Gasoline prices are to drop NT$0.3 per liter this week due to a fall in global crude oil prices last week, CPC Corp, Taiwan (CPC, 台灣中油) and Formosa Petrochemical Corp (台塑石化) said in separate statements yesterday.

Crude oil prices fell last week after OPEC forecast a slight oversupply in the oil market for next quarter, the companies said.

Oil prices also dropped amid heightened fears of a global economic slowdown amid the collapse of Silicon Valley Bank in the US and the financial crisis at Credit Suisse Group AG in Europe, they said.

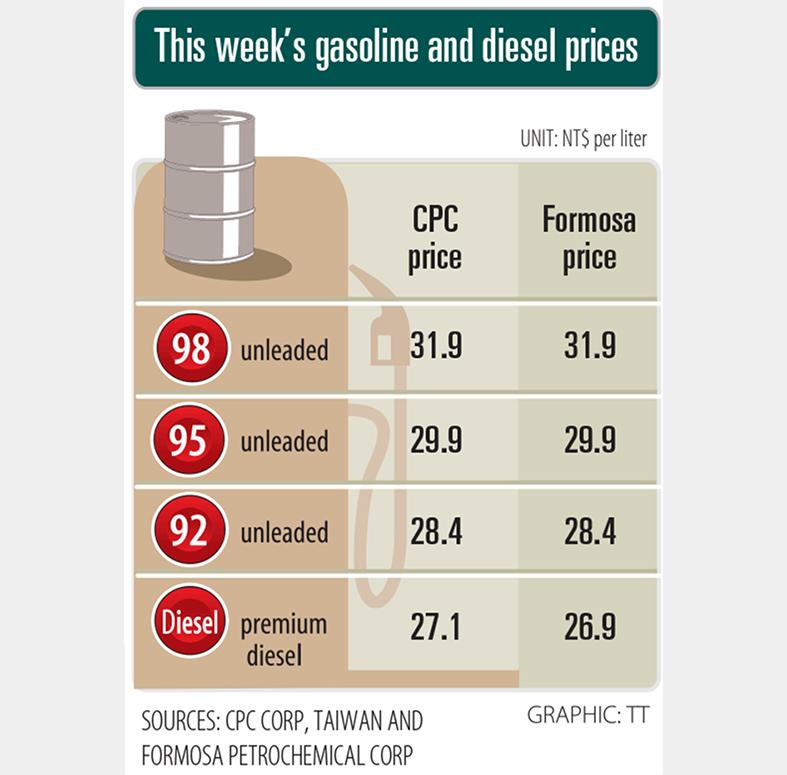

Gasoline prices at CPC and Formosa stations today are to decrease to NT$28.9, NT$30.4 and NT$32.4 per liter for 92, 95 and 98-octane unleaded gasoline respectively, the companies said.

However, the price of premium diesel is to rise NT$0.5 per liter to NT$27.6 at CPC stations, and to NT$27.4 at Formosa pumps this week, after the companies factored in their oil price formulas, domestic market competition and global market trends, they said.

Separately, the government has secured liquefied natural gas (LNG) supplies after the closing of a nuclear reactor increased the need for alternative power sources.

CPC, which supplies gas to Taiwan’s power utility, last week purchased through a tender a minimum of 10 LNG cargoes for delivery between May this year and March next year, traders with knowledge of the matter said.

The purchases are part of a larger strategy to secure LNG over the next year amid lower nuclear output, the traders said.

The Guosheng Nuclear Power Plant No. 2 reactor in New Taipei City’s Wanli District (萬里) retired last week upon reaching its service lifetime of 40 years.

Additional reporting by Bloomberg

The US dollar was trading at NT$29.7 at 10am today on the Taipei Foreign Exchange, as the New Taiwan dollar gained NT$1.364 from the previous close last week. The NT dollar continued to rise today, after surging 3.07 percent on Friday. After opening at NT$30.91, the NT dollar gained more than NT$1 in just 15 minutes, briefly passing the NT$30 mark. Before the US Department of the Treasury's semi-annual currency report came out, expectations that the NT dollar would keep rising were already building. The NT dollar on Friday closed at NT$31.064, up by NT$0.953 — a 3.07 percent single-day gain. Today,

‘SHORT TERM’: The local currency would likely remain strong in the near term, driven by anticipated US trade pressure, capital inflows and expectations of a US Fed rate cut The US dollar is expected to fall below NT$30 in the near term, as traders anticipate increased pressure from Washington for Taiwan to allow the New Taiwan dollar to appreciate, Cathay United Bank (國泰世華銀行) chief economist Lin Chi-chao (林啟超) said. Following a sharp drop in the greenback against the NT dollar on Friday, Lin told the Central News Agency that the local currency is likely to remain strong in the short term, driven in part by market psychology surrounding anticipated US policy pressure. On Friday, the US dollar fell NT$0.953, or 3.07 percent, closing at NT$31.064 — its lowest level since Jan.

Hong Kong authorities ramped up sales of the local dollar as the greenback’s slide threatened the foreign-exchange peg. The Hong Kong Monetary Authority (HKMA) sold a record HK$60.5 billion (US$7.8 billion) of the city’s currency, according to an alert sent on its Bloomberg page yesterday in Asia, after it tested the upper end of its trading band. That added to the HK$56.1 billion of sales versus the greenback since Friday. The rapid intervention signals efforts from the city’s authorities to limit the local currency’s moves within its HK$7.75 to HK$7.85 per US dollar trading band. Heavy sales of the local dollar by

The Financial Supervisory Commission (FSC) yesterday met with some of the nation’s largest insurance companies as a skyrocketing New Taiwan dollar piles pressure on their hundreds of billions of dollars in US bond investments. The commission has asked some life insurance firms, among the biggest Asian holders of US debt, to discuss how the rapidly strengthening NT dollar has impacted their operations, people familiar with the matter said. The meeting took place as the NT dollar jumped as much as 5 percent yesterday, its biggest intraday gain in more than three decades. The local currency surged as exporters rushed to