Shares in Asia on Friday advanced, tracking a rally on Wall Street after a group of big banks offered a lifeline to First Republic Bank, the lender investors had focused on in their latest hunt for troubles in the banking industry.

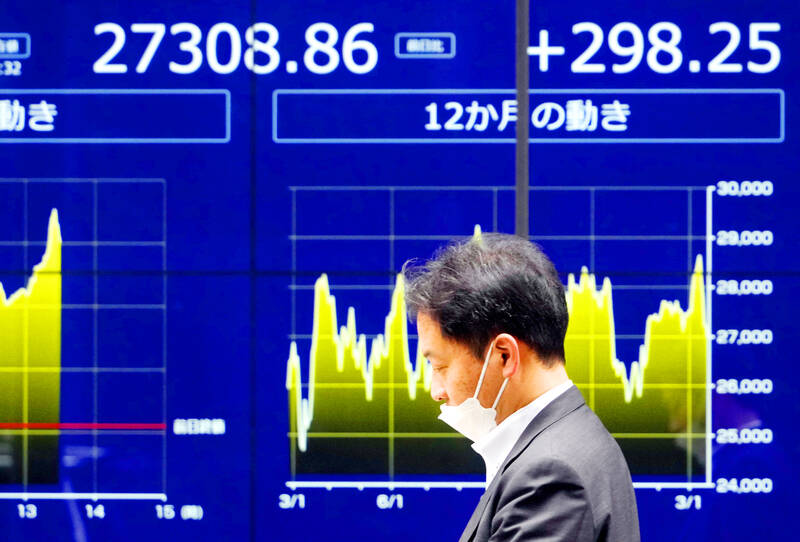

Benchmarks rose more than 1 percent in Taiwan, Hong Kong and Tokyo. US futures were mixed and oil prices climbed.

The S&P 500 on Thursday rose 1.8 percent, erasing earlier losses following reports that First Republic Bank could get help or sell itself to another bank.

Photo: EPA-EFE

Markets have gyrated this week on concerns over the toll on banks from the fastest set of interest rate hikes in decades. The turmoil flared with last week’s collapse of Silicon Valley Bank, the second-largest bank failure in US history.

“The market remains cautious; traders do not want to get overexcited, especially with investors still focusing on what can go wrong instead of what could go right,” SPI Asset Management managing partner Stephen Innes said in a report.

In Taipei, the TAIEX closed up 231.84 points, or 1.52 percent, at 15,452.96, falling 0.47 percent from the previous week. Turnover totaled NT$264.593 billion (US$8.66 billion) during the session.

Hong Kong’s Hang Seng rose 1.64 percent to 19,518.59, posting a 1.03 percent weekly gain, while the Shanghai Composite Index added 0.73 percent to 3,250.55, rising 0.63 percent for the week.

Tokyo’s Nikkei 225 gained 1.2 percent to 27,333.79, falling 2.88 percent from the previous week, while the broader TOPIX rose 1.15 percent to 1,959.42, down 3.55 percent weekly.

Shares in major Japanese banks, which fell sharply at times this week, were mostly slightly higher.

Seoul’s KOSPI added 0.75 percent to 2,395.69, up 0.05 percent for the week, while Australia’s S&P/ASX 200 rose 0.42 percent to 6,994.8, down 2.1 percent weekly, and India’s SENSEX gained 0.62 percent to 57,989.90, falling 1.94 percent for the week.

Additional reporting by staff writer, with CNA

To many, Tatu City on the outskirts of Nairobi looks like a success. The first city entirely built by a private company to be operational in east Africa, with about 25,000 people living and working there, it accounts for about two-thirds of all foreign investment in Kenya. Its low-tax status has attracted more than 100 businesses including Heineken, coffee brand Dormans, and the biggest call-center and cold-chain transport firms in the region. However, to some local politicians, Tatu City has looked more like a target for extortion. A parade of governors have demanded land worth millions of dollars in exchange

Hong Kong authorities ramped up sales of the local dollar as the greenback’s slide threatened the foreign-exchange peg. The Hong Kong Monetary Authority (HKMA) sold a record HK$60.5 billion (US$7.8 billion) of the city’s currency, according to an alert sent on its Bloomberg page yesterday in Asia, after it tested the upper end of its trading band. That added to the HK$56.1 billion of sales versus the greenback since Friday. The rapid intervention signals efforts from the city’s authorities to limit the local currency’s moves within its HK$7.75 to HK$7.85 per US dollar trading band. Heavy sales of the local dollar by

Taiwan Semiconductor Manufacturing Co’s (TSMC, 台積電) revenue jumped 48 percent last month, underscoring how electronics firms scrambled to acquire essential components before global tariffs took effect. The main chipmaker for Apple Inc and Nvidia Corp reported monthly sales of NT$349.6 billion (US$11.6 billion). That compares with the average analysts’ estimate for a 38 percent rise in second-quarter revenue. US President Donald Trump’s trade war is prompting economists to retool GDP forecasts worldwide, casting doubt over the outlook for everything from iPhone demand to computing and datacenter construction. However, TSMC — a barometer for global tech spending given its central role in the

An Indonesian animated movie is smashing regional box office records and could be set for wider success as it prepares to open beyond the Southeast Asian archipelago’s silver screens. Jumbo — a film based on the adventures of main character, Don, a large orphaned Indonesian boy facing bullying at school — last month became the highest-grossing Southeast Asian animated film, raking in more than US$8 million. Released at the end of March to coincide with the Eid holidays after the Islamic fasting month of Ramadan, the movie has hit 8 million ticket sales, the third-highest in Indonesian cinema history, Film