conservative due to the spate of financial turmoil. Before that, they were more proactive” about placing orders,” GlobalWafers chairwoman Doris Hsu (徐秀蘭) said on the sidelines of an investors’ conference in Taipei.

Two months ago, GlobalWafers told investors that chip demand would pick up at a marked pace during the second half, as customers’ inventory corrections were expected to bottom out at the end of the second quarter, paving the way for a rebound in end-product demand from the third and fourth quarters.

“We are not saying that market demand will sour in the second half,” Hsu said. “Overall market sentiment turned conservative. At the same time, we also see signs of a positive direction.”

The company signed two new long-term supply agreements in the first quarter, normally a low season, Hsu said.

That indicates some customers remain bullish about chip demand in the long run, she said.

Infineon Technology AG, one of its long-term customers, this week issued a robust business outlook for this year, Hsu said.

Infineon did not ask for a delay in wafer shipments like other customers, given solid demand for power chips, she said.

Texas Instruments Inc also said it might rebuild inventory, as its stocks have dropped to a low level, Hsu said.

Another encouraging sign is that some customers have asked to reduce the number of wafers whose shipments had been delayed, Hsu said.

In addition to strong demand for chips used in autos and industrial devices, GlobalWafers has seen a recovery in demand from display drive IC makers, while demand from memorychip makers remains fragile, she said.

The company’s 8-inch and 12-inch wafer plants continue to operate at a higher utilization rate of at least 95 percent, the company said.

Regarding GlobalWafers’ new 12-inch fab in Texas, Hsu said construction has been proceeding as planned.

The US plant is expected to ramp up production at the beginning of 2025.

Asked if GlobalWafers believes the US’ request to share profits of subsidy applicants based on the Creating Helpful Incentives to Produce Semiconductors (CHIPS) and Science Act is “excessive,” Hsu said the company is categorized as a material company, rather than a foundry company, so the requirements could vary.

The company is closely monitoring when the US would release details about subsidy applications for “Phase 2” companies, she said.

NEW IDENTITY: Known for its software, India has expanded into hardware, with its semiconductor industry growing from US$38bn in 2023 to US$45bn to US$50bn India on Saturday inaugurated its first semiconductor assembly and test facility, a milestone in the government’s push to reduce dependence on foreign chipmakers and stake a claim in a sector dominated by China. Indian Prime Minister Narendra Modi opened US firm Micron Technology Inc’s semiconductor assembly, test and packaging unit in his home state of Gujarat, hailing the “dawn of a new era” for India’s technology ambitions. “When young Indians look back in the future, they will see this decade as the turning point in our tech future,” Modi told the event, which was broadcast on his YouTube channel. The plant would convert

Nanya Technology Corp (南亞科技) yesterday said the DRAM supply crunch could extend through 2028, as the artificial intelligence (AI) boom has led the world’s major memory makers to dramatically reduce production of standard DRAM and allocate a significant portion of their capacity for high-bandwidth memory (HBM) chips. The most severe supply constraints would stretch to the first half of next year due to “very limited” increases in new DRAM capacity worldwide, Nanya Technology president Lee Pei-ing (李培瑛) told a news briefing. The company plans to increase monthly 12-inch wafer capacity to 20,000 in the first half of 2028 after a

Property transactions in the nation’s six special municipalities plunged last month, as a lengthy Lunar New Year holiday combined with ongoing credit tightening dampened housing market activity, data compiled by local land administration offices released on Monday showed. The six cities recorded a total of 10,480 property transfers last month, down 42.5 percent from January and marking the second-lowest monthly level on record, the data showed. “The sharp drop largely reflected seasonal factors and tighter credit conditions,” Evertrust Rehouse Co (永慶房屋) deputy research manager Chen Chin-ping (陳金萍) said. The nine-day Lunar New Year holiday fell in February this year, reducing

New vehicle sales in Taiwan plunged about 37 percent sequentially last month as the long Lunar New Year holiday and 228 Peace Memorial Day holiday cut short the number of working days, along with the lingering uncertainty over import tax cuts on US vehicles, market researcher U-Car said in a report yesterday. New car sales last month totaled 22,043, slumping from 35,073 units in January and down 19.89 percent from 37,515 in February last year, U-Car data showed. Sales of imported luxury cars, led by Mercedes-Benz, plummeted about 45 percent to 3,109 units last month from 5,663 units in the previous month,