Power plants would be paid 15 percent less next year to provide backup electricity on the largest US grid, a big blow to aging coal units that have already struggled against cheap renewable energy.

Generators that provide electricity to the grid stretching from New Jersey to Illinois would get US$28.92 a megawatt-day from utilities to provide capacity over a 12-month period starting in the middle of next year, according to the results of an auction disclosed on Monday.

That is down from US$34.13 in the previous auction, released in June last year.

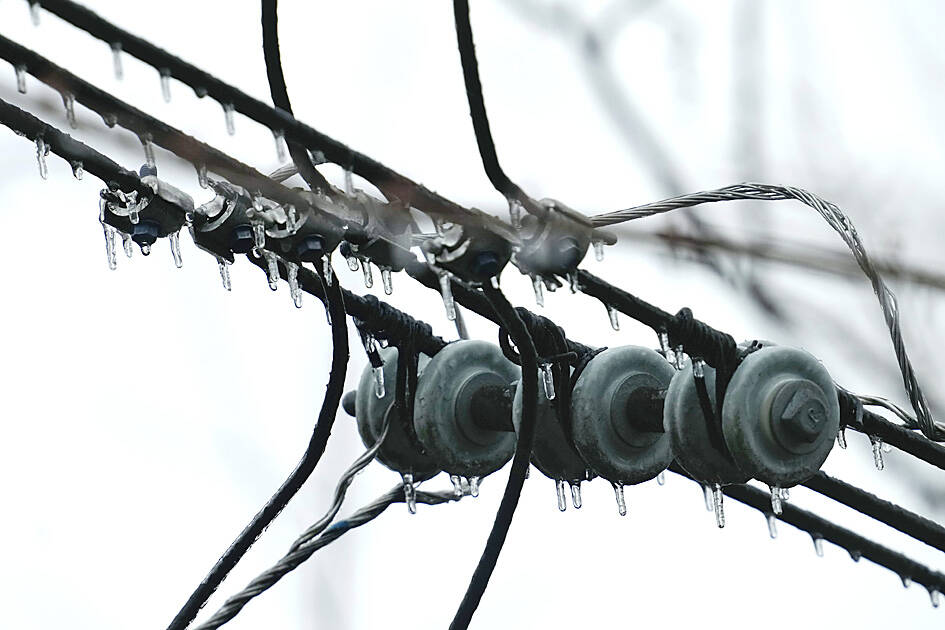

Photo: AP

The auction provides a crucial source of revenue for plants that together serve 65 million people, shaping the electricity mix for a vast swathe of the US.

One of the most notable changes from past auctions was the sharp decrease in coal plants vying for contracts coupled with a big increase of solar. The change reflects the accelerating shift to clean energy, driven in part by tighter environmental rules that affect the dirtiest fossil fuel, as well as federal and state incentives to support clean power.

“The economic consequences and the policy decisions being made are affecting coal more than other resources,” Stu Bresler, senior vice president of market services at grid operator PJM Interconnection LLC, said in a briefing.

The amount of power that bid into the auction fell by about 2 gigawatts from the prior auction, mostly coal units.

Altogether, about 6 gigawatts of capacity shuttered last year and about 6 additional gigawatts are expected to close this year.

The majority of the retirements across last year and this year are expected to be coal units.

The latest auction continued a three-year trend of decreasing amounts of megawatts offered.

If that continues, Bresler said it could raise concerns about reliability.

For now, the grid has enough capacity to ensure the lights stay on, officials said.

“They are concerned about retirements — and the new stuff coming is renewables,” said Paul Patterson, an analyst at Glenrock Associates LLC. “It seems like they are planning significant market rule changes to address what they feel are problems with the market.”

The auction results were delayed by two months after some fossil-fuel and renewable plants that had been expected to be online by June next year did not bid into the auction. That risked a surge in power prices in part of the grid’s territory.

The grid operator called these costs “unjust and unreasonable,” and it sought permission from the US Federal Energy Regulatory Commission to revise the rules. The agency approved the change last week, allowing PJM to release the auction results.

To many, Tatu City on the outskirts of Nairobi looks like a success. The first city entirely built by a private company to be operational in east Africa, with about 25,000 people living and working there, it accounts for about two-thirds of all foreign investment in Kenya. Its low-tax status has attracted more than 100 businesses including Heineken, coffee brand Dormans, and the biggest call-center and cold-chain transport firms in the region. However, to some local politicians, Tatu City has looked more like a target for extortion. A parade of governors have demanded land worth millions of dollars in exchange

Hong Kong authorities ramped up sales of the local dollar as the greenback’s slide threatened the foreign-exchange peg. The Hong Kong Monetary Authority (HKMA) sold a record HK$60.5 billion (US$7.8 billion) of the city’s currency, according to an alert sent on its Bloomberg page yesterday in Asia, after it tested the upper end of its trading band. That added to the HK$56.1 billion of sales versus the greenback since Friday. The rapid intervention signals efforts from the city’s authorities to limit the local currency’s moves within its HK$7.75 to HK$7.85 per US dollar trading band. Heavy sales of the local dollar by

Taiwan Semiconductor Manufacturing Co’s (TSMC, 台積電) revenue jumped 48 percent last month, underscoring how electronics firms scrambled to acquire essential components before global tariffs took effect. The main chipmaker for Apple Inc and Nvidia Corp reported monthly sales of NT$349.6 billion (US$11.6 billion). That compares with the average analysts’ estimate for a 38 percent rise in second-quarter revenue. US President Donald Trump’s trade war is prompting economists to retool GDP forecasts worldwide, casting doubt over the outlook for everything from iPhone demand to computing and datacenter construction. However, TSMC — a barometer for global tech spending given its central role in the

An Indonesian animated movie is smashing regional box office records and could be set for wider success as it prepares to open beyond the Southeast Asian archipelago’s silver screens. Jumbo — a film based on the adventures of main character, Don, a large orphaned Indonesian boy facing bullying at school — last month became the highest-grossing Southeast Asian animated film, raking in more than US$8 million. Released at the end of March to coincide with the Eid holidays after the Islamic fasting month of Ramadan, the movie has hit 8 million ticket sales, the third-highest in Indonesian cinema history, Film