Wall Street’s main indices reported their biggest weekly drop of the year after sharp losses on Friday, as investors braced for the possibility of more aggressive rate hikes from the US Federal Reserve due to US economic data pointing to resilient consumers.

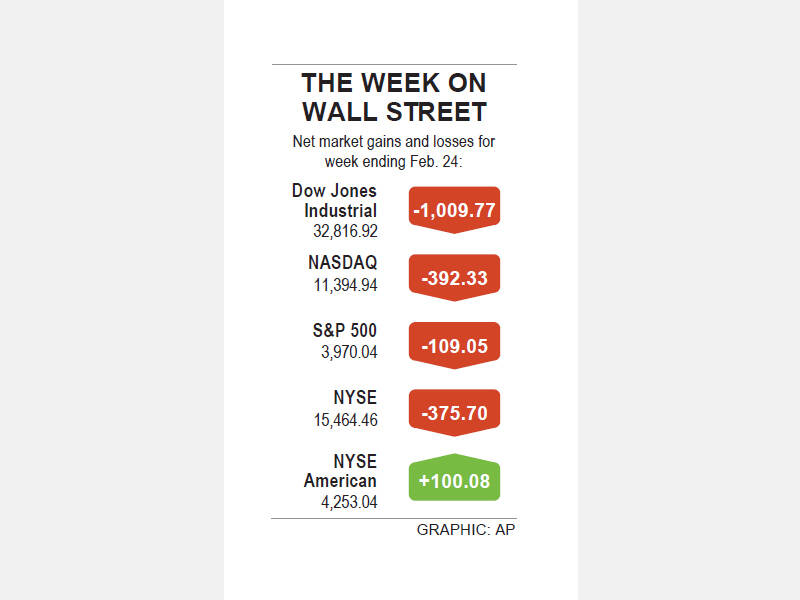

For the blue-chip Dow Jones Industrial Average, the 2.99 percent fall was its biggest weekly decline since September last year. It was also the Dow’s fourth straight weekly decline, its longest losing streak in nearly 10 months.

The S&P 500 and NASDAQ Composite were also down 2.67 percent and 3.33 percent respectively.

After a strong month last month, stocks have retreated this month as a slew of economic data amplified worries that the US central bank might have to keep rates higher for longer.

The personal consumption expenditures price index, the Fed’s preferred inflation gauge, shot up 0.6 percent last month after gaining just 0.2 percent in December, data released on Friday showed.

Consumer spending, which accounts for more than two-thirds of US economic activity, jumped 1.8 percent last month, exceeding forecasts for a 1.3 percent increase.

Photo: Reuters

Previous market cycles had witnessed similar delayed reactions by the market to rising interest rates and data releases, which helps explain volatile trading patterns as investors slowly adjust, Glenmede chief investment officer of private wealth Jason Pride said.

“This market has not yet realized the likelihood of a recession that we think is reality,” he said, adding that past rate hikes had normally taken between six and 18 months before their effects fully filtered through into the economy.

“We don’t think [a recession is] a given, but there’s a higher likelihood than the market has embedded in its thought process,” Pride said.

Traders of futures tied to the Fed’s policy rate added to bets of at least three more rate hikes this year, with the peak rate expected to be in the range of 5.25 to 5.5 percent by June.

The Fed should raise interest rates higher than necessary if need be to get inflation fully under control, Cleveland Fed President Loretta Mester said.

The Dow Jones Industrial Average fell 336.99 points, or 1.02 percent, to 32,816.92, the S&P 500 lost 42.28 points, or 1.05 percent, to 3,970.04 and the NASDAQ Composite dropped 195.46 points, or 1.69 percent, to 11,394.94.

Nine of the 11 major S&P sectors fell, with real estate, technology and consumer discretionary the biggest decliners. Communication services fell 1.4 percent, marking a sixth straight loss, its worst run since a similar six-session skid in August.

Megacap stocks including Tesla Inc, Amazon.com Inc and Nvidia Corp slid 1.6 to 2.6 percent as US Treasury yields rose.

The yield on two-year Treasury notes, which are highly sensitive to Fed policy, climbed to 4.826 percent — its highest in nearly four months.

Volume on US exchanges was 10.31 billion shares, compared with the 11.53 billion average for the full session over the past 20 trading days.

The S&P 500 posted two new 52-week highs and 11 new lows, while the NASDAQ Composite recorded 44 new highs and 162 new lows.

The US dollar was trading at NT$29.7 at 10am today on the Taipei Foreign Exchange, as the New Taiwan dollar gained NT$1.364 from the previous close last week. The NT dollar continued to rise today, after surging 3.07 percent on Friday. After opening at NT$30.91, the NT dollar gained more than NT$1 in just 15 minutes, briefly passing the NT$30 mark. Before the US Department of the Treasury's semi-annual currency report came out, expectations that the NT dollar would keep rising were already building. The NT dollar on Friday closed at NT$31.064, up by NT$0.953 — a 3.07 percent single-day gain. Today,

‘SHORT TERM’: The local currency would likely remain strong in the near term, driven by anticipated US trade pressure, capital inflows and expectations of a US Fed rate cut The US dollar is expected to fall below NT$30 in the near term, as traders anticipate increased pressure from Washington for Taiwan to allow the New Taiwan dollar to appreciate, Cathay United Bank (國泰世華銀行) chief economist Lin Chi-chao (林啟超) said. Following a sharp drop in the greenback against the NT dollar on Friday, Lin told the Central News Agency that the local currency is likely to remain strong in the short term, driven in part by market psychology surrounding anticipated US policy pressure. On Friday, the US dollar fell NT$0.953, or 3.07 percent, closing at NT$31.064 — its lowest level since Jan.

The New Taiwan dollar and Taiwanese stocks surged on signs that trade tensions between the world’s top two economies might start easing and as US tech earnings boosted the outlook of the nation’s semiconductor exports. The NT dollar strengthened as much as 3.8 percent versus the US dollar to 30.815, the biggest intraday gain since January 2011, closing at NT$31.064. The benchmark TAIEX jumped 2.73 percent to outperform the region’s equity gauges. Outlook for global trade improved after China said it is assessing possible trade talks with the US, providing a boost for the nation’s currency and shares. As the NT dollar

The Financial Supervisory Commission (FSC) yesterday met with some of the nation’s largest insurance companies as a skyrocketing New Taiwan dollar piles pressure on their hundreds of billions of dollars in US bond investments. The commission has asked some life insurance firms, among the biggest Asian holders of US debt, to discuss how the rapidly strengthening NT dollar has impacted their operations, people familiar with the matter said. The meeting took place as the NT dollar jumped as much as 5 percent yesterday, its biggest intraday gain in more than three decades. The local currency surged as exporters rushed to