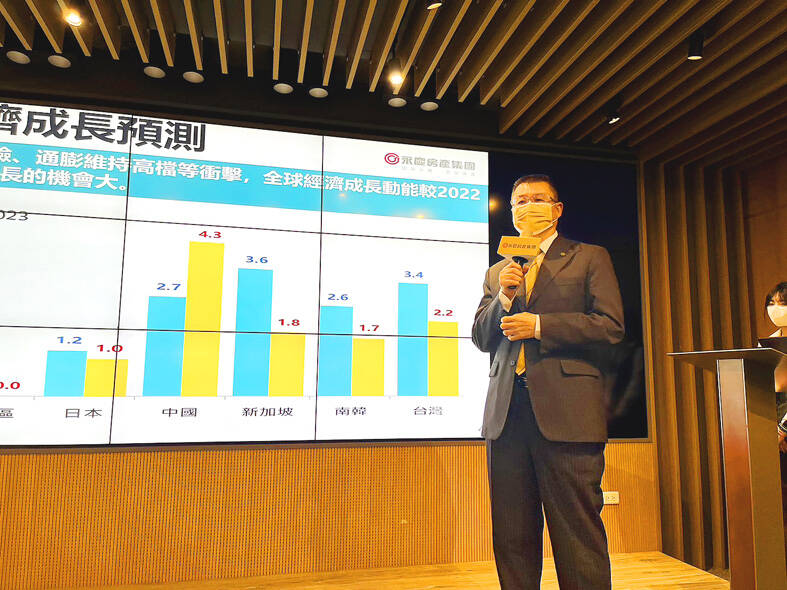

Evertrust Rehouse Co (永慶房屋), Taiwan’s largest property broker by number of offices, expects up to a 23 percent annual decline in housing transactions in the first half of this year, as its first-quarter results are worse than expected so far, high-ranking officials said yesterday.

While buying interest has picked up slightly from a quarter earlier, most buyers are hesitant to close deals due to expectations that prices will decline amid financial and economic woes, Evertrust general manager Yeh Ling-chi (葉凌棋) told a news conference in Taipei.

Property deals for this year are likely to total 132,000 to 140,000 units by June — a retreat of 18 to 23 percent from the same period last year, Yeh said.

Photo: Hsu Yi-ping, Taipei Times

The conservative forecast came after transactions nationwide in the first two months of the year slumped 28.8 percent annually to 37,048 units, he said, adding that the retreat grew to 29.4 percent in Taipei, New Taipei City, Taoyuan, Hsinchu City, Taichung, Tainan and Kaohsiung.

“An economic slowdown at home and abroad fueled expectations of price concessions, but sellers generally refused to concede, thereby slowing transactions,” Yeh said, adding that recent bank collapses in the US and Europe have encouraged caution and patience.

However, inflation and continued monetary tightening have given sellers reason to hold firm, Evertrust’s quarterly survey showed.

The poll found that 40 percent of respondents were expecting price declines, down 6 percentage points from three months earlier, while 31 percent had a neutral view.

That is because things become more expensive in times of inflation and interest rate hikes, Evertrust research manager Daniel Chen (陳賜傑) said.

About 64 percent of respondents expected the central bank to raise interest rates this year to curb inflation and account for the difference in interest rates between Taiwan and the US, Chen said.

A rapid recovery from the COVID-19 pandemic among retailers and restaurants has bolstered the occupancy rates of storefronts and dining spaces, he said.

Of the survey’s respondents, 64 percent expected vacancy rates to drop, while 74 percent expressed an interest in resuming social gatherings and eating out, Chen said.

He said 86 percent supported the government’s ban on the transfer of presale house purchase agreements, saying that the practice would help limit property speculation.

Fifty percent of people said the ban would not affect their plans to buy presale housing, he said.

Taiwan’s long-term economic competitiveness will hinge not only on national champions like Taiwan Semiconductor Manufacturing Co. (TSMC, 台積電) but also on the widespread adoption of artificial intelligence (AI) and other emerging technologies, a US-based scholar has said. At a lecture in Taipei on Tuesday, Jeffrey Ding, assistant professor of political science at the George Washington University and author of "Technology and the Rise of Great Powers," argued that historical experience shows that general-purpose technologies (GPTs) — such as electricity, computers and now AI — shape long-term economic advantages through their diffusion across the broader economy. "What really matters is not who pioneers

In a high-security Shenzhen laboratory, Chinese scientists have built what Washington has spent years trying to prevent: a prototype of a machine capable of producing the cutting-edge semiconductor chips that power artificial intelligence (AI), smartphones and weapons central to Western military dominance, Reuters has learned. Completed early this year and undergoing testing, the prototype fills nearly an entire factory floor. It was built by a team of former engineers from Dutch semiconductor giant ASML who reverse-engineered the company’s extreme ultraviolet lithography (EUV) machines, according to two people with knowledge of the project. EUV machines sit at the heart of a technological Cold

Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) last week recorded an increase in the number of shareholders to the highest in almost eight months, despite its share price falling 3.38 percent from the previous week, Taiwan Stock Exchange data released on Saturday showed. As of Friday, TSMC had 1.88 million shareholders, the most since the week of April 25 and an increase of 31,870 from the previous week, the data showed. The number of shareholders jumped despite a drop of NT$50 (US$1.59), or 3.38 percent, in TSMC’s share price from a week earlier to NT$1,430, as investors took profits from their earlier gains

TAIWAN VALUE CHAIN: Foxtron is to fully own Luxgen following the transaction and it plans to launch a new electric model, the Foxtron Bria, in Taiwan next year Yulon Motor Co (裕隆汽車) yesterday said that its board of directors approved the disposal of its electric vehicle (EV) unit, Luxgen Motor Co (納智捷汽車), to Foxtron Vehicle Technologies Co (鴻華先進) for NT$787.6 million (US$24.98 million). Foxtron, a half-half joint venture between Yulon affiliate Hua-Chuang Automobile Information Technical Center Co (華創車電) and Hon Hai Precision Industry Co (鴻海精密), expects to wrap up the deal in the first quarter of next year. Foxtron would fully own Luxgen following the transaction, including five car distributing companies, outlets and all employees. The deal is subject to the approval of the Fair Trade Commission, Foxtron said. “Foxtron will be