Taiwan is not at risk of stagflation as the nation’s economy would grow at least 2 percent this year with inflation expanding by a similar rate, rendering current monetary policies appropriate, central bank Governor Yang Chin-long (楊金龍) said at a meeting of the legislature’s Finance Committee yesterday.

Taiwan’s GDP growth, projected at 2.12 percent this year by the Directorate-General of Budget, Accounting and Statistics (DGBAS), would receive a further boost from the government’s plan to distribute NT$6,000 to all citizens later this year, Yang said.

The stimulus program would lift this year’s economic growth to about 2.5 percent, he added.

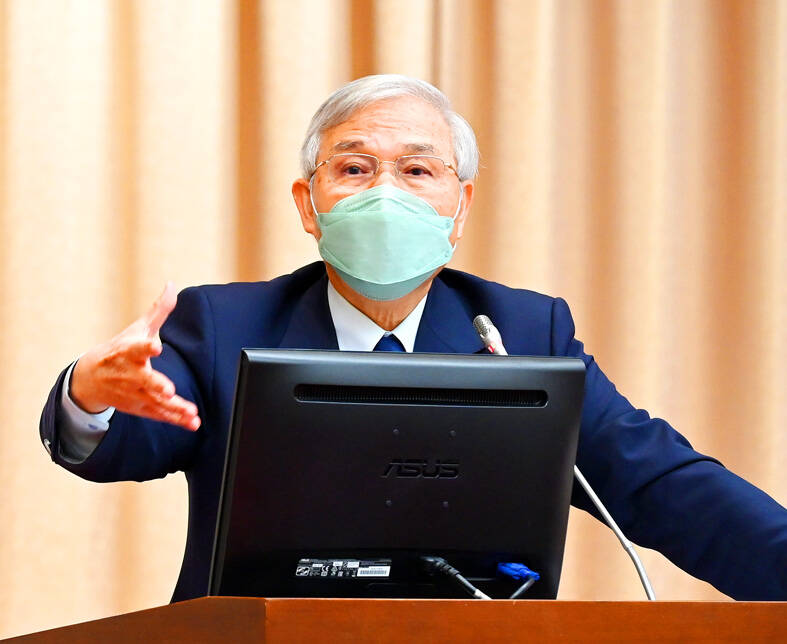

Photo: Wang Yi-sung, Taipei Times

Yang’s statements came after lawmakers cited central bank Deputy Governor Chen Nan-kuang (陳南光) as questioning whether the bank should act more aggressively in fighting inflation.

In an article in last month’s edition of Taiwan Banker magazine, Chen said the central bank should have adopted a more aggressive monetary policy to fight inflation as the country could slip into stagflation.

Stagflation refers to a period of rapid price increases, accompanied by low or negative growth and high unemployment.

Yang dismissed the concern, saying that Taiwan’s GDP would expand by more than 2 percent this year unless global economic conditions deteriorate faster than expected.

The first half of this year would be fairly weak as inventory corrections are likely to continue hounding exporters, Yang said.

However, the situation should improve in the second half of the year on the back of inventory restocking and the holiday season, he said.

Taiwan’s low unemployment rate should further lend support to the governor’s cautiously optimistic view.

The central bank is looking at inflation of 2 percent and would update its forecast at the next board meeting on March 23, Yang said.

Most board members rallied behind the decision in December to hike policy rates by 12.5 basis points, a move Yang called “appropriate” given Taiwan’s moderate inflation.

Since March last year, the central bank has raised rates by 62.5 basis points, while the US Federal Reserve has increased rates by 450 basis points.

Growth in Taiwan’s consumer price index (CPI) climbed above the 3 percent mark in January, but this was mainly due to the Lunar New Year holiday effect, and likely eased last month and possibly beyond, the governor said.

Inflationary pressures remain, and the central bank would review policy rates after considering geopolitical tensions, commodity price trends, climate change, and economic movements at home and abroad, he said.

International research bodies expect Taiwan’s CPI to expand between 1.4 percent and 2.6 percent this year, compared with the DGBAS’ projection of 2.16 percent, Yang said.

The wide range highlights the uncertainty that makes forecasting difficult, he said.

The governor said he welcomed a bill sponsored by US lawmakers advocating IMF membership for Taiwan, which he said would bring plenty of benefits and no negative effects.

IMF officials assisted the central bank in drawing up its duties and responsibilities, and guided it in how it should operate to maintain the financial market’s stability, Yang said.

However, Yang said he understood that UN membership is a precondition for pursuing IMF membership.

Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) last week recorded an increase in the number of shareholders to the highest in almost eight months, despite its share price falling 3.38 percent from the previous week, Taiwan Stock Exchange data released on Saturday showed. As of Friday, TSMC had 1.88 million shareholders, the most since the week of April 25 and an increase of 31,870 from the previous week, the data showed. The number of shareholders jumped despite a drop of NT$50 (US$1.59), or 3.38 percent, in TSMC’s share price from a week earlier to NT$1,430, as investors took profits from their earlier gains

In a high-security Shenzhen laboratory, Chinese scientists have built what Washington has spent years trying to prevent: a prototype of a machine capable of producing the cutting-edge semiconductor chips that power artificial intelligence (AI), smartphones and weapons central to Western military dominance, Reuters has learned. Completed early this year and undergoing testing, the prototype fills nearly an entire factory floor. It was built by a team of former engineers from Dutch semiconductor giant ASML who reverse-engineered the company’s extreme ultraviolet lithography (EUV) machines, according to two people with knowledge of the project. EUV machines sit at the heart of a technological Cold

TAIWAN VALUE CHAIN: Foxtron is to fully own Luxgen following the transaction and it plans to launch a new electric model, the Foxtron Bria, in Taiwan next year Yulon Motor Co (裕隆汽車) yesterday said that its board of directors approved the disposal of its electric vehicle (EV) unit, Luxgen Motor Co (納智捷汽車), to Foxtron Vehicle Technologies Co (鴻華先進) for NT$787.6 million (US$24.98 million). Foxtron, a half-half joint venture between Yulon affiliate Hua-Chuang Automobile Information Technical Center Co (華創車電) and Hon Hai Precision Industry Co (鴻海精密), expects to wrap up the deal in the first quarter of next year. Foxtron would fully own Luxgen following the transaction, including five car distributing companies, outlets and all employees. The deal is subject to the approval of the Fair Trade Commission, Foxtron said. “Foxtron will be

INFLATION CONSIDERATION: The BOJ governor said that it would ‘keep making appropriate decisions’ and would adjust depending on the economy and prices The Bank of Japan (BOJ) yesterday raised its benchmark interest rate to the highest in 30 years and said more increases are in the pipeline if conditions allow, in a sign of growing conviction that it can attain the stable inflation target it has pursued for more than a decade. Bank of Japan Governor Kazuo Ueda’s policy board increased the rate by 0.2 percentage points to 0.75 percent, in a unanimous decision, the bank said in a statement. The central bank cited the rising likelihood of its economic outlook being realized. The rate change was expected by all 50 economists surveyed by Bloomberg. The