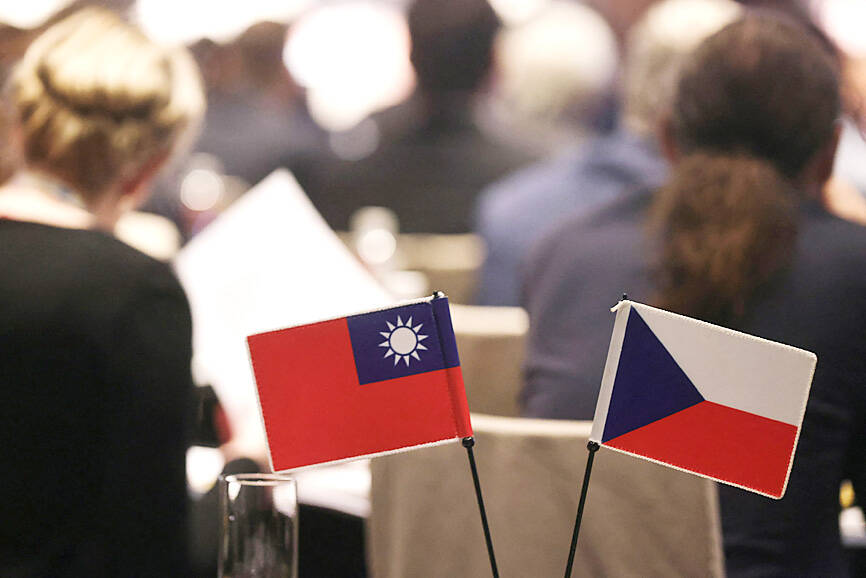

Taiwan is seeking to boost bilateral trade cooperation with the Czech Republic, targeting semiconductors, information and communication technology and electric vehicles (EVs), Minister of Economic Affairs Wang Mei-hua (王美花) said yesterday.

The ministry is working on several projects with the Czech Republic, including offering semiconductor programs, scholarships and collaboration on research and development, Wang told reporters on the sidelines of the 18th session of the Taiwan-Czech Joint Business Council meeting in Taipei.

“We are pondering how to deepen collaboration with the Czech Republic in those areas, as Taiwanese enterprises are redeploying supply chain networks in response to the recent [geopolitical] situation,” Wang said.

Photo: Reuters

“The Czech Republic considers Taiwan an ideal partner in those areas,” she said.

A Taiwanese EV company plans to expand its investment in the Czech Republic, Wang said, without disclosing the company’s name.

MIH Consortium chief executive officer Jack Cheng (鄭顯聰) attended the meeting, where he discussed the state of global EV development.

MIH is an EV alliance led by Taiwanese manufacturing giant Hon Hai Precision Industry Co (鴻海精密), which has had production lines in the Czech Republic since 2000.

Wang yesterday met a 160-member Czech delegation, led by Czech Chamber of Deputies Speaker Marketa Pekarova Adamova.

To facilitate bilateral cooperation, Taiwan plans to open a new round of trade and technology meetings in September, focusing on trade, investment and a wide range of industrial cooperation on semiconductors, smart machinery, EVs, cybersecurity and “smart” city projects, the ministry said.

Collaboration in science, research and innovation would also be on the agenda, it said.

Labor shortages and a lengthy process to apply for investment incentives are two major concerns for Taiwanese companies, it said.

Taiwanese businesses, most of which are involved in electronics, have invested US$1.2 billion in the Czech Republic, the ministry said.

SEMICONDUCTORS: The German laser and plasma generator company will expand its local services as its specialized offerings support Taiwan’s semiconductor industries Trumpf SE + Co KG, a global leader in supplying laser technology and plasma generators used in chip production, is expanding its investments in Taiwan in an effort to deeply integrate into the global semiconductor supply chain in the pursuit of growth. The company, headquartered in Ditzingen, Germany, has invested significantly in a newly inaugurated regional technical center for plasma generators in Taoyuan, its latest expansion in Taiwan after being engaged in various industries for more than 25 years. The center, the first of its kind Trumpf built outside Germany, aims to serve customers from Taiwan, Japan, Southeast Asia and South Korea,

Gasoline and diesel prices at domestic fuel stations are to fall NT$0.2 per liter this week, down for a second consecutive week, CPC Corp, Taiwan (台灣中油) and Formosa Petrochemical Corp (台塑石化) announced yesterday. Effective today, gasoline prices at CPC and Formosa stations are to drop to NT$26.4, NT$27.9 and NT$29.9 per liter for 92, 95 and 98-octane unleaded gasoline respectively, the companies said in separate statements. The price of premium diesel is to fall to NT$24.8 per liter at CPC stations and NT$24.6 at Formosa pumps, they said. The price adjustments came even as international crude oil prices rose last week, as traders

Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), which supplies advanced chips to Nvidia Corp and Apple Inc, yesterday reported NT$1.046 trillion (US$33.1 billion) in revenue for last quarter, driven by constantly strong demand for artificial intelligence (AI) chips, falling in the upper end of its forecast. Based on TSMC’s financial guidance, revenue would expand about 22 percent sequentially to the range from US$32.2 billion to US$33.4 billion during the final quarter of 2024, it told investors in October last year. Last year in total, revenue jumped 31.61 percent to NT$3.81 trillion, compared with NT$2.89 trillion generated in the year before, according to

PRECEDENTED TIMES: In news that surely does not shock, AI and tech exports drove a banner for exports last year as Taiwan’s economic growth experienced a flood tide Taiwan’s exports delivered a blockbuster finish to last year with last month’s shipments rising at the second-highest pace on record as demand for artificial intelligence (AI) hardware and advanced computing remained strong, the Ministry of Finance said yesterday. Exports surged 43.4 percent from a year earlier to US$62.48 billion last month, extending growth to 26 consecutive months. Imports climbed 14.9 percent to US$43.04 billion, the second-highest monthly level historically, resulting in a trade surplus of US$19.43 billion — more than double that of the year before. Department of Statistics Director-General Beatrice Tsai (蔡美娜) described the performance as “surprisingly outstanding,” forecasting export growth