US stocks closed higher on Friday, marking the end of a tumultuous week as US Federal Reserve officials calmed investor fears over a potential liquidity crisis in the banking sector.

While all three major US stock indices started the session sharply lower on the heels of a sell-off among European banks, those losses reversed by closing bell, repeating the intraday roller coaster ride of recent sessions.

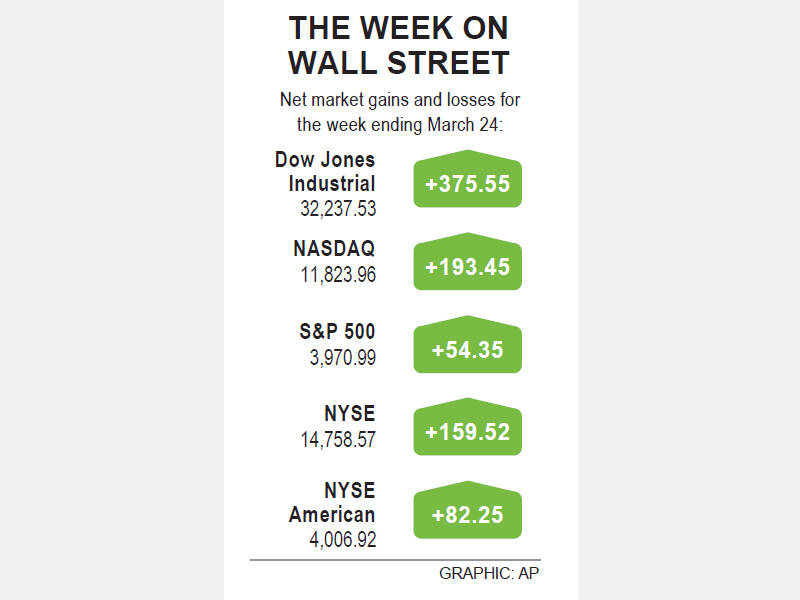

At the conclusion of an up-and-down week, marked by a Fed interest rate hike and mounting worries over the health of the US banking system, all three indices notched weekly gains.

The S&P 500 inched up 22.27 points, or 0.56 percent, to close at 3,970.99, after gaining 1.39 percent over the week.

The Dow Jones Industrial Average on Friday rose 132.28 points, or 0.41 percent, to 32,237.53, ending the week 1.18 percent higher, while the NASDAQ Composite added 36.56 points, or 0.31 percent, to close at 11,823.96, gaining 1.66 percent over the week.

“Equity markets drifted higher as concerns lingered about another banking flare-up in the US or abroad,” said David Carter, managing director at JPMorgan Private Bank in New York. “Wall Street is taking its cues from Washington and other capitals as it relates to interest rates and banking regulations.”

Photo: Reuters

In separate appearances, three regional regional Fed presidents said that their confidence that the banking system was not facing a liquidity crisis is what led to the decision to implement a 25 basis point policy rate hike on Wednesday.

However, while Fed officials continue to see additional rate hikes as a strong possibility, financial markets are favoring the likelihood of no hike at all at the conclusion of its next policy meeting in May.

“The Fed may be jaw-boning a bit as it says more rate increases may be coming this year,” Carter said. “It helps both their inflation goal and suggests confidence in our economic system.”

Worries over potential contagion beyond regional banks threatening to spread to their larger peers was sparked by a sell-off of European bank shares.

That sell-off was prompted by the rising cost of insuring Deutsche Bank’s debt, expressed by its credit default swaps, coming on the heels of a Swiss government-sponsored buyout of Credit Suisse.

However, worries over sector-wide stress eased by mid-afternoon on Friday.

Nine of the 11 major sectors in the S&P 500 inched up, with defensive sectors such as utilities and real estate enjoying the biggest percentage gains. Consumer discretionary and financials were the two losers.

US-traded shares of Deutsche Bank dropped 3.1 percent.

Shares of major US banks, such as JPMorgan Chase & Co and Wells Fargo, pared their losses, but still ended lower, while Bank of America flipped green.

Regional lenders PacWest Bancorp and Western Alliance Bancorp jumped 3.2 percent and 5.8 percent respectively, while First Republic Bank dropped 1.4 percent.

Activision Blizzard Inc jumped 5.9 percent after the British competition regulator dropped some competition concerns over a Microsoft Corp-Activision deal.

Advancing issues outnumbered declining ones on the New York Stock Exchange by a 1.47-to-1 ratio, while on the NASDAQ, a 1.26-to-1 ratio favored advancers.

The S&P 500 posted four new 52-week highs and 35 new lows, and the NASDAQ recorded 34 new highs and 298 new lows.

Volume on US exchanges was 11.08 billion shares, compared with the 12.84 billion average over the past 20 trading days.

Among the rows of vibrators, rubber torsos and leather harnesses at a Chinese sex toys exhibition in Shanghai this weekend, the beginnings of an artificial intelligence (AI)-driven shift in the industry quietly pulsed. China manufactures about 70 percent of the world’s sex toys, most of it the “hardware” on display at the fair — whether that be technicolor tentacled dildos or hyper-realistic personalized silicone dolls. Yet smart toys have been rising in popularity for some time. Many major European and US brands already offer tech-enhanced products that can enable long-distance love, monitor well-being and even bring people one step closer to

Malaysia’s leader yesterday announced plans to build a massive semiconductor design park, aiming to boost the Southeast Asian nation’s role in the global chip industry. A prominent player in the semiconductor industry for decades, Malaysia accounts for an estimated 13 percent of global back-end manufacturing, according to German tech giant Bosch. Now it wants to go beyond production and emerge as a chip design powerhouse too, Malaysian Prime Minister Anwar Ibrahim said. “I am pleased to announce the largest IC (integrated circuit) Design Park in Southeast Asia, that will house world-class anchor tenants and collaborate with global companies such as Arm [Holdings PLC],”

TRANSFORMATION: Taiwan is now home to the largest Google hardware research and development center outside of the US, thanks to the nation’s economic policies President Tsai Ing-wen (蔡英文) yesterday attended an event marking the opening of Google’s second hardware research and development (R&D) office in Taiwan, which was held at New Taipei City’s Banciao District (板橋). This signals Taiwan’s transformation into the world’s largest Google hardware research and development center outside of the US, validating the nation’s economic policy in the past eight years, she said. The “five plus two” innovative industries policy, “six core strategic industries” initiative and infrastructure projects have grown the national industry and established resilient supply chains that withstood the COVID-19 pandemic, Tsai said. Taiwan has improved investment conditions of the domestic economy

Sales in the retail, and food and beverage sectors last month continued to rise, increasing 0.7 percent and 13.6 percent respectively from a year earlier, setting record highs for the month of March, the Ministry of Economic Affairs said yesterday. Sales in the wholesale sector also grew last month by 4.6 annually, mainly due to the business opportunities for emerging applications related to artificial intelligence (AI) and high-performance computing technologies, the ministry said in a report. The ministry forecast that retail, and food and beverage sales this month would retain their growth momentum as the former would benefit from Tomb Sweeping Day